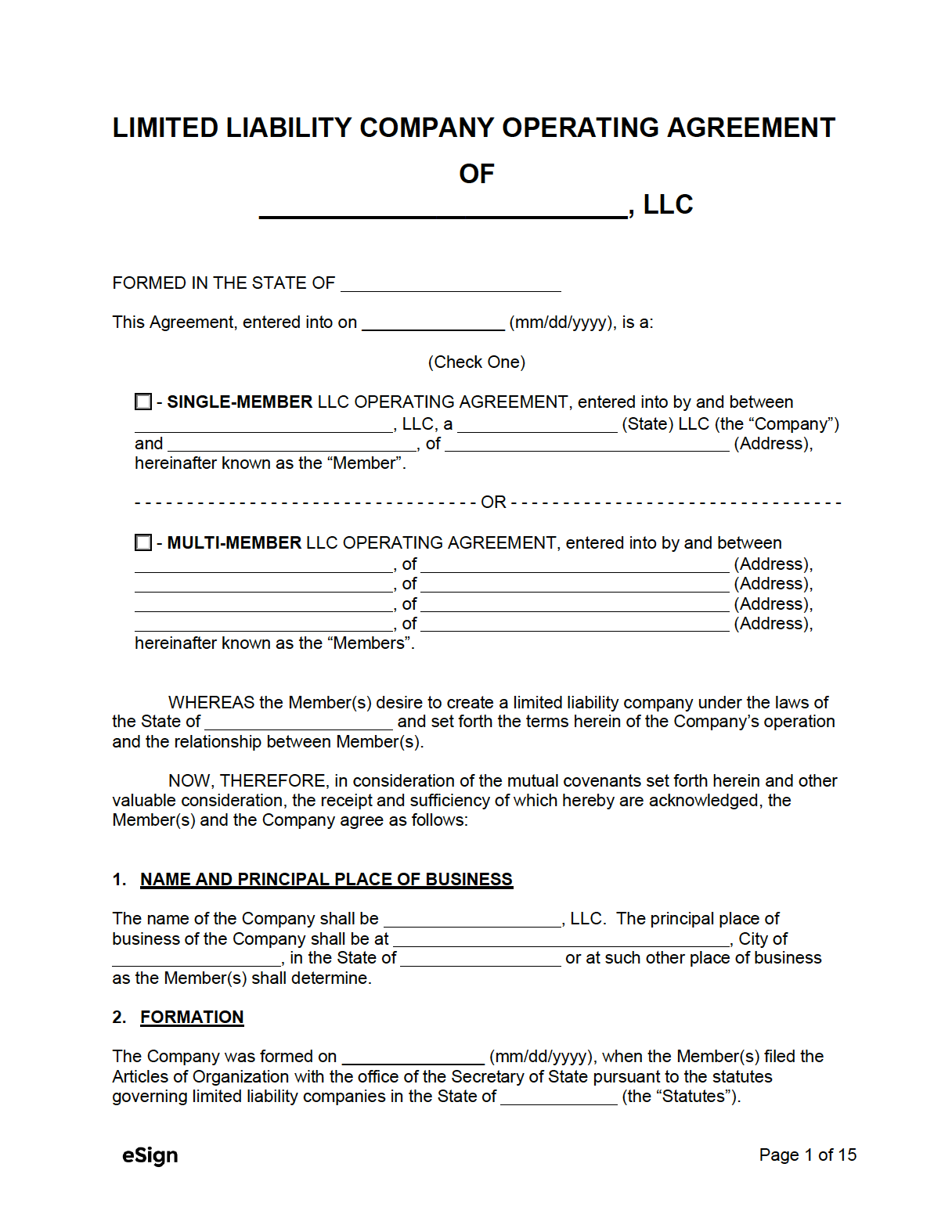

The operating agreement is considered the key document used by the LLC as it sets out the financial and economic decisions of the business, including rules, regulations, and regulations. The purpose of the document is to regulate the internal workings of a business in such a way that it meets the specific needs of business owners.

What is the difference between an LLC agreement and an operating agreement?

The Limited Liability Company (LLC) is undoubtedly a popularAn excellent choice for commercial organizations for supplier owners. (A business entity is also recognized as a business entity.) Although an LLC has several record keeping formalities required by the government, business owners should take the time to make sure they have a good, proper operating agreement with the LLC when establishing an LLC. as it is usually the key document of the LLC that controls the structure and operation of the business. He also oversees the relationships between musicians in multi-member LLCs.

What Should Be Recorded? (5 Points)

If a new member is frequently added to the business, which means that the LLC’s operating agreement must be changed, all existing customers must accept that new member’s written consent. It also correlates with an increase or decrease in the number of executives from member to member.

What Is An LLC Operating Agreement?

An LLC Operating Agreement allows you to manage and structure your finances. effective relationship with your co-workersMembers in a way that suits your business. As part of your operating agreement, you and your co-owners (called “participants”) determine each owner’s percentage of ownership of the LLC (limited liability company), their share of the profits (or losses), benefits, rights and jobs, and how what will happen to sales if any of you leave.

Article III: Capital Contributions

This section covers members who have some money to earn to start an ltd . But there is also some debate about what the extra money will be for high-profile members. For example, an LLC may issue “shares” in the form of ownership rights for cash.

Additional Terms

Much of your understanding of how an LLC depends on your individual career and your industry business. That being said, in addition to the provisions listed above, several other provisions that you may see (or wish to include) in your actual agreement are correct.

What Is A Limited Operating Agreement?private Responsibility. ?

The LLC Operating Agreement is an important document that sets out the ownership and membership of the LLC. The agreement establishes business and financial relationships that meet the specific needs of business owners. From day-to-day operations to what would be available if a member left the common business, an operating agreement is vital to your business and should be prepared as soon as you form an LLC.

Are Required Management Agreements For An LLC?

Every state usually says you should, but speculation, right? Almost all state laws say that breaching an LLC’s operating agreements does not require you to disregard your liability protection. We have yet to see any government agency requiring you to maintain an operating agreement with an LLC.

Why You Must Have An Operating Agreement

Some states require an operating agreement with an LLC. Sometimes this is only necessary if the LLC has more than one member. Although this? and not required by law, an operating agreement serves three other important purposes:

What Is An LLC Operating Agreement?

LLC means a limited liability company. and is the most popular small business shed in the United States. The designation was created primarily to increase small business access to shareholder liability protection.

What Is An LLC Operating Agreement In Florida?

A LLC Operating Agreement is an agreement between owners or only members of a Florida An LLC that, among other things, manages the members? Savings contributions to LLCs, distribution of LLC payments, and how decisions are made in each LLC. Unlike the Articles of Incorporation, a fantastic LLC operating in Florida is definitely required. However, it is generally better to formalize the agreement between LLC members in an operating agreement.

What Is An LLC Operating Agreement?

The LLC Operating Agreement is a hard copy that customizes the terms of the limited liability company to meet specific needs.?ny of its participants. It also describes each financial and functional decision making in a structured way. It is similar to the founding documents that govern the activities of a corporation.

What does an operating agreement need to include?

For decisions requiring a vote of members, your activity report must indicate whether they require a majority or unanimous vote. By default, in many states voting rights in an LLC are proportional to ownership. If it suits your business, great! But if not, you can of course change it, which makes sense for your situation. If desired, you can finally transfer all decision-making powers to one person. Or your business may specify that one person is responsible for day-to-day operational decisions, but important decisions (such as closing large business deals or buying another business) require the unity of members.