The EIN stands for Employer Identification Number and is likely issued by the IRS to your incredible Washington State LLC. An EIN is to your Washington LLC what a social security number is to a person. This allows the IRS to identify your business for income tax and reporting purposes.

Do I need an EIN in Washington state?

Your Washington EIN is a required form of identification for many government agencies and financial companies. You must have an EIN to open a bank account, file taxes, and even hire cells.mines. In addition, your tax identification number provides an additional layer of protection as it effectively acts as a social security number for your business. GovDocFiling offers tax pages for Washington DC business owners, as well as those who need an Idaho or Colorado tax ID.

Steps To Obtain A Washington State Taxpayer Identification Number (EIN):

Your first step will often be one of the easiest, as all you have to do is ask a lot of questions and take a few notes. The process of obtaining a tax identification number involves many questions about your business. It is very helpful to collect the necessary information before starting this process. You need to know your company name, so take the time to do so from now on if you haven’t already.

What Is A UBI Number (Uniform Business Identifier)?

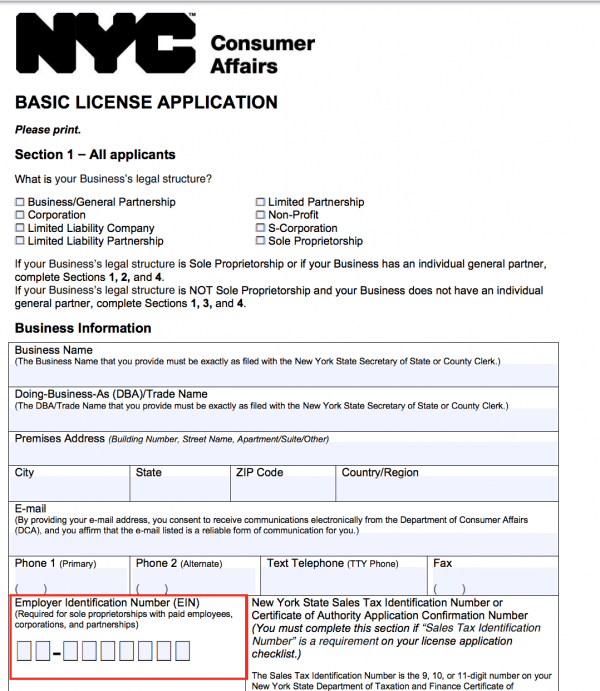

The UBI is a nine-digit number that registers you with several government agencies and allows you toAllows your website to do business in Washington state. UBI is a number sometimes referred to as a tax burden registration number, a business registration number, or sometimes a business license number. Use the Business License Application to apply for a UBI number.

What Is An Employer Identification Number (EIN)?

EIN is abbreviated as an Employer Identification Number (EIN). sometimes used as federal employer identification number, FEIN, federal tax identification number, or federal tax identification number. This is a unique nine-digit number that looks like a social security number for an individual, but instead identifies a business.

State Tax On An ID From Washington

In addition to obtaining your own federal tax identification number ( EIN) in Washington, you will probably also need a Washington tax ID. This ID is required on the marketplace to pay business taxes, income tax shtat and/or sales tax on the goods you sell. Typically, a State Tax Identification Number is used for the following purposes:

Learn How To Get A Washington State EIN

The process by which you obtain your Washington State Identification Number. Obtaining an EIN may seem too complicated, but if you are sure of what you are doing and follow specific instructions, or if you decide to hire a specialized company to apply for your identification number. Fill in the federal tax, the task of “Accepting your employer identification number” becomes a major problem.

Usually, An LLC With Several Members Is Treated As A Partnership

Except in special cases, the only members of an LLC are a man and a woman living in a community-owned state (such as Washington DC). states), multi-member LLCs operating in a commercial business are likely to normally need an EIN as they must file the partner’s tax return.?va for an LLC.

Uses Related To Washington State Taxpayer Identification Numbers (EIN)

Obtaining any type of Washington State Taxpayer Identification Number (EIN) is required is the main thing that most corporations , trusts, estates, nonprofits and even religious organizations must complete. Even for finding businesses and corporations that don’t require a Washington tax ID number, it’s a good idea to get one as it will certainly help protect some people’s personal information by allowing them to use those tax IDs instead. EIN) will use your Social Security Number in a variety of important ways to help you manage your business or organization, including obtaining local licenses and permits from the State of Washington. Any business that meets the affirmative requirements for any of the weight reduction criteria must obtain a Washington State Taxpayer Identification Number (EIN):

What Is A UBI Number?

Washington State providesRequires a UBI number to be registered Have a registered company so you can work in the state. The number contains convenient government agencies to identify the company. Local authorities use UBI to identify businesses.

Name And Address Of The Applicant Phone:

Silvia EzekilovaDeputy Vice-Rector for Sponsored ProjectsGeorge Washington UniversityProsecutor’s Office for Research1922 F Street NW, Suite FloorWashington DC 2005 2Phone: (202) 994-0728Fax: (202) 994-9137Email: [secure email address]* Address all correspondence to the answer above

Do I need an EIN for my LLC in Washington state?

You may need to obtain an Employer Identification Number (EIN) for a new Washington State LLC in order to open a bank account and file federal income and payroll tax returns.

How do I find a company’s EIN number?

Most people know their tax number by heart, but almost all business owners do not know their tax number. Your EIN is not something a person uses on a daily basis, so managing this number is not as easy as remembering your work phone number, or perhaps your work address.

How to obtain my Ein number?

Where can I look up an EIN number?

How to verify an EIN number?

Where to find business Ein number?