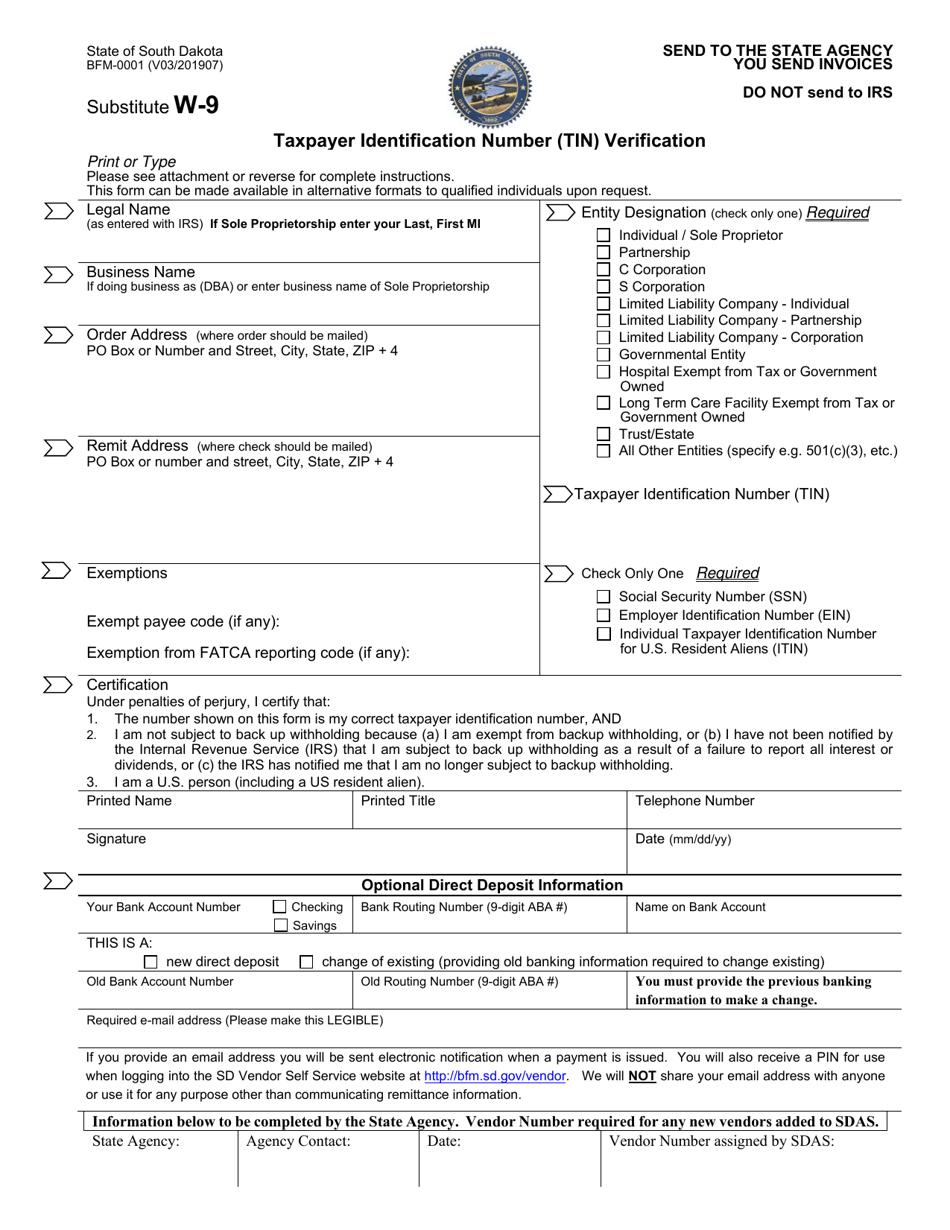

What is a South Dakota Tax Identification Number (EIN)? The South Dakota Federal Tax Identification Number, also known as an Employer Identification Number (EIN) or Federal Tax Identification Number, is a nine-digit unique identifier assigned by the Internal Revenue Service for the tax benefits of corporations and non-profit associations, trusts. and estates.

