(c) The Certificate of Authorization must identify all New Jersey licensees who are ordinarily responsible for the professional concept and/or professional surveying activities and LLC or company rules.

Doing Business In New Jersey

Any individual, entity, or simply organization doing business in New Jersey must apply for Business Registration (NJ-REG) by registering with the State Revenue Office New Jersey. also works with Enterprise Services (DORES). This includes individuals who sell from time to time (flea markets, shops, then fairs), craft and non-profit organizations.

DO I NEED A SALES TAX PERMIT IN NEW JERSEY?

H2>You Must Receive A Sales Tax That Allows And Complies With Sales Tax Laws. You May Have A Connection Or Association With The State Of New Jersey. Nexus Must Be Activated By A Physical Or Industrial Presence.

What Is A New Jersey Certificate In Terms Of Authority?

Corporations must successfully register with the New Jersey Department of Revenue before doing business in the State of New Jersey. Companies that may be registered in another state usually practice business certification in New York.Jersey. This will allow part of the company to be registered as a foreign company and eliminate the need to create a future company.

How do I get a certificate of Authority in NJ?

Many businesses do not have their own address or a physical address in a new location. SEO responds to the address of our local registered agent on your current request for confirmation of power of attorney the possibilities of the state. In addition, you will receive document integration from us on the same day. local office in the 50 United States and the District of Columbia. Our registered agent fee is $99.per year you can easily add our service to any power of attorney order.

Who Needs A New Jersey Agency Certificate?

New Jersey law requires you to obtain a Sales Tax Eligibility Certificate if your New Jersey business generates income from the following activities: retail, rental, use of tangible personal property, or digitized property; retail services related to the production, manufacture, machining, installation, maintenance, repair and maintenance of physical or digital goods; maintenance, maintenance and/or repair of real estate; some direct mail services; services of needles, solarium and massage; investigation and protection services; information Services; limousine service; Sale of all restaurant dishes and ready meals; Rental of adjacent hotel and motel rooms; certain confession statements; certain membership fees; Parking Fee; warehouse services; sale of magazines and magazinesCatch by mail; Expenses; and therefore telecommunications services, unless otherwise stated in sales and use tax law.

If You Must Buy New Jersey Sales Tax

New Jersey levies a sales tax on advertisements for tangible goods and certain services. The tax is collected by the seller and transferred to the state tax authorities. The owner acts as the de facto tax collector.

What Forms Do I Need To File In New Jersey To Qualify My Out-of-state Corporation?

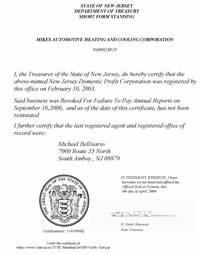

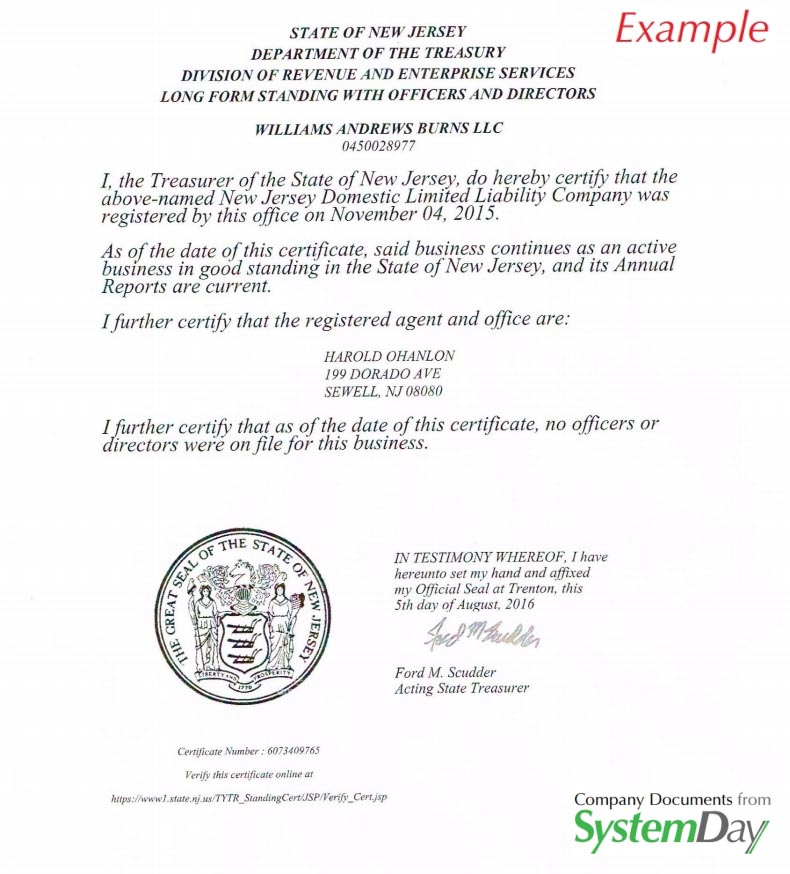

If I request registration via mail or send by fax, a duplicate of the public deposit in the archives, a certificate of good condition or existence, a cover letter, or perhaps even a service request sheet and a deposit fee is required. Other types of registration forms may be required depending on the type of medical record or the nature of your business.

Business Identifier

Organization ID: Enter the organization ID nj of your LLC number. . you can find iton your certificate of study. You can also search for your LLC in the New Jersey Company Name Search.

New Jersey Business Licenses

All companies do need to register to obtain a business registration certificate in New Jersey. During this registration process, businesses indicate whether they are subject to state sales tax. If so, they’ll need a CA certificate in addition to what’s called merchant authorization.

Is a certificate of Authority the same as a tax ID number?

In New York State, the Certificate of Authority, also known as the AssociatedThe sales tax collection is usually the sales tax identification number that the state consists of the corporation used to collect the products or services sold. Tax number requests must be made through the New York State Department of Treasury and Taxation (NYS). The New York State Department of Revenue and Finance accepts online requests for certificates of authority through the DTF-17 registry for a specific request for certificates of authority for sales tax, which can be found in the OPAL (Online Assistance with Authorization and Licensing) system.

How do I get a sales tax certificate in NJ?

For tax purposes, New Jersey considers anyone who retails goods or services in that state to be a merchant. This includes retailers from flea markets, craft fairs, music venues, carnivals, bazaars, gun fairs or trade shows. In New Jersey, sellers are required to collect sales tax on all taxable sales made in that state. This includes online sales as well as goods or services shipped to New Jersey.

How do I obtain a New Jersey Certificate of authority?

You can easily obtain a New Jersey Authority Certificate online through the New Jersey Business Registry Service website. If you have questions about the online permit application process, you can contact the Department of Finance Sales Authorization Hotline at (609) 292-9292 or visit the Authorization Information website.

What is a New Jersey sales tax certificate of authority?

New Jersey law requires you to obtain a Sales Tax Eligibility Certificate if your business in New Jersey derives its income primarily from the following activities: retail, ?Renting or using tangible personal and digital property; Retail trade with production, manufacture,

What is a business registration certificate in New Jersey?

Business Registration Certificate A Business Registration Certificate serves two purposes: For government purchases, as evidence of the business’s actual registration with the New Jersey Internal Revenue Service.

How do I get a sales tax license in NJ?

How to Get a Certificate of Authority in the State of New Jersey. You can obtain a certificate of sales tax authority by completing the NJ-REG form or by using the New Jersey tax/employer registration online interface. Finally, before you can begin, you must have a registered business organization and a specific federal EIN number.