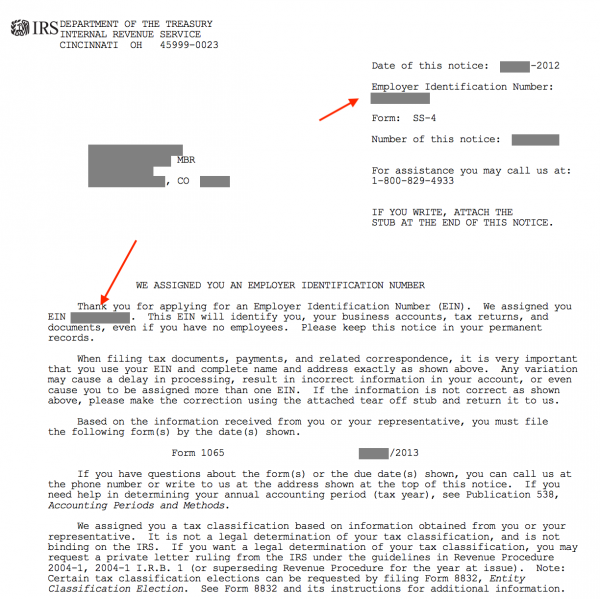

The easiest, fastest and most preferred way is to apply for an EIN online. Toll Free: 800-829-4933.

Explanation Of Employer Tax Liabilities (Publications 15, 15-A And/or 15B)

Publication 15PDF contains information on the tax responsibilities of managers in relation to taxable wages, withholding tax when preparing and filing more complex tax returnstions. Covered. For Publication 15-APDF and the tax treatment associated with many employee benefits, see Publication 15. We encourage employers to download these publications from IRS.gov. Copies can be requested online (search for “Forms and Publications”) or by calling 1-800-TAX-FORM.

Is Texas tax ID the same as EIN?

The Texas Taxpayer Identification Number is assigned by our State Comptroller or Franchise Tax Authority. Read in 3 minutes

Steps To Obtain A Texas Tax Identification Number (EIN):

The process of obtaining a taxpayer identification number can be divided into two stages: registration and waiting for the processing of this request. But to fill out an application quickly and efficiently, you must have all the information you need in place and available to streamline your process.

What Is An EIN?

This lesson is about obtaining a Federal Taxpayer Identification Number (also known as an EIN) from the IRS . Please do not confuse it with your Texas LLC tax number. I know the nicknames are almost identical, but your LLC is the 9 digit number that shows up on the IRS. Your 11-digit tax number from the Texas Comptroller. You will alwaysReceive your tax number in the controller’s welcome letter.

What Is A Texas Tax Number?

A Texas tax number is assigned by the California comptroller or the franchise tax office. An Employer Identification Number (EIN) is a nine-digit number assigned to a business or corporation through the IRS. As part of the process of obtaining a Texas tax number, you must provide a federal type of EIN. Although this is an employer identification number, it does not mean that you must have employees.

Registering A Business In Texas

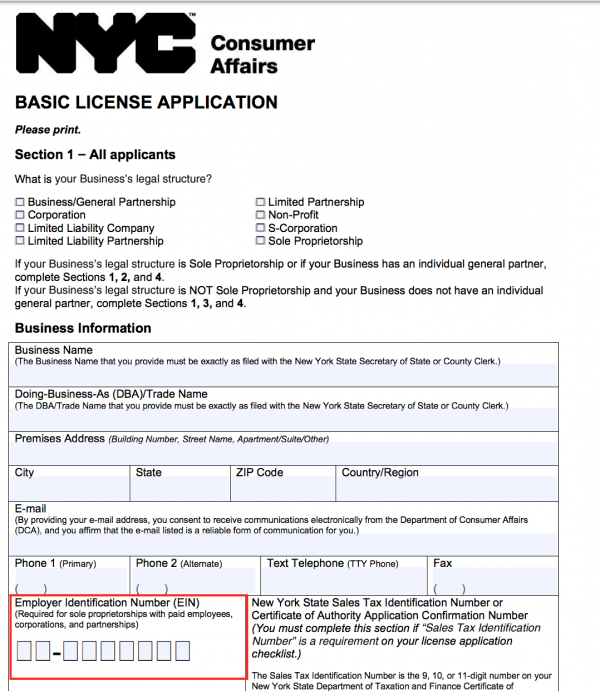

To register a business, you first need to know the type of legal entity being registered. Business units include: sole proprietorships, general affiliates, limited liability partnerships, not-for-profit corporations, and limited liability companies.It is imperative that you select the correct legal entity. Some companies offer customer protection while others do less. Some economic entities “pass” directly ?? you, so you must tax them once. Other businessmen will be taxed on their own income and you will have to pay taxes.At this stage it is important to get professional help â?? In addition to protecting yourself, you must ensure that you comply with all federal and state laws.

Texas Tax ID

In addition to obtaining your federal tax ID (EIN) in Texas, you may also need a Texas tax ID. This ID is required to pay property tax, state income tax, and/or sales tax on items you sell. Typically, the State Taxpayer Identification Number is used for the following purposes:

What Would An Employer Identification Number (EIN) Be?

EIN stands for Employer Identification Number and is sometimes referred to as B .as Federal Identification Number employer, FEIN, Federal Tax Identification Number, or Federal Tax Identification Number. This is a unique nine-digit number that, carriedCertainly resembles the social security number of any good person, but rather identifies the business. Please

follow the unique link to access the entire IRS Online Application Portal: https://sa.www4.irs.gov/modiein/individual/index.jsp

However, if you are unsure or find the online software process confusing,Please let Filing Assist, LLC help you. Many small or new business owners, like you,The IRS online application process can seem confusing and/or intimidating.Is EIN number free in Texas?

Applying for an Employer Identification Number (EIN) is an ideal free service offered by the Internal Revenue Service. Beware of websites that charge for this free service.

How do I find a company’s EIN number?

Most people know their social security number by heart, but not all marketplace owners know their tax identification number. Your EIN is not something you enter every day, so remembering the number is not as convenient as remembering your work phone number or address.