Does NY have an annual LLC fee?

The NY Country LLC formation fee refers to the price a company must pay when it wants to form a limited liability company (LLC) in New York. In addition to wasting fees, he must also complete all the procedures required to form an LLC.3 Minute Reading

Choose A Company Name

You can use any name, as long as it exists and ends with “Limited Liability Company” or a variant or acronym. You can find out if the name someone has chosen for your LLC is available and meets state requirements, ?By submitting a name availability request to the Department of State.

How To Write A Beautiful Annual Report In New York?

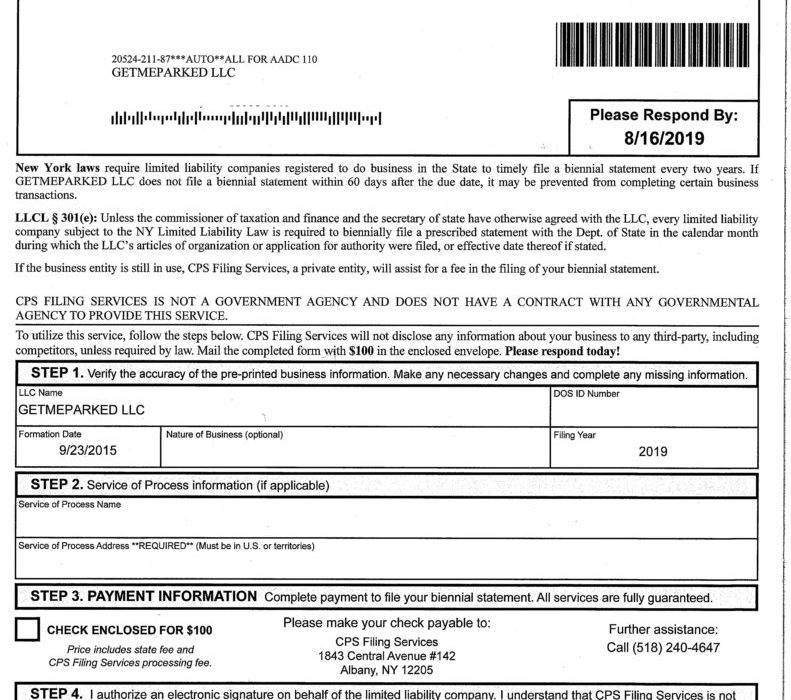

Generally, there are two ways to file your annual return in New York.

LLC, PLLC, Corporation & PC:

New York LLCs, plcs and PCs, foreign and industrial, present their biennial report. The state filing fee is $9. The deadline for filing this application is the biennial anniversary of incorporation.

New York LLC Application Fee: Varies

New York State requires that within 120 cases all LLCs have filed a copy of the Memorandum of Association or Notice of Incorporation of the LLC in two newspapers (one weekly or one daily). When most of the expenses are incurred, the understanding may also depend on whether you are setting up a domestic LLC or a foreign LLC. However, you can send both to your New York Secretary of State.York.

Certificate Of Publication

The New York Department of State requires many LLCs in New York to publish a translation of their articles. organizations in certain newspapers for six consecutive weeks. The documents you choose must be obtained from the county official where your current business is registered.

B. Payment Of Fees

Please note: payment is made externally The United States must be transferred to the United States by check or draft US bank and US currency; Payments submitted in any other form will certainly not be accepted and will not be returned.

New York Corporation Franchise Tax

New York Corporations and in particular Are C-Corps are subject to their own business income. tax, which is calculated as the greater of Total Net Income (ENI), Maximum Taxable Income (MTI), Minimum Fixed Dollar (FDM), or New York Corporation Business Capital and Investment Fund. Annually

Recurring Reporting Transaction: $25 Or More

All New YorkLLCs are required to file an annual return, which is, of course, also a form of state tax filing. Fees start at $25 and range up to $4,500 depending on owners. Gross Income Received in New York.

Fees Articles

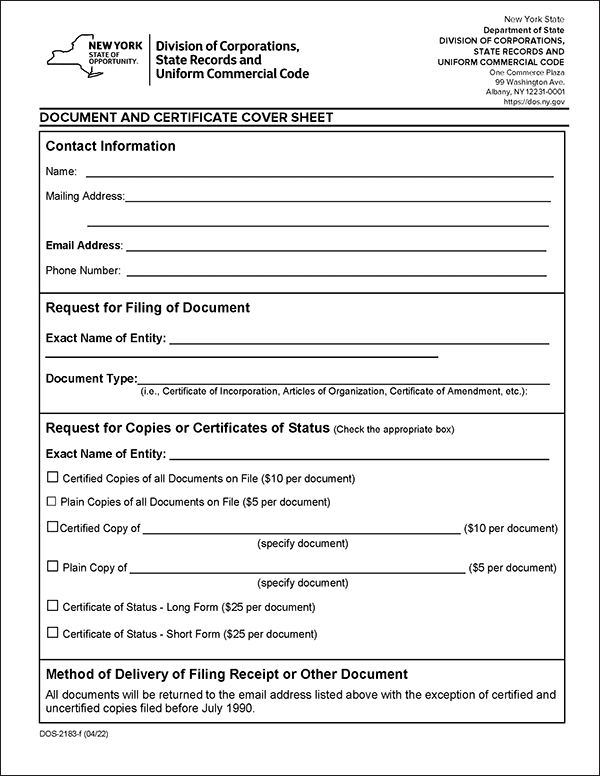

When starting a new small business, there are many steps you must first take to start your business. One of those steps is filing the state’s articles of incorporation. This document officially creates your specialist and defines its basic structure and charter.

Does NY require an annual report?

Businesses and non-profit organizations are required to file annual returns in order to maintain their senior status. Secretary of State. Annual reports are required in almost all states. Deadlines and fees vary and also indicate and enter from the entity.

How much does it cost to start an S Corp in New York?

NY S Corp is a standard corporation or LLC that experts say was incorporated in New York and treated as an S corporation for tax purposes. 3 minutes of reading