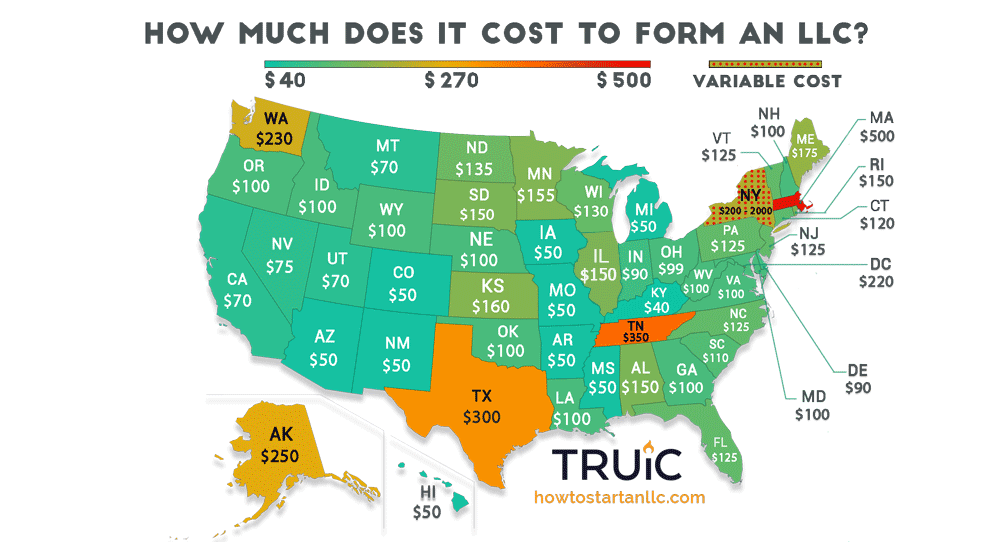

Texas LLC Expenses:

The name of your Texas LLC costs nothing to a person. The Texas Secretary of State does not require you to apply for a name reservation or anything like that. You can call or email the state before collecting a medical history if the name verification you want is available.

Is there an annual fee for an LLC in Texas?

If you are operating as a limited liability company (LLC) in Texas, you should know the procedures for registering your company with the Secretary of State of Texas. The fees below are effective from June 2018, but the type and amount of fees may change at any time. For up-to-date information on the forms and costs of running an LLC in Texas, visit the Secretary of State’s website.

Are There Any Penalties Forbuilding?

Yes. If you do not pay this fee, the state may cancel your registration. In addition, you can generally face civil or criminal penalties if you oversize without registering in his name.

Texas LLC Registration Costs

Texas, must file a Certificate of Incorporation (Form 205) with the Secretary of State of Texas and a $300 registration fee.

Business Permits And Licenses

Depending on your industry, but in addition to your geographic location, your business may need us, state and local, to obtain permits/licenses to operate legally in Texas. This is true whether they are setting up an LLC or another business structure.

Certificate Of Incorporation Filing Costs

The Texas Certificate of Incorporation makes up the bulk of the costs that are likely to costs incurred also differ depending on whether you createyou are a domestic LLC or a foreign LLC. However, you can file both with the Secretary of State of Texas.

State Business Tax

As for income tax, most LLCs are subject to pass-through taxation. In other words, the responsibility for paying federal income supplements lies with the LLC itself and with the individual members of the LLC. Non-payments. LLCs themselves do not pay federal income tax, only their members.

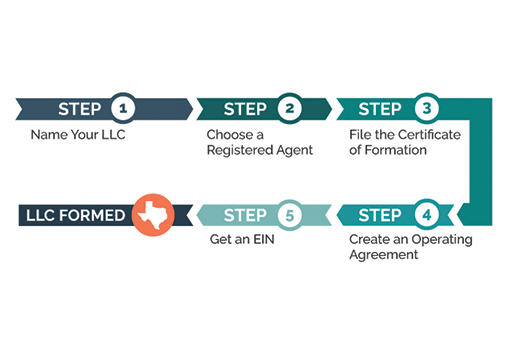

Right Now, Here Are The Steps You Need To Take To Get Started With A Limited Liability Corporation (LLC). Texas.

Here are the steps you need to take to register a Texas Services Limited Liability Company (LLC). For more information on creating an LLC in any form, see How to create an LLC.

What Is A New LLC?

A Limited Liability Company (LLC) can be a business structure. in the United States, where the owners are not personally liable for the debts or liabilities of the business. LLCs are hybrid entities that share the characteristics of a corporation with these ?Types of partnership or individual ownership.

Total Cost Of Formation For A Texas LLC

Saving a name is not a necessary step to form an LLC for setup, but this method can be a useful tool. If you still have a few things to do before signing up for your training certificate, but you have a big name in mind, it might be worth requesting a booking. The $40 fee gives you 120 days of exclusive rights associated with that name, which you can renew as needed for an additional $40. You can reserve a name online or use the paper form.

Does Texas Have An Annual LLC Fee?

No, an LLC is not allowed to prepare an annual return with the Secretary of State unless there has been a structural change. Instead, limited liability companies are required to file a Public Information Report once a year with the Comptroller of Public Accounts of Texas.

Do I need to renew my LLC in Texas?

If you really want to incorporate and operate a Texas Limited Liability Company (LLC), you will need to prepare and file various documents as per the current state. This article reviews the current major filing and filing restrictions for an LLC in Texas.