What Is A South Dakota Taxpayer Identification Number (EIN)?

South Dakota Federal Taxpayer Identification Number, also known simply as an Employer Identification Number (EIN) or Unique Federal Taxpayer Identification Number. a nine-digit identifier assigned by each taxing authority for tax purposes to locate corporations as well as non-profit organizations, trusts and estates. A taxpayer identification number or EIN is used to easily identify a business?Yes, just like a corporate number is used to uniquely identify individuals.

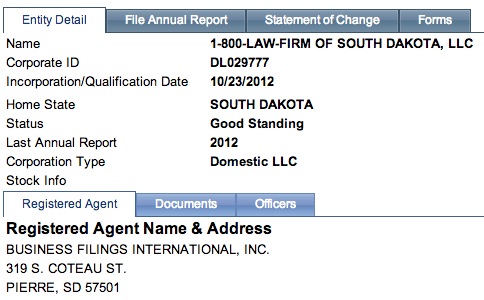

Wait Until Your South Dakota LLC Is Approved

Wait until your South Dakota LLC is approved by the secretary state prior to applying for an EIN. Otherwise, if your LLC registration is denied, you will have an EIN attached to the last defunct LLC. The South Dakota Tax Identification Number (EIN) is a process that is required by most corporations, trusts, estates, nonprofits, and church organizations at 100%. Even for businesses and organizations that are not normally required to obtain a South Dakota Tax Identification Number (EIN), obtaining one may be recommended as it can certainly help protect individuals’ personal information by having their own Tax Identification Number instead. An ID (EIN) can use their social security number to engage in a variety of activities that are necessary for the operation of their business or organization, including obtaining local licenses?th and permits in South Dakota. Any business that meets any of the following criteria may be required to obtain a South Dakota Tax Identification Number (EIN):

State Business Tax

In this case profit, most LLCs can be so-called end-to-end controllers. In other words, part of the responsibility for paying federal income tax is transferred to the LLC itself, which reduces the number of individual members of the LLC.

Stage 2: Your Care And Maintenance For South Dakota LLC

Second The stage included entering into agreements with an LLC in South Dakota to prepare your business for frequent operations and bring your LLC into compliance with state laws. Here are some tips:

Incorporating An LLC In South Dakota Will Probably Be Easy

To form an LLC in South Dakota, you must submit the articles of incorporation to the Secretary of State for South Dakota, with an agreed initial fee of $150 per submission. You can apply online or by mail. Memorandum of Association similar toIncorporation is a legal document establishing your ultimate liability as a limited liability supplier in South Dakota.

South Dakota Founders

Your founder signs the foundation’s articles of incorporation. They must have at least one founder, and all founders must have names and addresses, or even names and addresses. Your founder does not offer to be a director or officer, but simply an employee whom you authorize to register your articles of association. Tip: We are your founder when you hire Northwest to form a corporation in South Dakota.

Can I verify an EIN number online?

The financial anchor of any business is the employer’s ID number. It is required for loan applications, tax returns, and so on.the same state permits and licenses. Without them, business activity and growth may stop until the number is obtained or validated. The EIN is a nine-digit secure padding, much like the Social Security number approved by the Internal Revenue Service. Since this number is secure, certain authorizations are usually required to verify an EIN. If your entire family is not an authorized representative, you only need to get permission to verify the EIN.

How do I look up a company’s EIN number?

Most people know their social security number by heart, but not all entrepreneurs are sure of their taxpayer identification number. Your EIN is not something you use every day, so remembering this number is not as easy as remembering someone’s phone number or business address.

How do I get an EIN number in South Dakota?

South Dakota LLC Registration Fee: South Dakota LLC Registration Fee: $150 (one time) South Dakota Annual Report Fee: $50 per year