However, California, New York, Missouri, Maine, and Delaware are the only states that require operating agreements. While only a few states require them, it’s actually good business practice to have a valid agreement, whether you’re an LLC with one or more members.

I:

Organization Of The Article

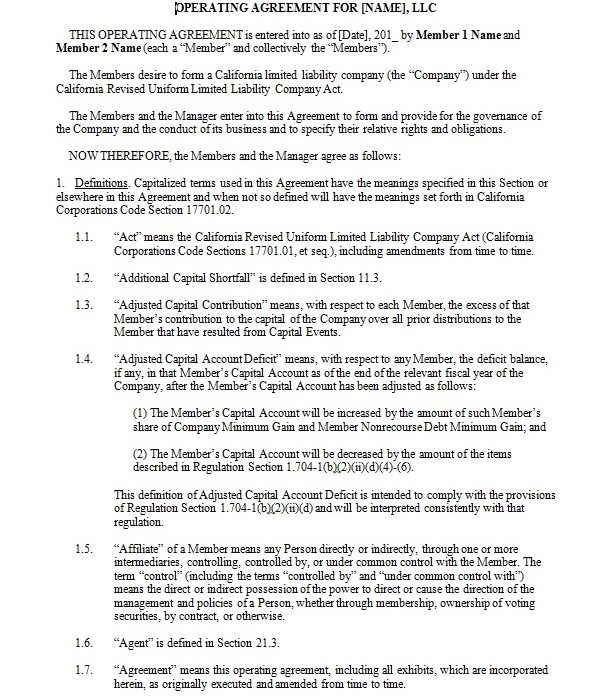

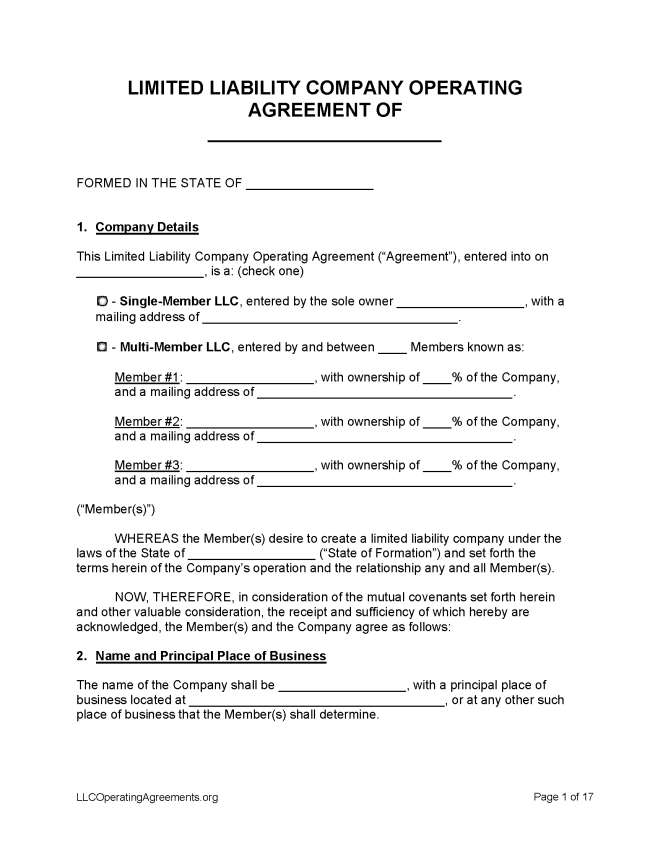

The first part of the operating contract covers the entire backbone of the business. This includes the founding date of the business, customers, and ownership of the structure. If there are several participants, they can all be more or less owners in equal or different numbers in terms of “units” of ownership.

Does California require an operating agreement for an LLC?

However, many states do not require LLCs to enter into operating agreements. Most of the news doesn’t. But that doesn’t mean you shouldn’t create it. As we explain in our article Why Your Limited Liability Company Needs a Limited Liability Operating Agreement, these types of agreements allow you to customize your business structure, avoid general government regulations, and protect your limited liability.

