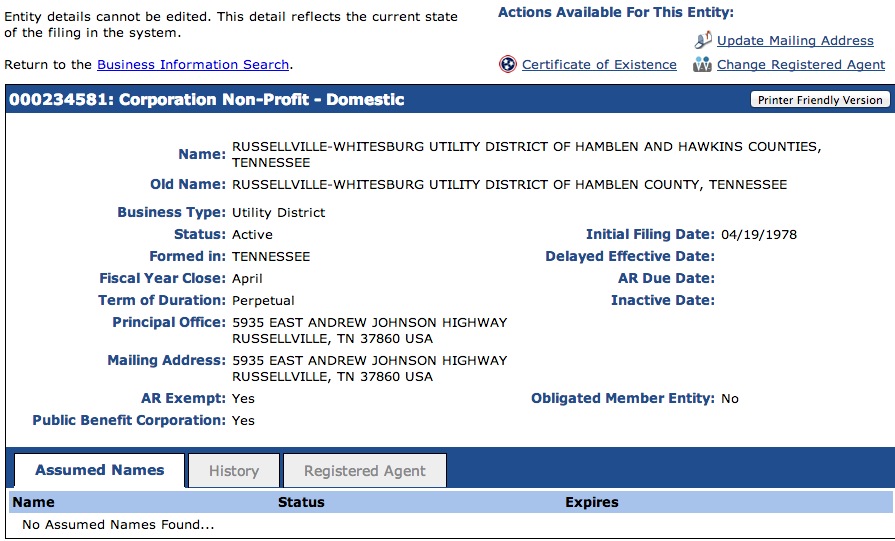

How much is a EIN number in Tennessee?

How to Start an LLC in Tennessee This quick guide provides a quick overview of how to start an LLC in Tennessee.

Wait For Your Tennessee To Llc To Be Approved

Wait for your Tennessee To llc to be approved by the Secretary of State before applying for your EIN. Alternatively, your family, if LLC registration is denied, you actually have an EIN attached to a non-existent Tennessee LLC tax ID (EIN), you will probably also need a Tennessee tax IDand. This ID is required to pay business taxes, government taxes, and/or marketing taxes on the products you sell. Generally, the actual State Taxpayer Identification Number is used for most of the following purposes:

Using A Tennessee Taxpayer Identification Number (EIN)

L Obtaining a Tennessee Taxpayer Identification Number (EIN) is a separate process Most corporations, trusts, estates, nonprofits and churches must close. Even for businesses and corporations that will never be required to obtain a Tennessee Tax Identification Number (EIN), obtaining one is encouraged as it can, in turn, help protect personal information from individuals by allowing them to identify their EIN. ) for use in place of their personal social security number in various activities useful to the operation of their business or organization, including obtaining licenses and permits on the premisesnia in Tennessee. Any business that meets any of the following criteria must obtain a Tennessee tax identification number (EIN):

How Much Does It Actually Cost To Obtain A Tennessee Corporate Tax ID? – Questions

You can register for sales tax at the Tennessee Taxpayer Access Center (TNTAP). The Tennessee Taxpayer Access Point (TNTAP) allows businesses to register by selecting New Business Registration from the menu. Please read this document for more information on how to tax sales and savings accounts.

The Steps To Obtain Your Tennessee Tax Identification Number (EIN):

The app requires you to have a few pieces of information about your business activities ready along the way. It is in your best interest to collect this information prior to applying so that the process goes more smoothly.

VAT ID $39

Also known as Seller Authorization, Wholesale ID, Sales IDReseller, Reseller ID.

Also, How Can I Start My Own Business?

Do market research. Market research will tell your business if there is a way to turn an idea into a successful business. Write your business plan. Fund your business. Choose the location of your business. Choose a company structure. Choose a field name. Register your business. Get a federal and state tax ID. So, do you know what the lack of GmbH is? Disadvantages of Starting an LLC Cost: Starting and maintaining a traditional LLC is more expensive than a sole proprietorship or partnership. States charge an advance registration fee. Many states also charge fees for general expenses such as annual returns and/or tax collection fees.

Starting A New Business Process

If you are starting a new business, TN regarding a Few Things take time to register in the state and municipalities. Different companies have different requirements, but the following steps have proven to be the minimum required toMost Companies:

Identification Codes And Form Codes

The following UTC identification numbers may be required for tender documents and other award documents. Contact the ORSP team at any time if you need other details, codes or passwords not listed here.

How do I find my Tennessee tax ID number?

A great way to find your professional taxpayer ID is to visit our tax filing website, Tennessee Taxpayer Access Point (TNTAP). Click on the Professional Privilege account ID network under the Information searches and queries heading.

What is a Tennessee Tax ID (Ein)?

What is a Tennessee Tax Identifier (EIN)? Tennessee Federal Tax Identification Number, also known as Employer Identification Number (EIN) or Federal Tax Identification NumberA tax identification number is a unique nine-digit identifier assigned by the IRS to individuals for tax purposes for businesses and non-profit organizations. trusts and estates.

How do I get a Tennessee Tax ID number?

Basically, you can get your existing ID using a Tennessee tax ID lookup, no doubt. We make it easy to apply for an EIN. Whether you need a Tennessee or Kentucky tax identification number, our simple online application form will help you quickly apply and get back to work.

What is a Tennessee business tax number?

Tennessee corporate tax statistics are often confused with a generic employer identification number. An EIN is any type of individual number that is used to register a business with the Internal Revenue Service (IRS) and may be required in addition to state tax numbers.

How do I apply for an EIN number?

We only request an EIN for the shoulder joint. Whether you need a Tennessee or Kentucky tax identification number, our simple online application will allow you to apply and get back to your business quickly.