Employing Families

Generally, if a person employs domestic workers and is likely to withhold Virginia income tax from their wages, you may need to register the family-employer with both the Virginia tax office and and in VEC.

Steps For Obtaining A Virginia Tax Identification Number (EIN)

Virginia Tax Identification Number is considered by businesses when registering with the government. However, once you have successfully registered, you will want to provide personal information about all of the founding members of your company. This includesyou and any partners who share a wardrobe with you in the store. Because if you need to provide your personal information for a particular application, you must obtain this information before you start working. Begin to turn into their full legal names and legal conversations. They must also provide their website 2 . 0 Security Numbers (SSN). By collecting this information in advance, you can complete your loan application faster.

Wait For Your Virginia Limited Liability Company To Be Approved

Wait for your Virginia limited liability company to be approved by the Public Corporation Commission before applying for your EIN. Otherwise, if you are denied LLC registration, you undoubtedly have an EIN attached to a wholly defunct LLC.

Using Virginia Tax Identification Numbers (EINs)

Obtaining Tax Virginia State Numbers (EIN) ) is a specific process that most corporations, trusts, estates, etc. must follow.Non-profit and religious organizations. Even for businesses and corporations that are not required to obtain a Virginia Taxpayer Identification Number (EIN), it is recommended that you obtain one as it can help protect individuals’ personal information when they apply for their Virginia Taxpayer Identification Number (EIN). in lieu of their valuable Social Security number in various activities that are important to the operation of their business or organization, including obtaining local licenses and permits in Virginia. Any entity that normally meets yes to any of the following criteria must obtain a valid Virginia tax identification number (EIN):

Virginia Tax Identification Number

H2>In Addition To Obtaining A Federal Tax Identification Number State Of Virginia. Tax ID (EIN), You May Also Need A Virginia Tax ID. This ID Is Required To Pay Income Tax, State Income Tax, And/or Sales Tax On Items You Purchase.You Give. Typically, A State Tax Identification Number Is Used For The Following Purposes:

Federal Taxpayer ID

Most businesses must obtain some type of state tax identification number (EIN), also known as a large federal tax. an identification number. The identification number is known. The only ones without the use of owners or without a Kyo plan do not need to have an EIN, of course. For more information about companies to contact, call the IRS at 800-829-3676 or visit their website. It is also strongly recommended that you consult with an accountant for more information about your business.

The Steps To Obtain A Virginia Tax Identification Number (EIN):

The process is likely to be much smoother if you get all the information you need before you start your application. This way you won’t contact people who might be trying to get information in the second step of the process.?ssa.

Business Closing

Complete the Business Closing Form (PDF) so that our office can determine if you have additional VAT liabilities for the current period and/or 12 months ago. Your obligation to pay business tax does not automatically end if you close your business, change ownership, or change businesses. In most cases, tax liability for business, professional and occupational licenses (BPOL) is calculated based on the number of days a business operates in a calendar year. Doing business or choosing to do business at any time of the calendar year carries full tax liability.

How do I get an EIN number in Virginia?

To apply for an EIN in Virginia, apply today. We make it easy to get your Virginia Taxpayer Identification Number by offering a faster online form and an easy EIN service process. We do business with this Virginia tax identification number.

After That, How Many Of Us Register To Do Business In Virginia?

Open to Businesses Step 1: Choose the type of business. This decision will affect both your legal rights and your benefits. 2: Step Choose a real company name. This unique name is how other people and Volya recognize your current business. Step 3: Choose a registered agent. Step 4: Register our SCC with you. People alsoDon’t ask what is exempt from sales tax in Virginia? Some buyers are exempt from sales tax, which is governed by Virginia law. Examples include government agencies, many non-profit organizations, and merchants who buy goods for resale. Sellers must obtain a new Resale Exemption Certificate or a valid Home Title Certificate to validate any exempt transaction.

Do I need a Virginia Tax ID number to start a business?

If you are definitely starting one of the following businesses but have employees, you may need to obtain a tax identification number: If you can answer yes to any of the following questions,May I need to apply for a tax identification number for a business loan provider account?

What is a federal tax ID Number (EIN)?

Like a life insurance number, a federal tax identification number is a unique number assigned to a business and remains with that business for the life of the business. The types of businesses that should receive an EIN call include corporations, LLCs (limited liability companies), partnerships, and sole proprietorships that have employees.

What is a reverse Ein lookup?

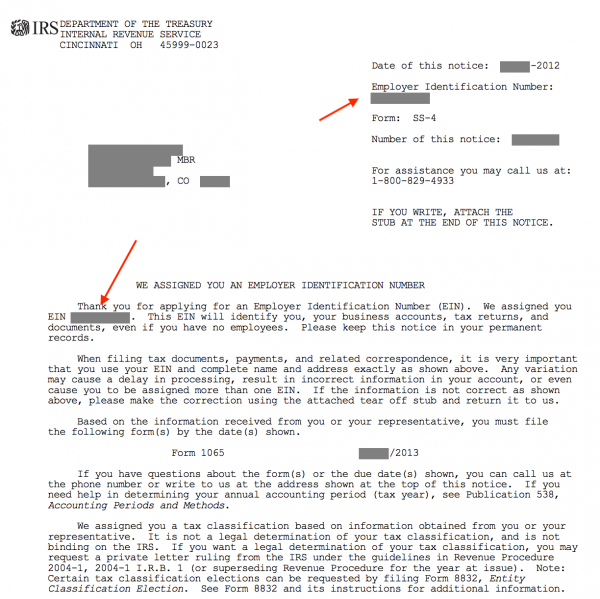

Reverse EIN lookup. The Employer Identification Number (EIN), also known as the Federal Employer Identification Number (FEIN) or Federal Tax Identification Number, is a unique nine-digit number assigned only by an employer to the Internal Revenue Service (IRS) to identify companies operating in the United States. assist States in obtaining identification goals.