The Difference Between? Required And Required Documentation

Required Documentation means that the LLC deems it necessary to provide documentation under the laws of each state, and if not, that state is unlikely to allow the ongoing formation and registration of your LLC. operating agreements, although when a written operating plan is required varies. Alabama, Ohio, California, for example, require written terms and conditions when an LLC has more than one member. Arkansas, New Mexico, and the District of Columbia require all business records to be in writing. Iowa also requires that an operating agreement be in effect in a production, unless otherwise specified in the organization’s bylaws. Colorado, Georgia, Connecticut, and Kentucky require LLCs to operate with a single member.

Operating Agreement FAQ

The easiest way to create an LLC operating agreement is to create a free sample paper. Agreement. You can use the template as a guide, and customize sections however you like.

What Is An Operating Agreement?

Not required in most statesThis is only minimal information, such as the name of the company and its registered representative in accordance with the articles of association. Details of the structure and activities of the GmbH should be left to the discretion of these members. Ideally, members should adopt an established operating agreement designed to meet the specific needs, desires and understanding of each individual. This endorsement, which is not binding on members until they sign it, should include:

An Introduction To Writing Your Working Agreement So You Know The Current Terms

Or maybe it’s important to know that a controlled business structure will benefit your business, even if you live in one of the 45 states where this arrangement differs and the rules are often the norm.

Like An Agreement

If there is only one LLC user, is an exploit transaction necessary? The answer is positive. Here are a few reasons why a single member LLC should prepare an operating agreement – and through this

Adjusting The Distribution Of Corporate IncomeDoes

Do S-Corp or C-Corp have shareholders? The distribution of funds should be consistent with their ownership interests, but all limited liability operating agreements give you more leeway for all the rights of the owners.

A Limited Liability Agreement Protects Their Status As Limited Liability

Having An Operating Agreement Helps Ensure That The Courts Will Establish Your Limited Personal Liability. This Is Generally Beneficial For The Sole Trader Where, In The Absence Of Any Operating Agreement, An LLC Is Similar To A Sole Proprietorship. With Your Express Consent, The Individual Existence Of Your LLC Will Have A Limited Liability Status.What Is An LLC Operating Agreement?

An LLC operating agreement is a document that tailors the terms of a limited liability company to the specific circumstances of its members. He also describes these financial and functional solutions in a completely new way. It is like the Charter of all constitutions thatgovern the operation of the corporation.

What is the difference between an LLC agreement and an operating agreement?

A Limited Liability Company (LLC) is a great choice for business owners. (A legal entity is also known as a proper corporate structure.) While an LLC does not do well with government-mandated record keeping requirements, when setting up a separate LLC, the company owners should take the time to help you make sure they have a good, valid contract for the LLC. . ? sweatWell, this is the essence of the LLC document, which controls how an organization is structured and operates. It also establishes the relationship between members of limited liability companies consisting of several members.

Does Maryland require an LLC to have an operating agreement?

An LLC in Maryland must have an operating agreement because not all corporations can go it alone. LLCs are dominant to operate and require bona fide individuals (and other companies) to perform fixed operations.

Do I need an operating agreement for my LLC?

For example, Alabama, California, and Ohio must require you to enter into an operating agreement if your LLC has more than one song member. This is in contrast to other states such as Colorado and Connecticut, which require a new good working agreement for a single member LLC.

What is an operating agreement and do I need one?

The Profit and Loss Statement is an internal document. Although it is officially binding as a specific law,Well, it doesn’t need to be filed with the state. Most operating agreements contain the following key provisions:

Do I need to keep a copy of my operating agreement?

Once you have completed this key information document, you must leave a copy of the relevant document with your registered agent. Most filings do not require an LLC to create an operating agreement. However, most states specify who makes such an LLC declaration, which is legally binding.

What percentage of ownership should be defined in an operating agreement?

However, ownership percentages must be fully specified in the operating agreement. Distribution rights relate to the division of profits in addition to losses. Often operating agreements set the distribution percentage in the same way as the ownership percentage.