- Appoint a Registered Agent in the State of Nebraska. Nebraska law requires LLCs licensed to do business in Nebraska to appoint a qualified

- Get security clearance. Nebraska requires you to obtain a certificate of good conduct from your home.

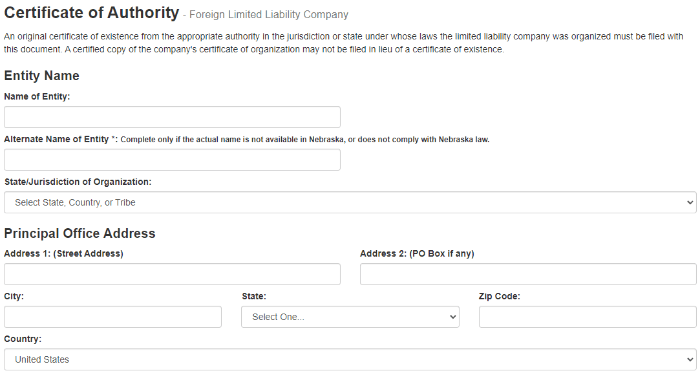

- Request a certificate for a specific authority. Register a foreign LLC

Can I Be A Known Agent For My Nebraska Foreign LLC?

Yes, but only if you are in all of Nebraska. Unless you live in Nebraska, it’s quite difficult to be your own registered agent there. For this reason, most global LLCs prefer to hire a registered provider.

As A Registered Agent, We Can Insure Your Non-public LLC In Nebraska As A Registration Fee. “The State Plus $100”.

P>

h2>OR Individuals Can Self-apply And Easily Hire Us As Their Authorized Representative In Nebraska. All Foreign LLCs In Nebraska Require This Registered Agent. We Offer This Service For $49 Per Year.

For Foreign Limited Partnerships:

To obtain a Certificate of State Hebraska, you should also Submit:

How do I file a foreign LLC in Nebraska?

Nebraska law requires LLCs doing business in Nebraska to have a registered agent. Your registered agent in Nebraska can be either a state resident or “other person licensed to do business in the state”?”. All you need to do is have an office in the state (PO Boxes are not allowed) and be available at that address to accept delivery of funds on behalf of your business.

Doing Business In Nebraska

The complexity of taxation is up to the individual LLC organization. Under the rules, foreign LLCs must raise public sales funds in their home state. A business must have a physical presence or affiliation with the government in order to be required to collect state sales tax on sales to its residents. If a foreign LLC opens a store, office, or warehouse in Nebraska, or employs a sales representative, it is considered to be present in Nebraska.

Step 1. Invite A Specific Agent

If you are considering registering an LLC in Nebraska, you may need to appoint a registered agent in California several times. Rev. Stat. §21-113. This policy applies to both domestic limited liability and foreign limited liability. We would like to take this opportunity to simply let you know that we are one of the best registered representatives in the state and we are committed to work.Join over 11,494 registered companies in Nebraska. We can help you open an LLC in Nebraska.

How Much Does A Registered Agent Cost?

Hiring a public agent typically costs between $50 and $300 per person per year. This is a small purchase considering how much time it will save you. it’s mostly worth the price.

Professional LLCs

suggest that an LLC provides professional, practical services. In this case, the organization’s certificate must also normally indicate the professional services that members, officers, and professional employees are required to perform (or are generally authorized to perform) in Nebraska. LLC, and it must provide professional services as well as file a certificate of incorporation.

Nebraska Foreign Company Registration With Company Formation Lawyers

States require corporations to create an account as foreign corporation to ensure they comply with tax and regulatory requirements. If you are not sure if entertainment is requiredyour Nebraska foreign company registration, call our office at (800) 603-3900 to speak to a man or woman who can assist you immediately. Registering a foreign company and obtaining a Certificate of Attorney is a legal and business process; Avoid the pitfalls that a non-agency paralegal training service entails.

What Is A Foreign Degree?

A foreign degree allows your corporate liability to limit small businesses operating in Nebraska. It doesn’t matter what state you originally set up your current business in. or in other words, the state in which your domestic LLC is located – ?? because the qualification process for a foreign LLC in Nebraska can be the same no matter where your industrial LLC is located. labeled “Foreign Corporation”, “Foreign Limited Company”, etc.) who want to help you do business in Nebra?You may need to qualify as an alien from Nebraska. This rule applies broadly to businesses that want to open the perfect Nebraska physical store, rent office space or warehouse, hire employees, etc.

How do I register as a foreign entity in Nebraska?

You must have a registered agent in Nebraska. We charge $125 per year to act as your registered property in Nebraska. This is a flat fee, currently an annual fee, which includes additional costs for dealing with other registered agents. Here is a little more about our registered agent service.

How much does it cost to register an LLC in Nebraska?

Here are all the steps you need to take to form an LLC in Nebraska. For additional resources on starting an LLC in each state, see Nolo’s How to Start an LLC article.

Do I need a registered agent for my LLC in Nebraska?

Starting a business in Nebraska can be exciting, but it can also feel overwhelming. One of the first things you need to do is toStart your business with the Secretary of State. A stylized type of business entity is a limited liability company (LLC). The LLC reduces the liability insurance of owners (participants) while providing flexibility in administrative structure and taxation.

Can I do business in Nebraska with a foreign LLC?

If you have a trust company registered outside of Nebraska, you must allow them to qualify or register that company in Nebraska if you want to conduct your business properly. Here is an overview of the specifications on how to qualify your new limited liability company (not in Nebraska) to do business in Nebraska. What is a foreign LLC?

Can a registered agent be a corporation in Nebraska?

A registered agent can be a corporation if your current corporation is licensed to do business in Nebraska. The location of the registered agent must always be the same as the registered office. The registered agent and registered office must be maintained in this state at all times.

How do I register a new business in Nebraska?

You can register your new business for one of the following online tax programs: Tire tax. If your company has an existing Incredible Nebraska ID for the found tax program, you will not be able to useThere is an online business registration feature, but you will need to register with the Nebraska Tax Application Form 20 to find additional tax programs.

How do I qualify for foreign qualification in Nebraska?

If your business is organized as a corporation rather than an LLC, the rules and requirements for foreign qualifications in Nebraska are similar. However, you must use a special application form, Application for a Certificate of Proxy for Business Transactions. Visit the Secretary of State of Nebraska website for forms and instructions on how to complete the paperwork.