How do I get a business tax ID in Utah?

To apply, please select the category of organization or corporation for which you are seeking an EIN with the Utah Tax Commission, if you plan to do so. Aftercompleting the application you will receive your tax number (EIN) by e-mail. If you are registering a business for the Utah Tax Commission, Utah that may have employees, operate as a corporation or partnership, you must file one of the following tax returns: employment, excise, and tobacco and firearms, or your own trust, estate, or is a non-profit organization, you may be required to obtain a taxpayer identification number (EIN).

Links To A Key Business Licensing Program

that provides apartment owners and managers with training and resources to address code violations against their property and reduce criminal activity in their home rentals. Members receive a discount on fees from their licensing companies.

Address Required

Your address is also required to create a statement of the most important to the student system. If you do not provide an address, your application will normally be prepared by the C/O registry office. You can update your address to myid the.usu.edu.

Registration Is Named?My Companies

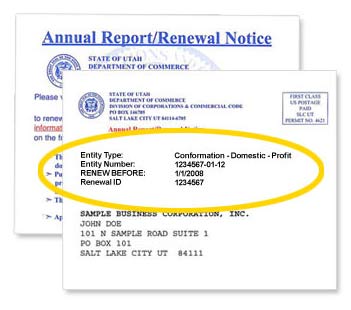

All companies doing business in Utah in good standing must be registered with the Utah Public Register, Department of Commerce. If you use your name in business, your contact details do not need to be registered.

Contact Details

The Spanish student is responsible for maintaining his contact concept to date at UVU, and after graduation to ensure the delivery of the company’s tax form. pupils Go to our refund page and scroll down to keep the address up to date for address instructions.

Addresses

The payment request may differ depending on the information on the site. connection Also ask for your billing address. For added convenience, you can also pay online or by phone.

How do I find my EIN number online?

Ideally, you should remember your tax identification number or keep it somewhere in a dedicated and easily accessible place. With all of this coming to your attention as a small business owner, you may not realize that you shouldn’t know your EIN until you’re halfway through your tax return. Don’t worry! Finding a forgotten, lost or misplaced company identification number is actually quite easy and won’t cost you anything. Here’s a hassle-free guide to finding federal tax IDs. We will also tell you how to find another provider’s EIN.

How long does it take to get an EIN in Utah?

We will quickly process your application and obtain your Utah EIN. Sometimes weWe can get a taxpayer identification number in just one day. If we have already helped you obtain a CEO ID number for your Utah LLC, your family may need our help in the future.

How do I get a Utah Tax ID number?

Obtaining a Utah tax identification number is as easy as one, two, three. First let us know what type of company you would like to receive an identification number for. Of course your business is unique. If you’re not sure which choice to make, this handy quiz can help. Second, fill out our simple online application.

Do you need an Employer Identification Number for your Utah LLC?

If we have already helped you obtain a Responsible Person Identification Number for your Utah LLC, your business may need our help in the future. If you make certain changes to your LLC’s tower system, you may need help obtaining a new federal tax identification number.

What does Ein stand for?

The Employer Identification Number (EIN), also known as the Federal Employer Identification Number (FEIN) or Federal Tax Identification Number, is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to companies operating in the United States for identification purposes. goals.