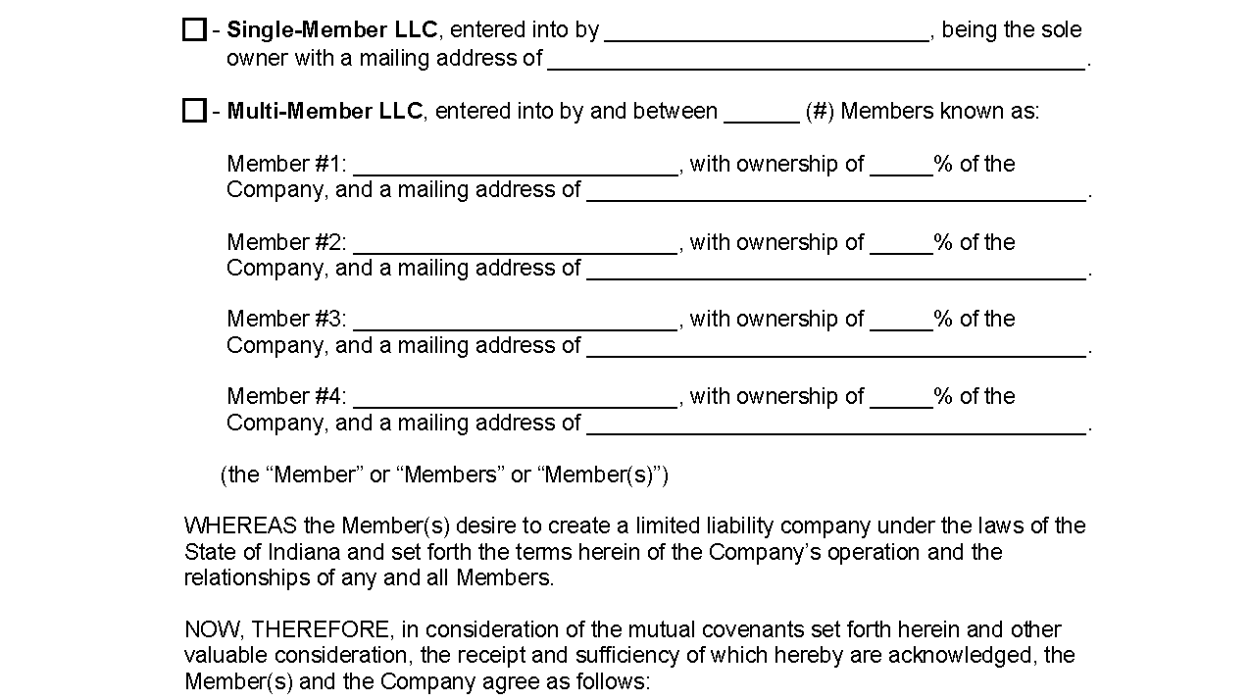

By Type (2)

Single member operating agreement LLC –? This is a specially designed document for a specific individual entrepreneur. The document sets the company on par with any other large business in terms of operating and protecting not only the member, but the business.

Does Indiana require an operating agreement for LLC?

An LLC in Indiana must have an operating agreement because the respective corporation cannot act on its own behalf. An LLC requires real people (and other legal entities) to carry out business operations.

Indiana LLC Model Operating Agreement

The RocketLawyer and LawDepot’s LLC Operating Agreement, which is free to download, will help you navigate specific government and legal issues so that you have an operating agreement that is right for your business. You will also have access to all of their research on individual business forms, contracts, and other important legal documents.

Why Does An Indiana LLC Need To Have An Operating Agreement?

Indiana LLC can have an operating agreement because a strong company cannot operate on its own. For an LLC to operate, real people (and a few other companies) must run the business.

What Can An Indiana LLC’s Operating Agreement Look Like?

An operating agreement is an important document that every An LLC in Indiana is due in regards to the general business. A good motto is to get a very good deal early in the LLC formation process. For example, consider preparing your operating agreement when filing your articles of association with the Indiana Secretary of State. While many LLCs believe that a verbal agreement can beSpecifically, a written operating agreement is a more reliable way to ensure the protection of your business.

What Is A Strong Operating Agreement?

