A TIN/TIN applies to businesses in the same way that a Social Security number applies to an individual. It identifies businesses of all types to the IRS. Pennsylvania is phasing out the use of unique tax identifiers for businesses. Instead, it uses a box/account mobile phone number for each tax account registered with the Pennsylvania State Department.

Explanation Of Employer Tax Liabilities (Publications 25, 15-A, And 15B)

Publication 15PDF provides information on employer tax liabilities with respect to taxable wages, payroll tax deductions, and tax refunds subject to deposit. Additional complex issues can be addressed in Publication 15-APDF, and tax interventions for many employee benefits can be identified in Publication 15. We encourage employers to obtain these publications at IRS.gov) in addition to calling 1-800-TAX-FORM .

Please Wait For Your Pennsylvania Limited Liability Company To Be ApprovedFee

Wait for your Pennsylvania Limited Liability Company to be pre-approved by the Department of State before applying for your EIN. Alternatively, if you are denied LLC registration, file an EIN attached to a specific non-existent LLC.

How much does it cost to get a EIN number in Pennsylvania?

Although this is an employer identification number, it does not mean that a person must have employees. An EIN is, of course, simply a type of Taxpayer Identification Number (TIN) that identifies your Pennsylvania LLC to the IRS.

Steps To Obtain An EIN And Register A Pennsylvania Corporation

Before everyone will go too far in the process of business problems and disputes, you need to decide what form you want your business to take. With all this information, you are ready to decide which of the large small business structures is best for your business.

What Is An Employer Identification Number (EIN)?

EIN is the lowercase letters for an Employer Identification Number and is sometimes referred to as the Federal Employer Identification Number, FEIN, Federal Tax Identification Number, or Federal tax identification number. An identification number. This is a unique nine-digit number that looks like an individual.A different social security number, but identifying another company instead.

Pennsylvania Tax ID And Federal Tax ID

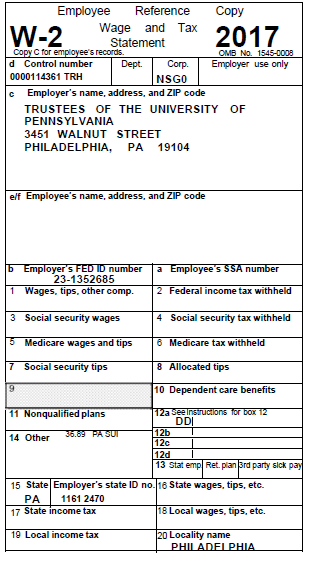

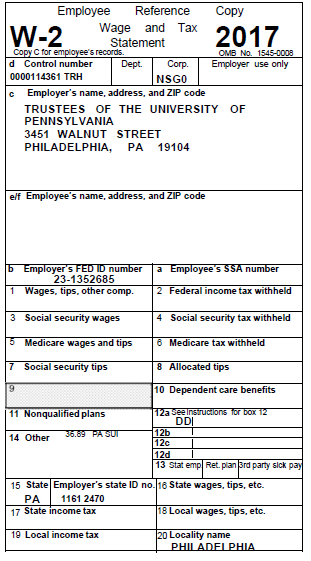

Your Pennsylvania businesses will receive separate tax IDs used for federal and state taxes . Learn about federal tax identification (phone numbers TIN, fTIN, EIN, and fEIN). if If you are applying for one or more Pennsylvania taxpayer identification numbers, you may also be required to apply for a federal taxpayer identification number. AT For example, when a company hires its first W-2 employee, it must credentials that you have not yet practiced.

Using A Pennsylvania Taxpayer Identification Number (EIN)

Obtaining a Pennsylvania Taxpayer Identification Number (EIN) is generally a process that, and religious organizations must comply for this. Even for businesses and corporations that canDemonstrating that they are not required to obtain a Pennsylvania Taxpayer Identification Number (EIN) is generally recommended so that it can help protect individuals’ personal information by allowing them to use their Pennsylvania Taxpayer Identification Number. . rather associated with their Social Security number during the various trips required to operate their business or organization, including obtaining local licenses and permits in Pennsylvania. Any business that meets any of the following criteria must register a Pennsylvania Taxpayer Identification Number (EIN):

Learn How To Get Your Pennsylvania Taxpayer Identification Number

The process by which you can Getting your Pennsylvania EIN can be intimidating at first, but if you know what you’re working on and follow the instructions, or if buyers decide to hire a specialist company to help you apply for your federal tax ID, we’re required to get your ID. ?? The employer number becomes much simpler.

Pennsylvania TIN

In addition to obtaining a Pennsylvania Federal Taxpayer Identification Number (EIN), you will most likely need a Pennsylvania Taxpayer Identification Number. This ID is required to pay corporate, state income tax, and/or sales tax on the sale of your items. Typically, the State ID control is used to:

How do I find a company’s EIN number?

Most people know most social security numbers by heart, but not all entrepreneurs knowgive your tax number. You don’t seem to use your EIN every day, so remembering this number isn’t as easy as remembering your phone percentage or business address.

What is the difference between an EIN and a Pennsylvania revenue ID?

You also use an individual’s EIN when applying for certain permits or licenses. In contrast, your Pennsylvania tax identification number registers your business at the indication level. Like the federal tax ID, it uniquely identifies your business, but unfortunately it is used for different purposes.

When do I need an EIN in Pennsylvania?

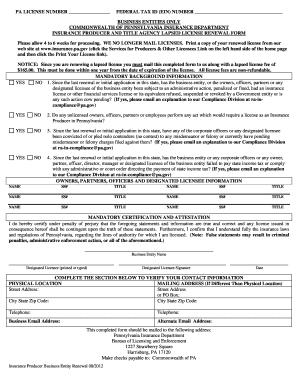

Applying for business certificates and permits. Most business licenses and permits in Pennsylvania require an EIN (or, in some cases, an SSN) before you can apply. Filing Tax Returns – EIN is used to identify a business when documenting state and federal tax returns. Who needs a Pennsylvania EIN?

What is an EIN number?

EIN is short for “Working with an Employer Identification Number” and is sometimes referred to as Federal Employer Identification Number, FEIN, Federal Tax Identification Number.fictitious number or federal tax identification number. This is an attractive nine-digit number that looks like any social security number for an individual, but instead identifies the business.

How do I apply for a Pennsylvania State Tax ID?

You must first receive your Federal Taxpayer Identification Number in the mail, so follow the steps in the sections above before trying to track down your Pennsylvania Taxpayer Identification Number. Once they receive them, they can help you apply for your tax ID through the traditional application method (such as telephone, mail, or fax) or online.