A single member LLC must also use its name, and therefore EIN, at all times in order to register for excise conduct on Form 637; payroll and rank taxes on Forms 720, 730, 2290 plus 11-C; and file all refunds, attributes, and payments on Form 8849. See Jobs and Excise Tax Returns for more information.

How are LLC taxed in New York?

A Limited Liability Company (LLC) is a new large unincorporated entity with one or more members, each of which has limited liability for the entity’s contractual obligations and other obligations,other than a partnership or trust which, in the opinion of the examiners, is common to all legitimate business purposes under New York State Limited Liability Company Law or under the rules of any other jurisdiction.

Government Corporate Taxes And Fees

As far as income tax is concerned, most LLCs are taxed. In other words, the responsibility for paying payroll taxes lies with the LLC itself and with the individual members of the LLC. In most states, LLCs do not pay income tax themselves, only their members are subject to partnership franchise tax calculated to potentially exceed total net income (TNI), maximum taxable income (MTI), minimum fixed dollar (FDM), or New York Corporation. Business and investment capital.

It Is Very Easy To Register A New LLC In York

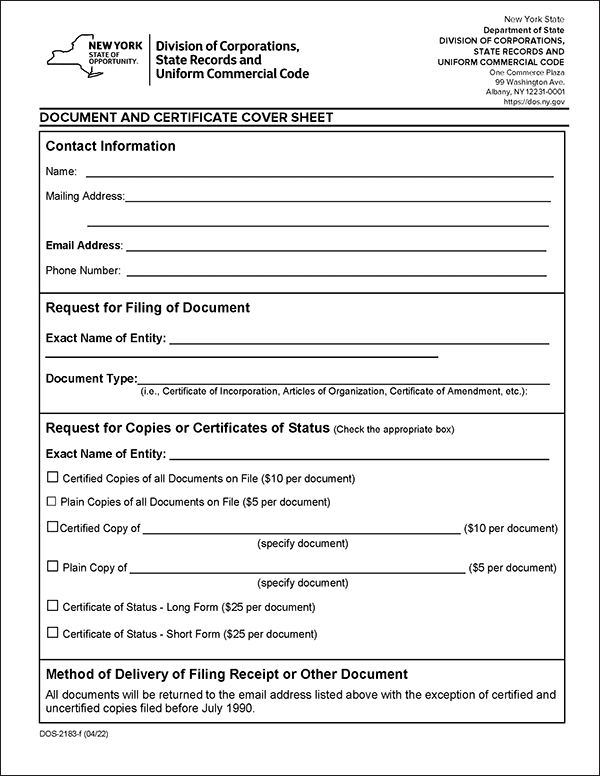

To register a new LLC in York, you must file your articles of incorporation with the Corporation of York associated with the new subdivision of the Department. from the State. which costs $200ares. You can apply online or by mail. Articles associated with the organization is a legal document, according to which thousands of people have created their limited liability company in New York.

Single Member LLC Owner

If a single member LLC does not want to be treated like a corporation, the LLC is an “ignored legal entity” and therefore The LLC’s activities must be listed on the owner’s federal income tax return. When the owner is an individual, the LLC business is usually disclosed:

How To Open An LLC In New York

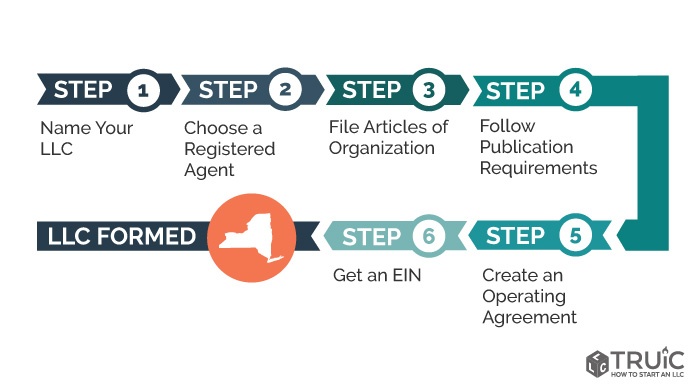

Starting a new business comes with an absolute variety of challenges. The following will highlight some important steps needed to keep your business eligible if you choose to form a New a York LLC. For detailed information on starting a business, check out each webinar “What You Need to Know When Deciding to Start a Small Business”.

What Are The Benefits Of An LLC? New York?

When starting a business, it is very important to choose a business?c-structure. You can create an LLC or limited liability company if you want to reduce individual ownership with corporate liability protection. An LLC also easily shields you from exposure to corporate debts and liabilities, which is why many freelancers and startups prefer an LLC.

What Is An LLC? LLC?

Before deciding to establish an LLC in New. You may need to find out what an LLC is in general and whether it is the right recognized structure for your business. An LLC is certainly a flexible commercial organization that offers liability protection for personal members throughout the country. Its members may also be individuals, other companies, GmbH or other companies. The advantage of an LLC is generally that it can have as many parties as it wishes. It is considered a good reliable hybrid commercial organization because it combines elements of a limited liability partnership and a joint stock company. I must comply with state LLC disclosure requirements. posNYC limited liability companies must post a back-up copy of their articles of incorporation or LLC registration notices within 100 days of the effective date after you file the articles of incorporation.

Registration In New York

Like many freelancers, your entire family started a small business “on the side” or to supplement the dollars you earned on â ? ? daytime? Full-time liability or soil testing before embarking on full-time self-employment.

What is a useful limited liability company? ) is a functional business structure that is a hybrid of a corporation and a sole proprietorship or partnership, although technically it is not. Its hybrid nature lies in the fact that it provides a limited function of society in which it protects its members from personal responsibility as a production of debt or from the responsibility of society as a whole. C dOn the other hand, they offer partnership-transferred tax breaks.

What are the LLC filing requirements in New York?

In order to form and manage a limited liability group (LLC) in New York, many documents must be prepared and filed with the state. This article covers the basic filing and tax reporting requirements for a New York LLC. Unlike most other states, New York may not require an LLC to file an inspection report.

How is a single-member LLC taxed in New York State?

A Single Member LLC (SMLLC) may be taxed as a corporation, including an S corporation, or help to ignore it as a corporation for corporate income tax purposes. If it is unlikely that SMLLC will be considered and the individual participant is a remarkable individual, SMLLC will be treated as a sole proprietorship for New York barrels purposes.

What is a limited liability company in New York?

A limited liability company (LLC) is a bona fide unincorporated entity consisting of one or more members, each of which has limited liability for the contractual and/or other obligations of the company being formed if it has a legitimate business purpose in accordance?vie with the legislation on companies with limited liability. New York State or any other jurisdiction.

What is a single member limited liability company?

Single Member Limited Liability Companies A Limited Liability Company (LLC) is a corporation incorporated under state law. Depending on the timing of the LLC and the number of individuals, the IRS often treats the LLC as a corporation, partnership, or as part of the owner’s tax return (“ignored corporation”).