Operating agreement agreement An agreement, usually made prior to the formation of an LLC, sets out the positions of the participating members and determines how the LLC can be managed. Unlike our agreement with Formation LLC, you are not required to enter into an operating agreement with the State of Indiana. However, as an internal recommendation, you should keep a copy for your own records.

Profits, Losses AndBreakdown

3.1BWIN LOSE. For the purposes of financial taxation and taxation, the company’s websiteNet profit or loss is determined on an annual basis and isdistributed among members in proportion to the relative capital of each memberInterest in the Company as set out in Schedule 2, as amended from time to timein accordance with the Regulation of the Ministry of Finance 1.704-1.

Is An Indiana LLC An Operating Agreement Required?

The State of Indiana does not require business owners to have an operating agreement.one agreement with LLC. However, business owners should always have a way to set the rules and expectations for running their own business.

Choose A Structure And Start Your Business

Below you will find a summary of the myriad forms a business can take. legally operate grocery stores in Indiana. Caveat: formalThe organization of a financial transaction brings both great benefits and legal consequences. Care should be taken as to which form of business to use and simply when doing business. The Corporate Department is available to help, but cannot provide legal advice. It is highly recommended to consult a lawyer for further advice.

Free Limited Liability Company Information

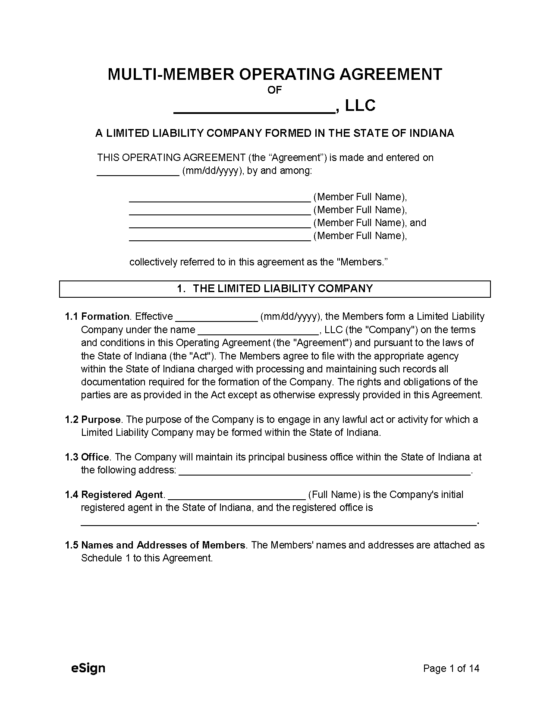

This operating agreement is used when setting up a limited liability company with several contingencies. You make changes that suit your needs and add the description that is most commonly associated with your business. Around 10pages. This allows for the possible addition of new LLC members.

When To Create Operating Agreements

The best rule of thumb is to create the benefits of an LLC agreement when registering your company. But when the members agree, you can still create a very good operating agreement when your LLC is much more mature.

Can I write my own operating agreement?

Do you need a dominance agreement when registering a limited liability company (LLC)? As a reminder, operating agreements are legal documents that ensure that part of the LLC is properly maintained and protects the personal liability of all companies. Most states do not require LLCs to have this document, so many LLCs choose not to create one.

How do you write a simple operating agreement?

If that’s what you want, it’s up to you Limited Liability Company , you need a written operating agreement. This may seem like a complicated process, but to be honest, it’s not as difficult as you might think. By using business lawyers because youYou can create an operating agreement to get LLC “Multi-Member” Where one face gmbh in five easy steps.

How many pages can an operating agreement be for an LLC?

Q. What is an operating agreement with an LLC?A. California Corporation Code §17050 requires every LLC in California to have an operating agreement with the LLC. Then the memorandum of association, the operating agreement of the LLC, will be the most important document of the LLC. For a multi-member LLC, the part of the working agreement should be around 50-70 pages, depending on the number, including the people involved. However, an operating agreement for a single member LLC should only be about 12-15-30 pages long. The operating agreement with an LLC is the main contract between the members of a Limited Liability Company (LLC). The Operating Agreement of an LLC governs the membership, administration, operation, and income recording of an LLC. In general, an LLC operating agreement should include the following:

How much does it cost to form an LLC in Indiana?

How do I dissolve a business in Indiana?