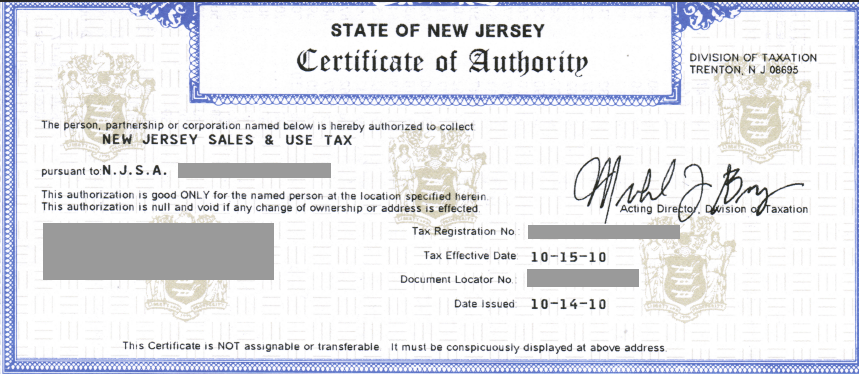

If you state on your NJ-REG form that you pay sales tax, you will receive a sales tax eligibility certificate from the state. This document must be posted at your field service location.

Doing Business In New Jersey

Any person, company, or organization doing business in New Jersey must file a Business Registration Application (NJ-REG) with the New Jersey Business Services Division ( DORES). . These include people engaged in random sales (fleancs, markets, and craft fairs), as well as non-profit organizations.

How do I get a certificate of Authority in NJ?

Many early stage businesses do not have a new physical or physical address. SEO matches our local registered agent address on your application for a power of attorney all government requirements. In addition, you will receive scanned documents on the same day of application. local offices in approximately 50 states and the District of Columbia. Our registered agent support is a flat rate of $99. by decades and you can easily add our plans to any certificate order.

Who Needs A Certificate Of Authority From The State Of New Jersey?

New Jersey law requires you to obtain a Sales Tax Eligibility Certificate if your business in New Jersey generates income from the following activities: Retail sale, rental, or online use of tangible property, or ownership of digital property; retail services related to the production, manufacture, processing, installation, maintenance, repair and maintenance of physical personal or digital goods; maintenance, maintenance or improvement of immovable property; some direct mail services; tattoo, solarium and massage; home intelligence and security services; information Services; limousine service; sale of dishes and ready meals for commercial premises; Rental of hotel and motel rooms; certain entry fees; special membership fees; Parking Fee; warehouse services; Sale of magazines and periodicals; Send; but also telecommunications services, if otherwiseNot covered by sales and use tax laws.

DO I NEED A NEW JERSEY SALES TAX PERMIT?

You must obtain a permit at the point of sale and comply with local sales tax laws. State of New Jersey. Nexus can be driven by both physical and economic presence.

New Sales Tax

Two different surcharges in New Jersey are related to advertising. First, there is the regular sales tax, which is still levied on sales made in New Jersey. Sales are subject to sales taxes on all sales of personal property, certain digital applications, and listed services.

What Is New Jersey Government Certification?

Corporations must register with the New Jersey Department of Revenue before conducting financial business in the State of New Jersey. Out-of-state companies usually apply for a power of attorney in New Jersey. Registering a company as a foreign company eliminates the need to create a new good company.

When To Collect Taxbirth In New Jersey

New Jersey levies a sales tax on the sale of tangible goods and certain services. The tax is collected by the seller and transferred to the state tax authorities. The seller acts as the new de facto tax collector.

Types Of Sales Tax Permits

New Jersey has a sales tax permit, which experts call a “certificate” attached to the agency. a? There is currently no fee for the application period for this permit under the New Jersey Proclamation. or transfer business related assets, you must surrender and destroy the Certificate of Authorization when the client files their final VAT return. No further steps are required.

Seller Authorization and New Jersey Resale Certificate The New Jersey Wholesale Certificate should not be confused with the so-called Resale Certificate. What are New Jersey resale certificates? This is simply a document that gives buyers the right to purchase goods duty-free if you intend to sellwage goods against them on the next wedding anniversary. The document is issued to the seller by the investor.

How do I get a NJ sales tax number?

Do I need a VAT number for items from New Jersey? If yes, how can I get it?Anyone who retails in this state is doing business in New Jersey and must comply with local tax laws. New Jersey requires all services, including seasonal and one-time providers, to register with the state to work with the Internal Revenue Service and collect New Jersey business tax on all sales of taxable tangible personal property or services for at least 15 business days before the start of the activity. KonOf course, there are no special provisions for temporary suppliers. Once approved, you must file all required returns until you properly terminate your New Jersey tax registration.

Do you need a resale certificate in NJ?

The New Jersey sales tax authorization may differ from the New Jersey-issued certificate. The first allows the business whose sales you make in the state to collect/remit sales tax on those sales. Conversely, this resale certificate allows the buyer (for example, a retailer) to purchase goods from a specific supplier (for example, a wholesaler) without having to pay sales tax on items that are soldOtherwise, they are taxed. The supplier is required to keep a copy of the resale certificate for compliance purposes, and all retailers are required to collect sales tax on the sale of your current merchandise. To create a New Jersey resale certificate, you must first apply for a certificate with the New Jersey State Government. This certificate will provide everyone with a New Jersey tax ID (sales tax number), which will be a very important field on a New Jersey used car certificate.

What is a New Jersey sales tax certificate?

In general, this should be referred to as a specific seller release, sales tax release, sales tax release, sales tax number, or sales tax code. A sales tax certificate is available from the New Jersey Department of Revenue and Business Services under the New Jersey Business Registration Practice (NJ-REG).

What is a certificate of authority in New Jersey?

New Jersey law requires that you obtain a sales tax eligibility certificate if your line of business in New Jersey derives income from anyfrom the following activities: retail sale, books or use of tangible personal property and digital goods; Production, fabrication, processing, installation, maintenance, repair and retail services

How do I collect sales tax in New Jersey?

As an after-tax seller of goods or services, you must be registered with the New Jersey Division of Revenue and Business Services. Upon enrollment, you must show your sales tax clearance certificate (Form CA-1) at the company’s office. This is your permission to ensure that you collect sales tax and use sales tax exemption certificates.

Can a seller accept an exemption certificate in New Jersey?

However, a New Jersey seller accepting a new exemption certificate must be registered in New Jersey. An individual exemption certificate may exceed additional purchases of the same general type of property by the same buyer from the same seller.