Is there an annual fee for an LLC in New Mexico?

There are various fees associated with forming an LLC. This fee commonly referred to as the Medical Application Fee and ranges from $40 to $500, depending on the state. The problem fee is a one-time fee EntranceDuring the course, documents such as founding documents Average data fees for an LLC in In the US it’s $132 and in New Mexico it’s only $50. This this is one of the reasons New Mexico is considered the newest advantage We propose to establish an LLC in

Choose An Available Name For Your LLC

In New Mexico, your LLC business name must contain the words “limited liability company” or “limited liability company” or one of the following abbreviations: “LLC, ” LK”, “LLC” or simply “LC” The word “Limited” can be abbreviated to “Ltd.” and write “corporation”, abbreviated as “Co.”

Creating An LLC In New Mexico Is Now Easy

To form an LLC in New Mexico, you must file a Articles of Association with the New Mexico Secretary of State -Mexico, which sometimes costs $50. You can apply online. The Articles of Association is the legal guide that formally establishes your new limited liability company in the Philippines.

Can I ReserveCan You Name A Company In New Mexico?

Yes. If you have a business name at home but are willing to not pull the trigger to form an LLC, you can indeed reserve a New Mexico name for up to 120 days. This will certainly protect your name from being used by another company. All you have to do is complete the Limited Liability Company Name Reservation Application on your computer and pay the $30 processing fee ($50 for expedited service).

Sign Up With The New Mexico Department Of Taxes And Revenue.

All LLCs operating in New Mexico must register with the New Mexico Department of Taxes and Revenue in order to obtain a reputation number for the combined reporting system. This includes LLCs registered outside this state that do business in New Mexico. carrying on a business” always means carrying on or inducing an activity with a view to deriving a primary or indirect benefit from it. For a person who does not have a physical presence in thisIn the state, “business” means that, during the previous calendar year, it had full taxable gross proceeds from the sale and rental of property, personal injury licenses, license sales, and service sales, and a license to use acquired real estate for an amount not less than one hundred thousand dollars ($100,000) in this state under Section 7-1-14 of the 1978 NMSA.

Benefits

Low-cost limited corporations throughout New -Mexico is not subject to miraculous fees or taxes – ?? The $50 filing fee is all that is required, unless the state charges corporate/franchise tax or an annual LLC closing fee.

LLC Benefits:

With All That, You Have Now Decided To Form An LLC In New Mexico. You Have Members, Your Project, Your Business, And A Small Start-up Capital, Plus You’re On The Road. NameThe name

Llc LLC Must Include “Limited Liability Company”, “Limited Liability Company”, “Limited Liability Company”Yu, “LC”, “LLC”, Or “LLC.” Instead, The Name Must Be The Same Or Confusingly Similar To The Name Of A Domestic Or Foreign LLC, Or To A Name Reserved Or Registered By Another LLC, Unless Another LLC Express Permission Obtained The Name Should Not Imply Any Intention That The Words “bank”, “insurance”, “league”, “small Olimpiyskiy” And “trust” Contained In The Organization’s Articles May Not Be Used.

Premium Service Includes

With the enrollment service, you are more than just a number. You can be a valued customer. We currently offer prices in the future, and no upsells because it’s easier for everyone. we take our business seriously. No reason to no longer fit And education in general should be expensive. Our services include:

Get Any Type Of Certificate From The State

Once the LLC has been approved beyond reasonable doubt, the state will send you this email. Email? must include a letter of confirmation, a stamped and approved memorandum of association, and a certificate of incorporation formally identifying the LLC after the LLC’s articles of incorporation have undoubtedly been submitted and further approved.

How long does it take to form an LLC in New Mexico?

First, you need to put the company. The state of New Mexico has several rules for designating an LLC (see NM Stat § 53-19-3), but here are the main ones. The name of your LLC must:

Do you need a physical address for an LLC in New Mexico?

New Mexico has one of the cheapest LLC registration fees in some parts of the country at $50. However, you will pay additional fees if you hire a company to help a client create your LLC or act as a good registered agent. These fees can really vary depending on the company and the company you choose. Consider overheads and plan exactly what services your customers need.

Does an LLC pay taxes in New Mexico?

At BizFilings, we clearly state our and New Mexico fees. If you look at our prices for registration of an LLC, you will clearly see:

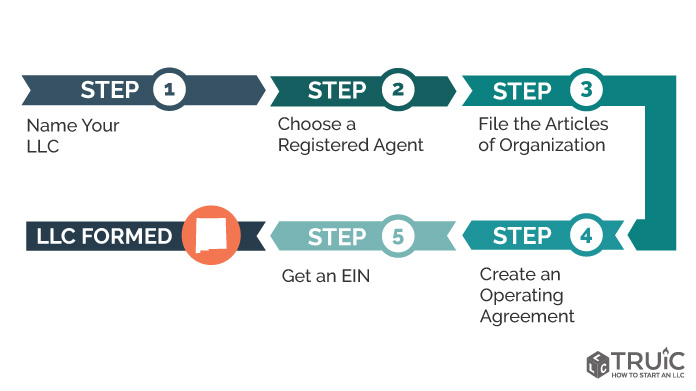

How to start an LLC in New Mexico?

What is a New Mexico limited liability company?

Can I form a New Mexico LLC with just a PO Box?

Why establish an anonymous LLC in New Mexico?