Certificates of Incorporation, also known as Certificates of Incorporation (CoF), are manually registered with the Washington Secretary of State (SOS) and show who your business is, who you are, where you are located, and where you are sending your mail.

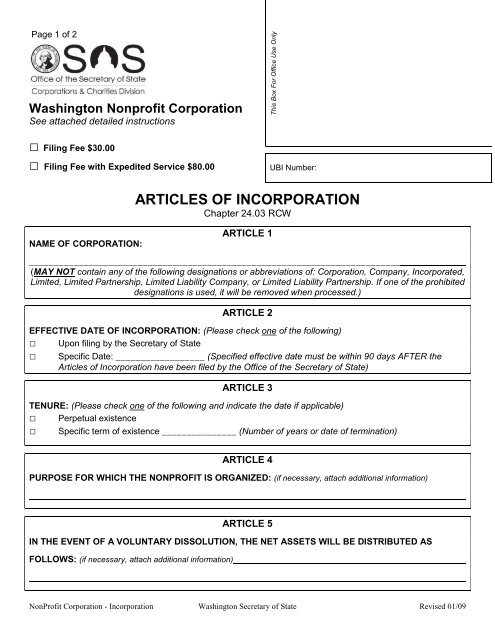

Submit Nonprofit Charter?

If your nonprofit is established or plans to receive donations from the public, it may also be required to register with the Secretary of State’s Charity Program. Charity program registration is separate and in addition to the documents required by the company law; Please visit the Charity Program for entry requirements and number forms.

Before Submitting Your Articles

As clients preparetsing to submit your articles, it is important to take your time to understand the features Information required for these documents. Secretary of State Washington lists the following most common causes they should actually reject the paperwork for the article:

How do I find articles of incorporation Washington State?

A certified successor to your charter or web content can be ordered by mail, in person, or online. You can’t order over the phone. Normal processing takes 5-7 business days plus additional shipping time. The Washington State Secretary of State will send you a certified copy. If you pay an additional $50 for expedited processing, your request will be processed within 2 business hours (plus shipping time).

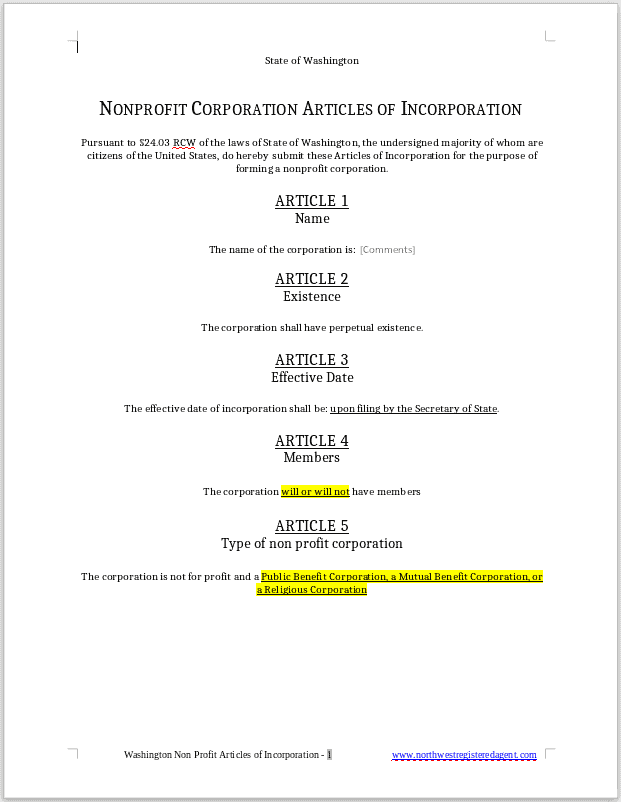

Deed Of Incorporation

Your company will most likely be legally incorporated by filing a Articles of Incorporation with the Secretary of State of Washington. Articles should contain: the name of the company and just the name, address; Process the address and signature of the deliverer; The number tells you what the company is authorized to issue; logo and address of each founder; the duration of the companies; Effective date of articles of association.

Order A Certified Copy Of The Articles Of Association Or A Certified Copy Of The Articles Of Association Of The State Of Washington

A certified copy of your Articles of Association or, alternatively, the Articles of Incorporation can be faxed, mailed, or delivered in person or over the Internet. You cannot order by phone. Normal processing takes 5-7 business days plus an additional postal day. The Washington State Secretary of State will send you a certified? a copy. If you can pay an additional $50 for expedited processing, a personal request will be processed within 2 days of receipt (plus shipping time).

Who Must File The Washington State Corporation Articles Of Association?

Any Person, Partnership, Or Group Wishing To Form A Washington LLC Must File A CoF With SOS. Incorporation Of A Corporation (S-Corp Or C-Corp), Limited Liability Partnership (LP), Professionally Controlled Liability Company (PLLC), Or Non-profit Organization Requires Incorporation Documentation Similar To But Different From The SOS Specific To That Organization. But In Short, Every Business Should Donate To SOS.What Are Washington Incorporations?

Incorporations are the building blocks of your business. Your company in Washington has no legal status, the relevant founder sends the articles of association to this secretary of state. The Secretary of State registers them in the state registration system. Once approved, the charter will become the legal basis for Best Corporation Washington. The actual action of the officeSecretary of State upon filing your Certificate of Incorporation is proof that you meet all the requirements for incorporation of a corporation.

Registration Requirements

It is recommended that individuals provide a name prior to incorporation filing analysis. The designation chosen must be unique and distinct from organizations such as limited partnerships, poor general partnerships, general partnerships, corporations, and various non-profit organizations incorporated in the state of Washington. The name chosen must contain the words “limited”, “company”, “incorporated”, “corporation” or their abbreviation (forms corporation, LLC, LLC, or even LLC). Other Requirements:

Incorporating A Corporation In Washington Is Certainly Easy

Incorporating a corporation in Washington is a completely simple process, which is achieved by filing the Articles of Association of the Secretary of State. becomes . Now we will show you step by step how to register a corporation in Washington.

P?Submit Washington Articles Of Association

You must file our Washington Articles of Association in order to register a corporation in Washington. . The Certificate of Incorporation is the document that formally establishes your corporation in Washington. You can mail it online or mail it to the Secretary of State for Washington. Registration fee $180.

Company Name

The company name must contain the keywords “Corporation”, “Incorporated”, “Company”, “Limited” or their abbreviation “Corp.”, “Inc.”, “Co.”. or “LLC” The name must not imply a destination other than that specified in the articles of association. It must be different from the name of any other domestic company or foreign company authorized to allow them to do business in the state. The terms of “bank”, “loan” and “mortgage loan” must be approved by the treasury agencies. The word “trust” should not be used in terms. The use of the word “cooperative” is often restricted.

Does Washington State require Articles of Organization for LLC?

For Articles LLC about organizations in the state of V?Shington has special requirements that must be met. 3 minutes of reading

How much does it cost to file articles of incorporation in Washington?

Each Washington corporation and foreign corporation licensed to do business in the state must file an initial report with the citing secretary of state within 120 days of incorporation. However, an annual report and license renewals must be filed with the Secretary of State each year. In all cases, the Secretary of State will send a renewal notice to the company’s registered agent approximately 45 days before you see the annual return due. Initial report and annual report may be filed on letterhead or in paper form sent by mail. The initial report fee is $10. The filing fee for this particular annual report is $60.