An LLC offers its members the limited liability that most corporation owners enjoy. A multi-member LLC may be affiliated with a corporation or partnership, while a single-member LLC may be wholly owned by a corporation or legal entity.

Here Are The Basic Steps You Need To Take In The Marketplace To Form An Idaho Limited Liability Company (LLC).

An Industry Limited Liability Company (LLC) is one way to corporatelaw structure. It combines the minimal liability of a corporation with the freedom and informality of a specific partnership or individual ownership. Any business enthusiast who wants to limit their personal liability for debts and business relationships should consider forming an LLC. An LLC is what is known as a tax transit legal entity. In other words, the responsibility for paying federal income tax lies with the LLC itself, in conjunction with the LLC of the individual members. As a standard, you do not pay the LLC yourself. With. Income tax, members only.

Can You Be A Registered Agent In Idaho?

Yes. However, you must then provide your name and public storage address. And you must be present during regular business hours to receive legal documents in person. If you wish, you can still act as your own registered agent in Idaho.

Does Idaho recognize single-member LLC?

Foreign LLC Registration An out-of-state LLC may be registered to actually conduct business in Idaho by filing an overseas registration application.

Creating An LLC In Idaho Is Very Simple

LLC Idaho – How to create an LLC LLC in Idaho, you must document the relevant documents.? State certificate of the organization to the secretary, which costs from 100 to 120 dollars. You can watch online, by mail, by email, or in person. The organization certificate is the legal document that officially incorporates your Idaho LLC company.

Idaho LLC Company Name

Before sending your Idaho LLC company certificate to the organization (the document that will create your LLC company) ), you will need to research the information to ensure that the desired LLC company name is available. This is called a “distinct” entity.

Idaho LLC Tax Classification

The LLC is considered a pass-through entity because it successfully allows income to pass through and become self-employment income. Non-members of an LLC must pay self-employment or income tax on all money earned through an LLC. The LLC must tax the franchise on its own income. In addition to self-employment income tax, there are other requirements that a large LLC company must consider, for example:

How To Form An LLC Company In Idaho

In this stratumIn this guide, we describe all the steps in an organized manner so that you have a complete picture of what the client needs to do and all the relevant details. A clear understanding of the requirements for starting an LLC in Idaho brings you to the question of how to start your newly formed business.

Book Your SARL Under The Name “Secretary Of State”. H2> After Choosing A Name For Your LLC, You Can Reserve It With The Secretary Of State Of Idaho For Up To 4 Months To Ensure That The Experts State That No Other Business Entity Is Using It Before You Are Legally Ready For The Specific Legal Entity Only. Establish.

It Is Very Easy To Register An LLC In Idaho

You can register an LLC in Idaho online by registering for an organization certificate with the Secretary of State. The cost to get this LLC in Idaho is $100 online or $120 mail.?. . The manager manages day-to-day affairs, while operations determine the organizational direction of the business. When you form a functional manager under You’ll LLC, you are acting as a passive client while someone else runs the business.

How is an LLC taxed in Idaho?

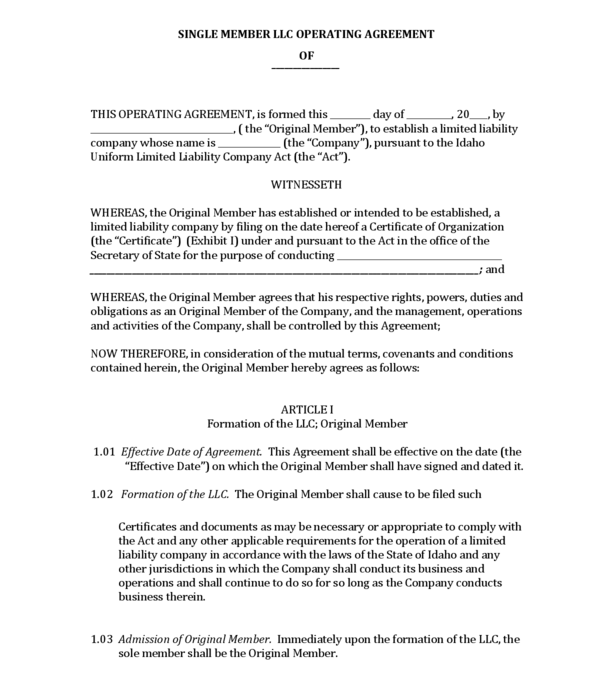

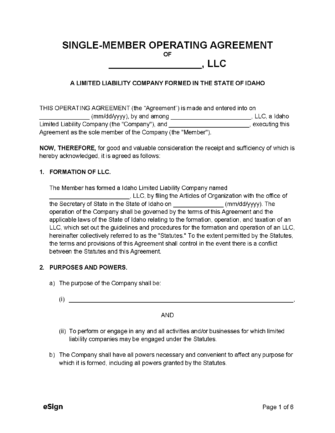

If you are hoping to incorporate and operate a very small limited liability company (LLC) in Idaho, you will need to draft and file various paperwork. This article covers the basic ongoing reporting and filing requirements for Idaho limited companies only.