Currently, failure to pay franchise tax by the due date is subject to a $200 fine and interest payments charged by the State of Delaware at a rate of 1.5% per month. This will most likely prevent the business from obtaining this permit and may result in your business being shut down as a result of a government process.

How do I pay Delaware franchise tax online?

Franchise taxes in Delaware are due on March 1 of each year. Use the guide below to submit it.

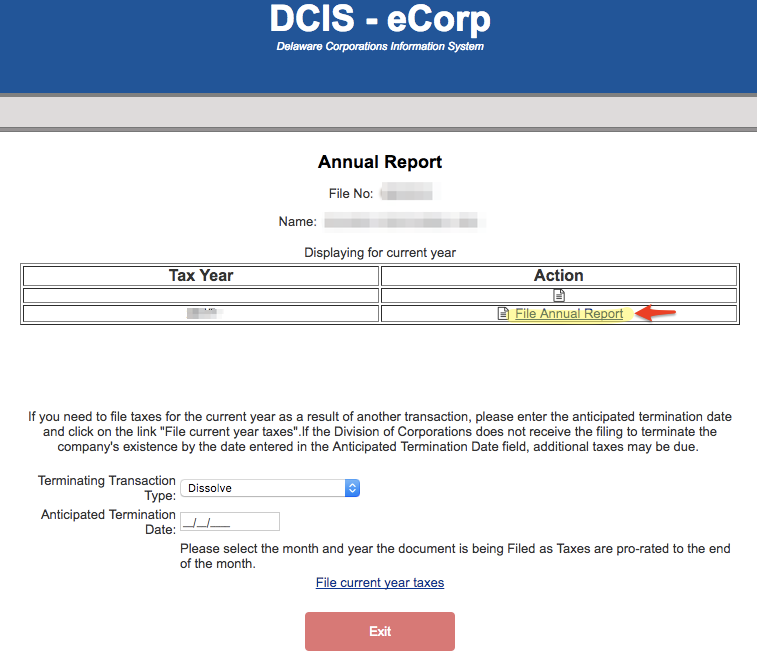

Click Here To Pay Your Taxes/file Your Annual Return

This application is available daily at 8:00 AM and 11:45 PM ET. When entering data, please use only the English version of the characters, otherwise it may result in an inaccurate background in your annual report.

What Is The Tax OnWhat About A Delaware Franchise?

The Delaware Franchise Tax is an unwanted Delaware tax on the right to own a business in Delaware. The keg does not affect revenue or business activity. The required tax is necessary to maintain a good business reputation in Delaware.

Delaware Franchise Tax Department Contact Information

If you have questions about taxing your LLC’s annual franchise fee, please contact you. You can contact the Franchise Tax Department at 302-739-3073 (option 3). Hours of Operation: 8:00 am to 4:30 pm EST, Monday through Friday.

Delaware Annual Report And Franchise Tax Deadlines

* All Required Local Businesses Delaware to file annually AND pay an annual franchise tax. The notice suggests two methods for calculating your high deductible tax and recommends using a process that results in a reduction in the amount owed. which must never be less than $175 or greater than $200,000. The following is a breakdown of the two functions for calculating tax onfranchise.

How To Set Up An LLC In Delaware?

Creating an LLC will be a difficult task. But with the right resources, you can gain the confidence to master the process. Below is a step by step guide to setting up an LLC in Delaware.

How do you pay Delaware franchise tax?

The Delaware franchise tax is due March 1, 2022.

Do you have to pay franchise tax in Delaware?

Corporations incorporated in Delaware but not doing business in Delaware are not subject to excessive corporation tax [30 Del.C, Section 1902(b)(6)], but are required to file a franchise tax administered by the Delaware Department of State.

How do I pay Delaware franchise tax for a corporation?

How do I pay my Delaware state taxes?

What is the Harvard Business Services Delaware Franchise Tax Service?

What are the filing requirements for Delaware State Corporation?