Here Are The Steps To Set Up A Limited Liability Company (LLC) In North Dakota.

A limited liability company (LLC) is a good and reliable business option. It combines the limited liability of the seller with the flexibility and lack of remuneration offered by a potential sole trader. Any business owner wishing to limit personal or personal liability for corporate debts and disputes should consider forming a Wonderful LLC.

What Is Regulatory Certification In North Dakota?

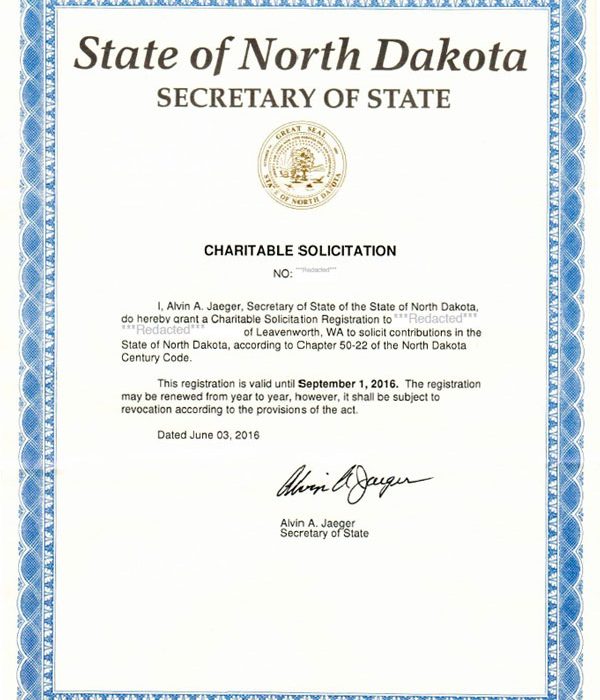

Corporations are required to register with the North Dakota Secretary of State before doing business in North Dakota. Out-of-state companies typically apply for agency certification in North Dakota. This will register his company as a foreign company and reduce the need to set up a new company.

Incorporating A North Dakota LLC Is Very Easy

To complete the North Dakota LLC application form, you must file a new charter with the Secretary of Statethat North Dakota. which costs $135. You can only apply online. The articles of association associated with an organization are the legal document that effectively establishes your North Dakota Limited Liability Company.

Open A Dedicated Business Bank Account

The use of financial and credit accounts for a business is an important corporate veil to your business. If your personal and business accounts are mixed, your separate assets (your house, car and any other valuables) are at risk if a lawsuit is filed against your LLC.

How To Order A Certified Copy Of The Articles Of Association Or Strictly Certified Copy Of ND Bylaws

A certified copy of your Bylaws or Bylaws can be ordered by fax, mail, email, phone, or in person, but we recommend calling instead. Processing usually takes up to 2 days plus additional shipping time and costs approximately $20 plus 50 cents per page depending on the type of business item. Expedited Service is not available, but personal orders are not available while youPlease wait.

Filing Annual Returns

All LLCs operating in North Dakota must have a 12-month deadline. report to the Secretary of State every 365 days. This includes foreign LLCs engaged in internet marketing in the state. The first annual income of the LLC must be received in the year of its legal registration.

LLC Name

The name of an LLC must end with “Limited Liability Company”, “LLC”, also known as “LLC”. There should be no words indicating that the LLC is created for any purpose other than those specified in the described articles. The name must not be the same or similar to the name of a limited liability company, partnership, limited partnership, reserved designation, marked fictitious designation, or commercial, domestic or foreign designation, unless a naming convention has been entered into.

Creating An Operating Agreement For North LLC

Creating an operating agreement for Dakota LLC is the only approach to legally securing the governance structure and operationsthe structure of your LLC. By having this document with you, you will be able to refer to something in the event of a dispute or dispute. The Certificate of Good Standing is another legal document issued by the Secretary of State of North Dakota (SOS). A job certification proves that your organization exists in North Dakota and is registered to do business in that state.

Why Start A Business In North Dakota?

In 2019 Usability Report for small businesses in the US. North Dakota received an overall score of “b+” for ease of use. The state’s high rankings necessarily include an A for its tax burden, as well as the For-A rule and license. In addition, North Dakota received an impressive A+ rating for good attitude and ease of starting the right small business.