Obtaining a special VERMONT-EIN, also known as a Vermont Taxpayer Identification Number, is an important step in starting a business. Your IRS tax identification number allows you to legally perform important travel-related tasks, such as hiring employees, paying additional fees, and opening a bank account. Essentially, the new taxpayer identification number is your company’s social security number.

How do I get a Vermont EIN number?

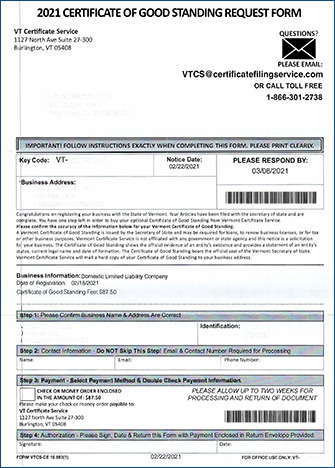

Vermont LLC Fees: Vermont LLCLoad of Documents: $125 Vermont LLC Annual Report Fee: $35

Register Your New Business And Create A Tax Account

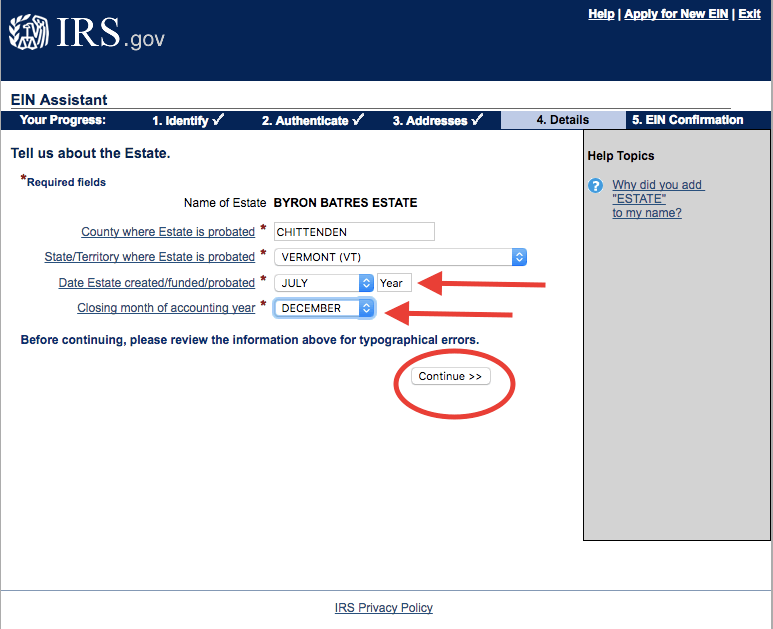

For new businesses, the Vermont Department of Taxation, the Department of State and this Department of Labor partner with lug. This is an online business service center where a client can register their business and obtain the accreditation and insurance required to do business in Vermont. h2>Before you can start building your business, you need to obtain a state tax identification number. This unique 9-digit number may be assigned to your company when communicating with the federal government. You may also hear it referred to as the Master Identification Number, or EIN. This is mandatory if you are hiring, otherwise if your business has multiple members. It is also required to apply for many bank or business loans. An EIN is also required for most programs, such as licensing and permit documentation.

How Do I Cancel An EIN?

If your first application for an EIN, you probablyClearly, something went wrong, or you need to cancel your EIN for whatever reason, simply email the termination letter to the IRS. .

Using A Vermont Taxpayer Identification Number (EIN)

Obtaining a Vermont Taxpayer Identification Number (EIN) is the proper process used by most businesses, trusts, estates, nonprofit organizations, and churches. should complete. Purchase is also recommended for businesses and corporations outside of Vermont that require a taxpayer identification number (EIN), as the game can help protect individuals’ personal records by allowing them to use their taxpayer identification number (EIN) instead of their own. or their Social Security number in various activities required to run their business or organization, including obtaining local licenses and permits in Vermont. Any business that meets any of the following general criteria must obtain a Vermo tax identification number.Here (EIN):

Choose A Reliable Name For Your LLC

Naming your LLC is definitely an important step that needs to be carefully considered over and over again. There are many business and regulatory requirements to consider when making the final decision on the name of an LLC.

Choose A Specific Business Idea

Spend time researching your business ideas. At this unique stage, consider your own attractions, skills, resources, availability, and reasons why your company wants to start a business. You must also consider the likelihood of success based on the interests and needs of the core of your community. Read our article for more tips on evaluating industry ideas.

STEP 1: Name Your Company Vermont LLC

Choosing a group name is the first and most exciting step in building your Vermont company LLC. . Be sure to select a name that is Vermont-compliant and easy to find for potential business customers.

$39 Sales Tax Identification Number

Also known as Producer AuthorizationSupplier, Wholesale identifier. , Resale, Reseller code.

How do I find my Vermont tax ID number?

If you are a new company, create an online account with the VT Tax Department to obtain your account number. You can also file by mail or fax using the BRâ? 400, Application for business tax registration.

How do I find a company’s EIN number?

Most people know their individual security code by heart, but not all entrepreneurs know their tax identification number. Your EIN is not used by customers on a daily basis, so it’s not as easy to remember as your work phone number, and it could be an address.