Unlike most other states, New York does not require limited companies to file an annual return. However, New York requires many LLCs to pay an annual fee (see below). When it comes to income tax, most LLCs remain so-called pass-through tax entities.

Annual Health Insurance Fee Amount

The application fee amount is generally based on New York State’s gross income for the tax year automatically preceding the tax year for which fees are due (previous tax year). If an LLC or LLP does not wish to receive New York source gross income for the previous tax year, the filing fee is $25.

Taxes And Fees When It Comes To Income Taxes, In Most Cases, Limited Liability Companies May Be Tax Entities. In Other Words, Federal Taxable Income Flows Through The LLC Itself And Goes To The Individual Members Of The LLC. In Many States, LLCs Do Not Pay Sales Taxes Themselves, But Only Their Members Pay.

Choosing A Company Name

You can use any notation, as long as it is actually available and ends with ?The words “limited liability company” or its variant or abbreviation. You can find out if the phone you have selected for your LLC is open and state compliant by submitting an Ideal Name Availability Request to the Department of State.

Does New York require an annual report for LLCs?

Unlike most other states, New York does not come close to requiring an LLC to file an annual filing. However, New York requires thatmany LLCs would pay an annual fee (see below). State Corporate Taxes and Fees When it comes to income tax, most LLCs are almost always tax structures.

New York Annual Report Information

Businesses and non-profit organizations must file annual returns to maintain a good reputation. state administrator. Annual returns are required in most states. Deadlines and fees may vary by state and type, including entity.

Annual Report Contents

As a rule, the report, submitted once a year by a New York corporation (or other legal entity for an LLC), contains all information related to its business and its members . Accepted standard contents of the Annual Return or Franchise Tax Annual Return:

