How much is an LLC in Vermont?

Here are the steps to form an LLC in Vermont. For more information on starting an LLC in any state, see Nolo’s How to Start an LLC article.

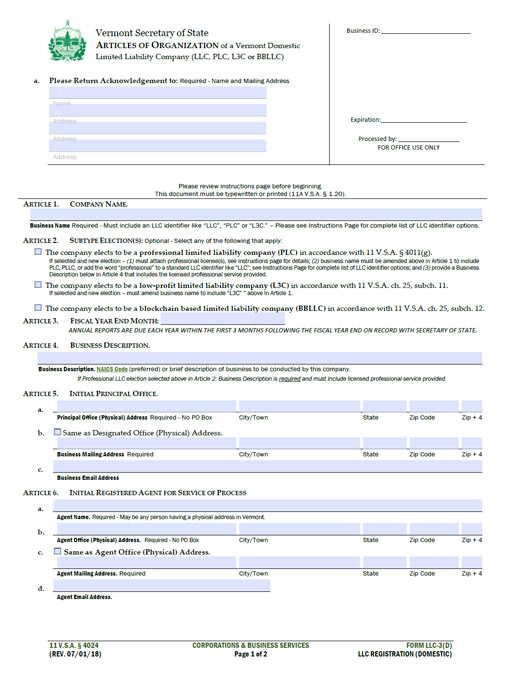

Company Name

The name must contain either a keyword phrase or an abbreviation of “Corporation”, “Incorporated”, “Company”, or possibly “Limited”. The name must not contain the word “Cooperative” or any of its abbreviations. The name must not contain language indicating or simply implying that the company is formed for purposes other than those permitted by law. It must be distinctive and simply different from what is actually deceptively similar or may be confused or possibly confused with the name provided, registered and reserved under the head or secretary of state.

At A Glance

As you prepare to adapt, keep these specific values ??in mind. this will help Vermont.

Open A Business Bank Account

Using business accounts and centralized bank credit is important for corporate protectionThe active veil of your business. When your personal and business accounts are linked, your personal assets (your home, car, and other valuables) are at risk if a lawsuit is filed against your LLC.

VT LLC, Unlike . VT Corporations Now That We’ve Covered The Necessary Characteristics That Apply To All Corporations, Including LLCs, Let’s Now Look At The More Specific Characteristics That Distinguish Vermont LLC Or Vermont Corporation From Other Terms, Which Brings Us To A Conclusion. Which Company To Choose For A Home Business. Each State Has Its Own Laws And Tax Codes That Govern Its Operation And Activities, And These Unusual Details Should Be Considered When Choosing Your Own Business. This Section Describes The Main Features Of Vermont LLC And Vermont Corporation.

Choose A Name For Your Nonprofit In Vermont

Your nonprofit name cannot be the same or the same, you may be confused with 1 other a company or business name already registered while using the Secretary of State. In addition, their name should matchneigh the word “corporation”, the key phrase “incorporated”, “company” or “limited” or the abbreviation “corporation”, “inc.”, “co.” or “ltd”, they may contain the word “Co-op” or an abbreviation of that word in your name. To see if your proposed name is available, you can search the Vermont corporations database on the Secretary of State’s website for keywords.

Register A Corporation In Vermont

Each state has its own its own set of rules for businesses and corporations seeking to form a corporation there. If you decide to register a company in Vermont, include.com has all the important information. We will review the availability of your corporate name and assist you in preparing and filing articles of incorporation with the Vermont Secretary of State. In addition, we can assist you with many of your follow-up needs, such as change requests, written consents, and annual return preparation and filing. Information

By continuing to

Use This Website, You Agree To The Monitoring And Testingsecurity. For Security Reasons And To Ensure That The Government Service Remains Accessible To Users, These Government Computer Systems Use Network Traffic Monitoring Programs To Detect Attempts By Unauthorized Persons To Download Or Expand Information Or Harm The User.

Choice Tax Designation C-Corp Vermont Or S-Corp

Because the limitations of liability, domicile, management, and compliance documents are fair, the following differences arise when choosing between filing an S Corp and/or a C Corp tax return in Vermont:

How to form a nonprofit corporation in Vermont?

How to form a corporation in Vermont?

How to create articles of incorporation?

How to form a Vermont LLC?