Here Are The Basic Steps You Need To Follow In Order ToRegister A Limited Liability Company (LLC) In Hawaii.

A Limited Liability Company (LLC) is an approach to legalizing a business structure. It combines the limited liability of a corporation with the flexibility and informality of a partnership or individual ownership. Any business owner who wishes to limit their liability or personal liability for business debts and lawsuits should consider forming an LLC. , you must report the statute to the Department of Commerce and Consumer Affairs, which costs $50. You can apply online, by mail, fax, email, through or at the student. The Memorandum of Association is the original document that formally establishes your LLC in Hawaii.

LLC Name

LLC must name the result “Limited Liability Company”, “LLC”, or “LLC”. Geographic locations only, and the “branch” command cannot be used in LLC names. Variants of the word and “bank” require approval outside of the U.S.Commissioner for Financial Institutions.

Your TIN Status Will Change The Way You Register Your Business In Hawaii

to support TIN and business registration. If you organized this business as a corporation, partnership, or LLC with one member, use the taxpayer identification number (FEIN) for government registration types – ?? not your social security number. In most cases, you will only report your security code on these forms if you are actually forming a sole proprietorship, if not a basic LLC. Filing a Limited Liability Company Article Complaint with the Business Registration Division of the Hawaii Department of Commerce and Consumer Affairs. Can articles be submitted online or by mail? The listing fee is definitely $50 (plus an additional $25 expedited service fee) and can be paid by check or credit card. state) LLCs wishing to sell in Hawaii must register online with the Department ofthose on trade-related and consumer affairs. You feel the need to create an eHawaii.gov account now (see below for how to get an account for these accounts).

Can I Reserve A Company Name In Hawaii?

Yes. If you are not ready to formally register your LLC, you can change your company name for up to 135 days by filing a name reservation with the Department of Commerce and Consumer Affairs for enforcement. There is a $10 registration fee.

Choose An LLC To Start A Business.

Hawaiian LLC law gives owners a lot of flexibility in how a business is run, literally owned and operated. An LLC allows most business owners to create a separate legal entity from themselves. With an LLC, owners can either centralize my manager-level management (manager-managed LLC) and all agent-level management (member-managed LLC). LLC owners may place special restrictions on managers andmembers.

Does Hawaii allow single-member LLC?

The Hawaii Board of Directors Agreement for a Sole Member LLC is a legal document that is commonly used by an individual owner to protect the company’s money and property. The document will also define procedures, policies and objectives related to the business.

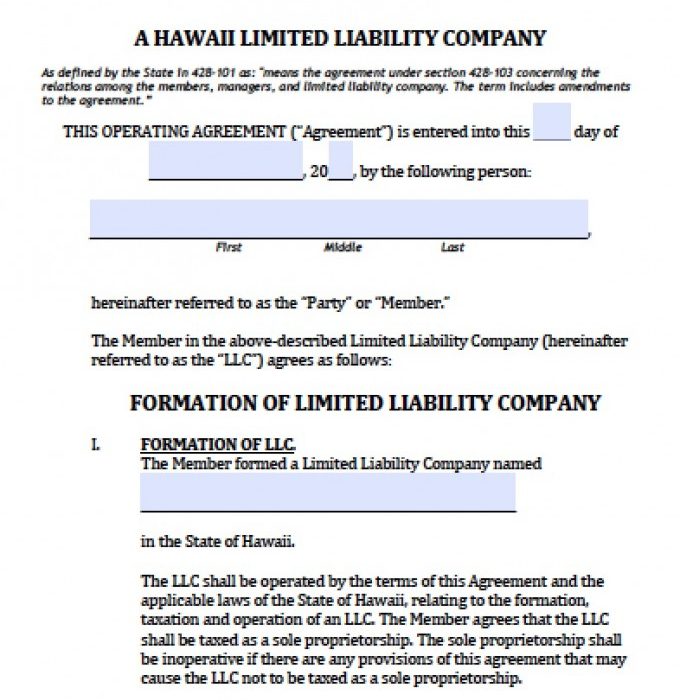

Hawaii Limited Liability Company Overview

This operating agreement applies to a corporation limited by one member. This form may be ideal for an LLC formed by a single person. You make changes to suit your needs and create your own business description. About 10 contents. This allows for the possible addition of new members to the LLC.

Hawaii Partnership

Hawaii Limited Venture is operated by general partners and possibly limited partners as well. However, limited liability newlyweds involved in management waive their limited liability status and are liable for the debts and obligations of Hawaii Partners Limited.

How much is LLC tax in Hawaii?

How your LLC will be taxedIn this guide, we’ll cover all of the major business taxes required in Hawaii, in addition to wages, self-employment, and federal taxes. LLC money is not taxed at the corporate level like C corporations are. Instead, property taxes are as follows:

Does Hawaii require operating agreement for LLC?

The Hawaii LLC Operating Agreement documents the operating procedures, bonuses, ownership, and structural aspects of the website. All decisions must be agreed with their owners (participants). Once an agreement is made, it belongs to each employee and can only be modified by a generated change. The operating agreement is not manually registered with any government agency.