New York Biennial Return Deadlines And Fees

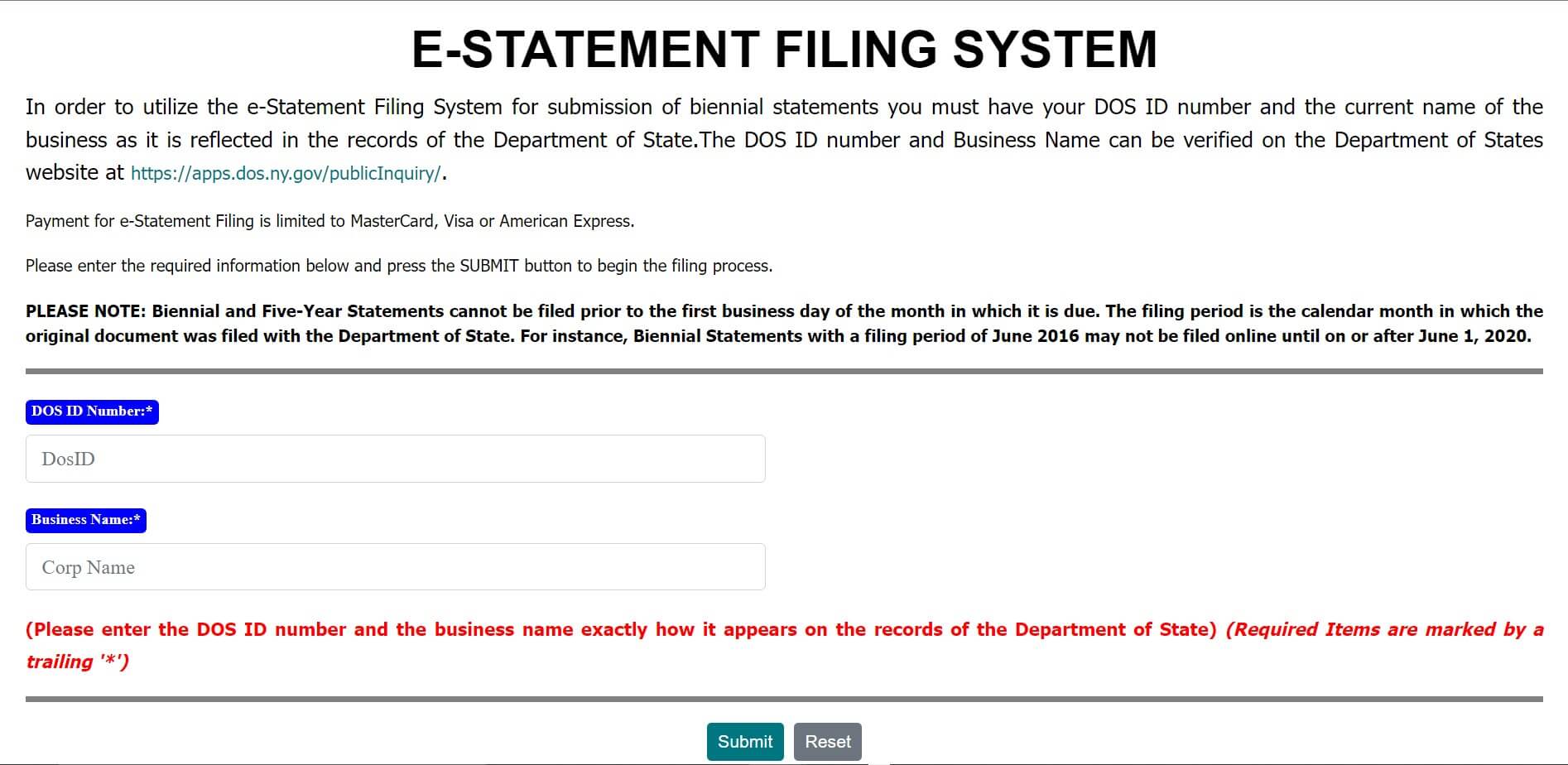

Do not stick to the date you started your businessbusiness? You can easily find the month of your birthday by searching the New York City business database. It will be listed in the company’s “DOS Starting Date” section for $9 for each online filing. Companies can pay for this level with a credit or debit card. Unlike some other states, New York does not offer expedited processing for virtually all biennial returns.

New York Corporation Franchise Tax

New York Corporations, or more specifically , C-Corps, are subject to corporate franchise tax calculated as the greater of Total Net Income (ENI), Maximum Taxable Income (MTI), Fixed Minimum Dollar (FDM), or New York Corporation corporate and investment capital.

Tax Information Package

The available package contains the policy required to register your business with the appropriate New Jersey tax authority. Descriptions with all government taxes included. Employers could potentially avoid future tax problems by knowing which tax liabilityVA apply to businesses and what strategies are best for them. For more information or any questions, please contact Tax Assistance at 609-292-6400 or the New Jersey Automated Tax Information System at 800-323-4400.

Submit documents for registration ð? ?

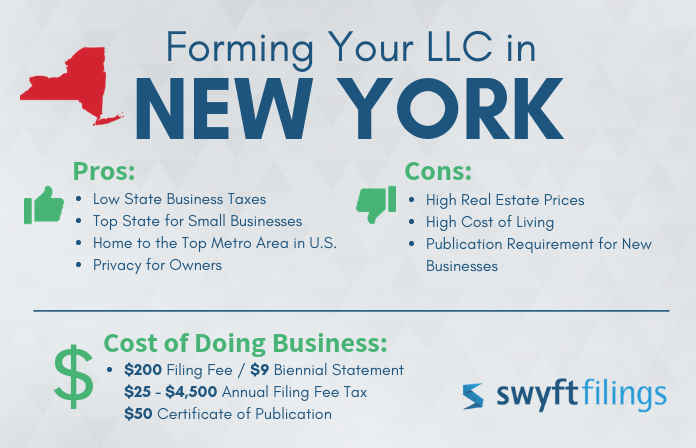

Before legally operating an LLC in New York, individuals must file a Memorandum of Association with the Secretary of State. Your one-time registration fee is currently $200. You already know this part.

Do you have to pay for an LLC Every year in NY?

Certain partnerships, limited liability companies (LLCs), and limited liability companies (LLPs) must pay an annual registration fee by completing Form IT-204-LL, Partnership, Limited Liability Company and/or Partnership. using a payment form

Does New York require an annual report?

If you need to register and manage a limited liability company (LLC) in New York, you really need to prepare and submit various documents to my state. This article reviews the key implications of current state reporting and tax returns for New York limited companies.

Do you have to file taxes as an LLC in NY?

Do not sell my personal information Unlike almost any otherIn the other state, New York does not have an LLC that is required to file an annual return. However, many LLCs are required in NYC, for which you can pay an annual fee (see below). When it comes to income tax, most LLCs are so-called pass-through tax entities.

How much does it cost to form an LLC in New York?

Our filing fees vary based on your New York LLC’s gross income for the entire previous tax year. Some LLCs, such as those with no income, profits, losses, or deductions in New York, do not have to pay a fee. Fees can range from $25 to $4,500.

What is a New York State biennial statement for LLCs?

Under Section 301(e) of the Limited Liability Companies Act, local and foreign small limited liability companies (LLCs) are required to file a biennial return with the New York State Department detailing the address of the Secretary of State of New York, sending a copy of each accepted the work on his behalf by mail.