Open A Commercial Bank Account

The use of commercial banks and specialized lending sites is necessary to protect the corporate and commercial veil of your business. If your personal and business accounts are indeed your mixed accounts, your personal assets (your house, truck and other valuables) will be at risk if a lawsuit is filed against your LLC.

Original Mailing Address (for Texas Controller)

For 2022, indicate that the original mailing address is now required. This address is commonly used by the Texas Comptroller to send team tax returns and send reminders to your LLC company.

Here Are The Steps You Need To Follow To Form A Limited Liability Corporation (LLC) Register In Texas.< /h2>Here Are The Steps To Follow To Register A Limited Liability Company (LLC) In Texas. For More Information About Starting An LLC In A Particular State, See How To Start A Great LLC.

How To Order An Article-Based Certified Copy Or Article-Based Certified Copyfrom Texas

A certified copy of your articles of association or articles of association may be ordered by fax, mail, email, mobile device, in person, online, or, as we suggest, online. Normal processing takes up to 2 days plus additional shipping time at a cost of $15 plus $1 per side. Expedited Service is available for an additional $10, but delivery will take less than a day, additional time.

Steps To Keep Organization Items Online

If you are registering your LLC business in Texas registration by offline method, it is possible by mail. Read the instructions below to file your Texas Certificate of Incorporation by mail:

Registered Agent And Registered Office

It is important for a corporation to have the name of a registered agent, which can be either a domestic or foreign corporation , registered in the state of Texas, or an individual residing in Texas.

Learn More With The Information

on this website, you say yes to security monitoring and check it out. At reasonable pricesFor security reasons and to ensure that most services are still available to users, this government computer system uses programs to monitor circuitous online traffic to detect unauthorized attempts to transfer or modify information or cause damage, including attempts to deny service to users.

Filing IRS Form 990-PF

OAG Retains Fake IRS Forms 990-PF (Private or Foundation Recovery Section 4947(a)(1) Unexempt Charitable Trust Treated as a Private Trust ). Under IRS rules, fund managers must provide a copy of Annual Reporting Form 990-PF (and 4720, if applicable) to be an OAG:

Before Forming A Texas LLC

know the exact steps and requirements before applying for an LLC. In Texas, as in any other state, there are a few vacation requirements that you must complete before proceeding with the process.

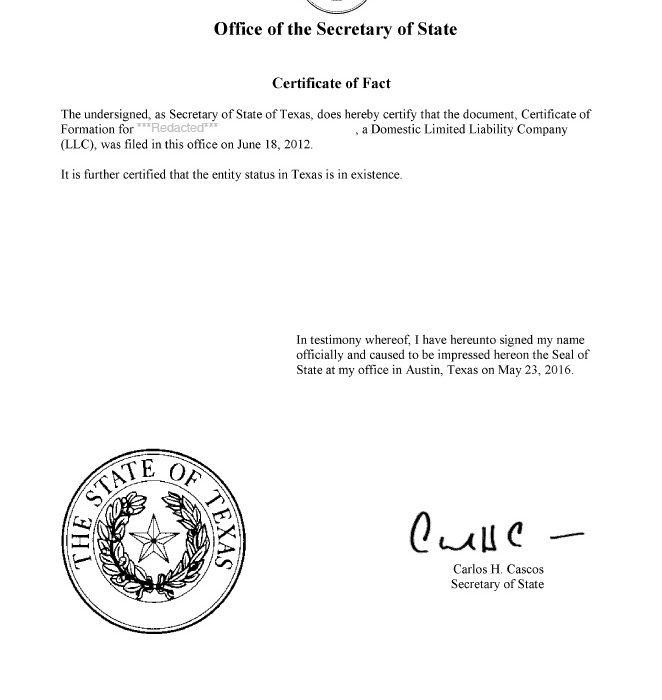

How often does a Texas Certificate of Validity have a reputation? Most corporations incorporated or registeredin your current state of Texas, you will need several documentation options depending on the business key. One such document is the Texas Records of Good Standing issued by the Comptroller. from the office to “certificate from all accounts of the state.” There is also a “certificate” or corporate charter issued by the Secretary of State. You are probably wondering what additional information this document contains, what is the meaning of such a document.