Register A Corporation, Limited Liability Company, Partnership, Or Sole Proprietorship (if You Are AIf You Are A Sole Proprietorship Or Partnership, Skip Step Two)

Corporations and limited liability corporations must apply to register Articles or Articles Organization through the Secretary of State of Nevada and maintain all records, journals, etc., as required by law . You can access their URL and download the relevant forms.

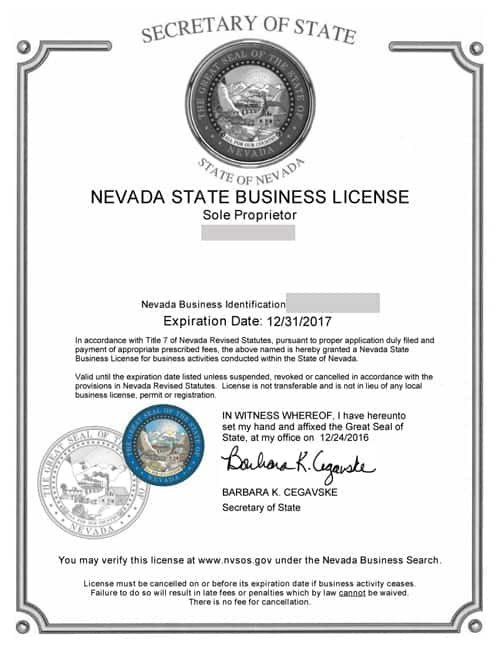

Where do I get my Nevada state business license?

All companies doing business in Nevada must have a state business license issued by the Secretary of State of Nevada. The certification is renewed annually. You can apply online or get forms on their website (www.nvsos.gov).

Step 3: Apply For A State Business And Tax License

The State of Nevada has created a website to guide you through the state’s process. You must apply for a specific government business license and register with the entity’s tax authority. You can use the portal frequently. After completing the application process, keep these documents in a safe place as you will need to refer to them in step 5 when working with the City Business License.

Creating A Legal Entity

There are many types of legal entities that you can choose from when starting a business.It is important to determine which entity types are appropriate for yourhis particular business. Each business runway presents unique legal and tax challenges, from what happens if you are sued to your tax liability. It is important to determine which type of related business structure is right for you.

Introduction To Obtaining A Business License In Nevada

Nevada strives to be a business-friendly state, so form an LLC or business -corporation is easy. A Nevada business license is required under revised Nevada state law and applies to any corporation or individual planning to do business in the state. The game requires you to know the type of license or permit required for the same business activity, and this information can always be obtained by searching for Nevada business certifications.

Obtaining A Nevada License

Nevada Commercial Driver’s License Can Be Obtained Online From The Nevada Secretary Of State. A Business License May Be Required To Identify And Hold Liable A Business ThatProtects The Public And Maintains Financial And Tax Records.Fees

For companies incorporated under section 7 of the NRS, such as corporations and LLCS, the business license fee must be made at the time the initial list of officers or the annual list of officers is to be issued. The state business license fee is in addition to the initial or annual listing taxes.

Are You Not Registered In The State Of Nevada?

State law requires that any person or entity did it. Those who do business in the state of Nevada receive a state license or exemption every year. The City of Henderson has partnered with the Secretary of State of Nevada to accept applications for City of Henderson business licenses for new internet companies through SilverFlume, Nevada’s business portal. If you have not registered your business in the relevant state of Nevada prior to applying for a Henderson business license, click on the detailed SilverFlume link below.

Steps To Obtain A LicenseNevada Business License

You can apply for a Nevada business license online, by mail, in person, or by fax. For corporations, limited liability companies (LLCs) and limited liability partnerships (LLPs), the SOE is the subject of the license at the initial selection of the list of officers included in the company registration application file.

How long does it take to get Nevada business license?

The price of a license depends on the services provided and activities. In addition to the corporate license fee, there is a one-time application fee of $45 on top of each license fee. If more than one service is provided, multiple authorizations may be required.

How much is a small business license in Nevada?

There are many types of business structures to choose from when starting a business.It is important to consider what type of business is right to support your particular business. Each business structure will have unique legal and tax implications, from what happens when you pay to how you are taxed. It is important to determine which type of business is right for you.