$100 plus $10 shipping; $125 plus $10 late fee. Annual reports must arrive at our office within two and a half 50% months after the end of the financial year, always with a postmark, for timely consideration. Late payment fees should be waived for annual reports filed on paper, in accordance with regulatory decisions.

Massachusetts Annual Return Fee And Instructions

The fee for filing an annual e-book with the Division of Corporations depends on the type of business you have. Commercial companies, both foreign and domestic, must pay $109 to file an annual return. Reports must be submitted 2.5 months after the end of the actual financial year. Nonprofits must pay an $18.50 annual return filing fee and catalog it by November 1.

Get The Massachusetts Annual Reporting Service Today!

GET STARTED

How much does it cost to form an LLC in MA?

We strive to publish free informationreference materials such as this manual. fulfill. Key industry organizations have shared our resources including:

Submit Your Annual Returns

Each year, an annual return must be filed with Crown Corporations Division. This must be done while preserving the date of the original certificate file. In the report, you should include such things as all information about the certification of the organization, as well as all other relevant information and facts.you. Today, the annual return filing fee is $500. Submission of this report is required to maintain the good standing of an LLC and obtain permission to do business in Massachusetts.

How To Incorporate Massachusetts

If you are asking for a decision to register in Massachusetts, please include .Will com will take care of the exact details. We investigate company name availability, help you draft and list your articles of incorporation with a Commonwealth Companies Division secretary, and expedite payment of fees. We can also support many of your industry’s tracking needs, including annual return preparation and filing.

Massachusetts LLC Commissions: How Do I Get There? Form ð???

for an LLC in Massachusetts, you must file a Certificate of Organization pertaining to Massachusetts to the Clerk of the Commonwealth. You can send in person, simply by mail, fax, or online. With most of our Massachusetts LLC formation services, we can open your LLC in as little as 5-10 minutes for just +$49 registration fee. It’s easy!

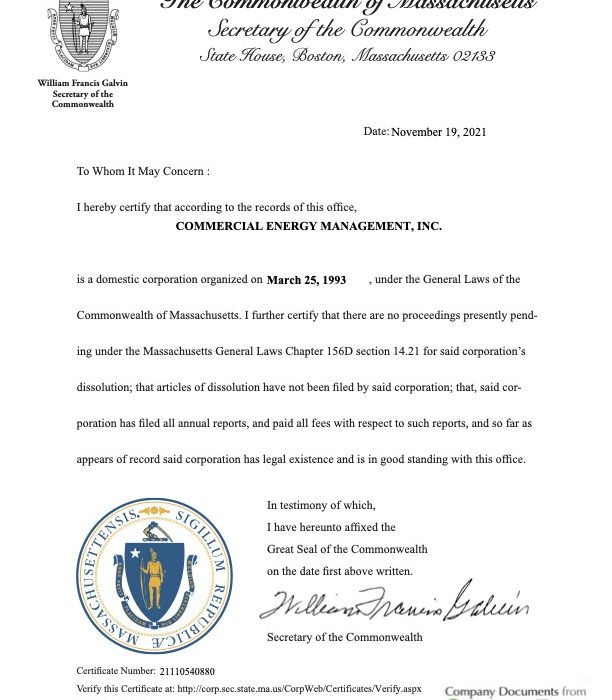

Regular Certification Fee?Massachusetts Quality Certificate

The hosted certificate verification process can be used to verify that a certificate escrow is otherwise a certificate of fact that has been issued by corporations. The section that pertains to the Commonwealth Secretary of State of Massachusetts.

The Cost Of Registering An LLC In Massachusetts: $500

The Certificate of Organization is the most expensive form. Create an entry when registering your LLC must be found. This is an old-fashioned official document used to register your business with the Secretary of the Commonwealth of Massachusetts. In different states, the same form is “article brand organization”.

How much is Ma annual report?

Government agencies do not provide constant reminders of due dates for annual reports. As an important result, you your company’s annual return dates may be attached to yours. You may have received every letter from the state telling your company that the annual report must be submitted, and, worse, late.

How much is a certificate of good standing in MA?

The Massachusetts Certificate of Good Standing (CGS) has become an easy way to demonstrate that your own business complies with Commonwealth regulations. This shows that every commercial enterprise is legally registered and has all the necessary documents.

What is the expedited fee?

The accelerated fee is in addition to the regular filing fees thatRelated to the requested document type service. Of course, the expedited review period only applies during business hours on business days and does not include weekends and holidays. Expedited Service is not available for trademark registrations, process options registrations, or other special vendor registrations.

How much does it cost to file a federal securities filing?

Registration fee rate. October 1, 2015 Current interest rate as of 01/10/2018 compared to 30/09/2019: $121.20 per $1,000,000. The commission can be described as being calculated by multiplying the total offer amount by 0.0001212. Registration fees are charged for filing under section 6(b) of the Securities Act of 1933.

What is the current fee rate for filing an offering?

Application fee rate Current fee rate as of 01/10/2020 if you need 09/30/2021: $109.10 for $1,000,000. Commissions can be calculated by multiplying the total offer by 0.0001091.