Percentage of ownership / how you will distribute profits.Administrative structure of your LLC/member, roles and responsibilities.How do you make decisions.What to do if a member wants to get out.

Can I write my own operating agreement?

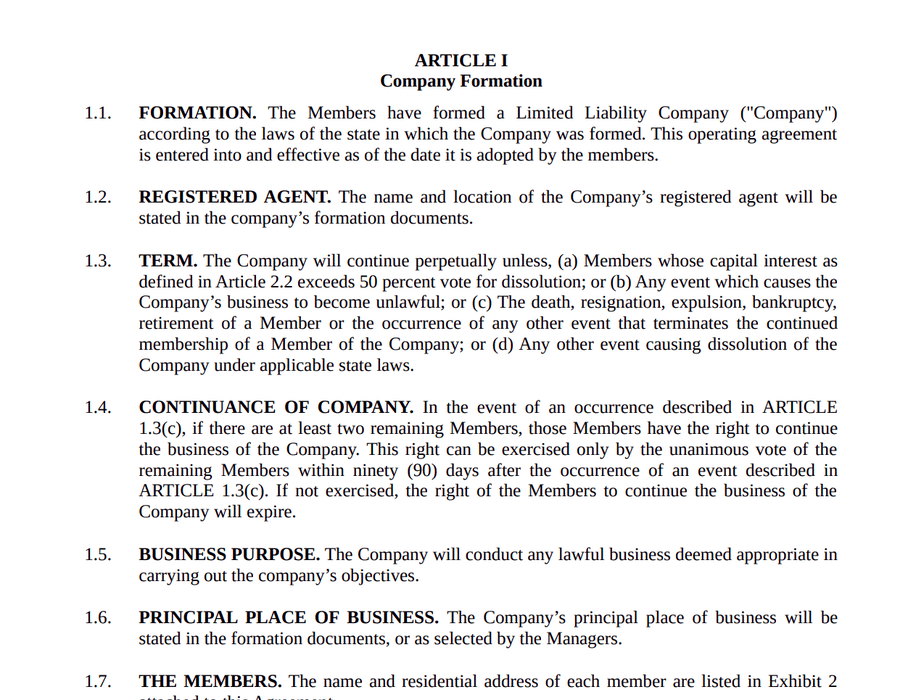

Do you really need an operating agreement when registering a limited liability company (LLC)? Quick and Safe Reminder: Operating Agreements are legal documents thatThose who ensure the proper management of the LLC and protect the specific liability of the business. Most states do not require LLCs to have this plain paper, so many LLCs choose not to write the paper.

What Is A Limited Liability Operating Agreement?

A limited liability operating agreement allows you to structure all your financial and operational relationships with your co-owners based on your business. In your operating agreement, you and your co-owners (called “participants”) define each user’s interest in the LLC (limited liability company), their share of the profits (or losses), and their rights and obligations with respect to what actually happens . companies in case one of you leaves.

What To Include? (5 Points)

If a new entity is added to the company whose assets would require a change to the LLC’s operating agreement, all existing members must accept this new type of member with written consent. This also applies to a significant increase or decrease inresponsibilities from agent to agent.

More Information

By using this online site, you agree, not to mention consent, to our security. Monitoring overview. For security reasons and to ensure that the public service remains available to users, this government computer system uses network traffic monitoring classes to detect unauthorized attempts to download or modify data in a malicious manner, including attempts to deny service to a user.

When To Create Agreements

The best operational guidance is to create a full LLC operating agreement when you start your online business. But if all members agree, you still have the option to create an operating agreement as your LLC becomes more mature.

What Is An Operating Agreement? Operating LLC?

Limited liability company. (LLC) An Operating Agreement, also known as an LLC Corporate Agreement, is a legal document that sets out rights and obligations.The details of each LLC member and includes details such as:

Download Operating Agreement

H2>This Standard Operating Agreement Applies When It Comes To Using A Company With Limited Liability Limited Liability With One Member, Where The Sole Member Has Full Control Over All Matters Related To The LLC, And No Other Person Represents Any Of The Interests Of The Members In The Company.

What Is An LLC Agreement?

An LLC agreement is an important legal document that establishes the ownership rights and obligations of the members of dozens of LLCs. The agreement establishes a personal financial and working relationship that meets the targeted needs of the business owners. From regular operations to what happens if a member leaves the business, a great operating agreement is vital to your agency and should be drafted quickly, especially when setting up your LLC.

Selected Resources For Small Business< /h2>Welcome To The SCORE Resource Library! Also Below Are Templates, Electronic Manuals?Features, Checklists, Blogs, Infographics, Tools, Online Videos, And More Created Specifically For Small Business Owners. Filters Allow You To View Resources By Business Stage, Element, Resource Format, Contractor Industry Type, And Dialect. We Are Here To Help Your Small Business Every Step Of The Way.

Powers And Responsibilities Of Members.

7.1 Governance. The activities and affairs of the company are governed by rules edited by members. . Members shall have full power and discretion in the management and control of the business, operations and property of the Society, in making all decisions relating to such matters, and in participating in all other normal or unlikely activities and activities. The functions of the company are related to business. Members may act with written consent.

Do LLCs Require Legal Agreements?

Every state dares to say you should, but guess what? Nearly all state laws state that failure to comply with LLC operating agreements for your LLC will not result in the loss of your protection. We have yet to see how realA government agency would like you to help maintain an operating agreement with an LLC.

How do you write a simple operating agreement?

If your employment as Limited Liability Company To do this, you will need a written license to operate. This may seem like a complicated approach, but it’s actually not as difficult as you might think. Meat can help business lawyers , you can create a different operating agreement for your LLC “Multi-Member” Where one face gmbh in five easy steps.

How many pages is an operating agreement?

To take full advantage of adding an LLC, you need to go a step further and draw up an operating agreement frequently during the incorporation process. Many people tend to overlook some important documents because they are not required in many states. Few major states require an operating agreement to form an LLC.

Is there a free sample operating agreement template?

Download these 13 free business agreement templates to help you prepare your own good agreement efficiently. The operating agreement must be a type of signed agreement between the members of the limited company?The responsibility of the LLC governing the activities of the LLC, as well as the financial and management rights relating to the members.

How do you write a business operating agreement?

For an operating agreement, always include only the name of the company followed by the words “operational plan” (for example, XYZ LLC: operating agreement) to keep it short and concise.

What is an operating agreement and why do you need one?

It also acts as a model for how a business does business. Then the document is signed by all participants of the limited liability company, fully binding them with the conditions set forth in the main contract.

What is an operating agreement for an LLC?

The operating permit is a key document for the GmbH. With this evidence, the LLC can establish important rules, regulations, distribution of profits and losses, the role of representatives, and more.