The cost of registering an LLC varies from $40 to $500. As of 2022, the average cost to set up an LLC in the US is $132. Important: Just because some states have lower fees doesn’t mean you should check them out!

Is there an annual fee for LLC in NY?

The New York State LLC registration fee refers to the fees that a corporation normally has to pay when it wishes to register a limited liability company (LLC) in New York. In addition to paying fees, this guy also has to payGo through all the necessary procedures to create an LLC. read 3 minutes

Annual Filing Fee Amount

The filing fee amount is based on gross New York source income for the tax year immediately preceding the tax year on the income to which the fee applies (the previous tax year). . If the LLC or simply LLP did not have gross New York source income for the previous sales tax year, the filing fee is $25.

LLC Annual Filings

The Pace Filing in New York State LLC is the payment required to become a limited liability company in its current state. If you are filing tax forms for a New York City corporation, you must provide your SSN (Social Security Number). You can also use this EIN (employer number) instead of your social security number as a deterrent.

Government Corporate And IT Taxes

When it comes to income taxes, most LLCs can use something called Pass-Through Control Units. In other words, the responsibility for paying tax returns lies with the LLC itself and the individual members of the LLC. As a rule, LLCs do not pay income tax themselves, but only their members.

Tax Due Date

Note. New York State private statement. tax. The filing deadlines are currently the same as in New York State for income tax filing dates and possible in-person taxes. New York State tax dates can be found here.

IT-204-LL Electronic Filing Form

IT-204-LL will print or generate an electronic file in one pass via the New Yorker. or government announcements. If you file your LLC return before the due date, regular New York State and State returns will not be generated.

Calculating Business Income Tax

Your federal taxable income (FTI) is the starting point for calculating your New York State business location. You can find it on line 36 of Form 1120, the federal tax expense form that corporations use to report their source of income to the IRS.

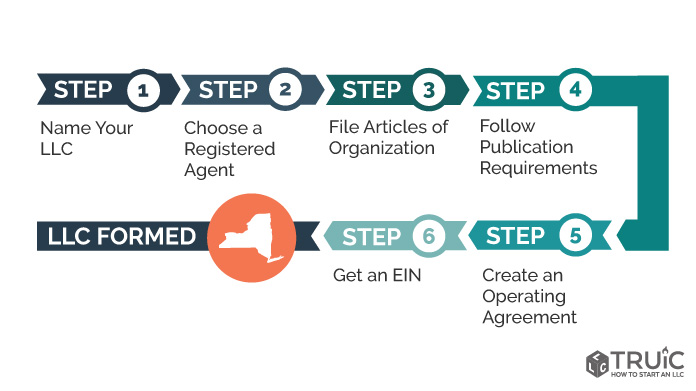

STEP 6: Receive? EIN LLC In New York

H2> What Is One? EIN Stands For Employer Identification Number. EINs Are Actually Nine-digit Numbers Assigned By The Internal Revenue Service (IRS) To Identify Ancillary Companies For Tax Purposes. In Fact, This Is A Real Social Security Number For Business.

What Is The Annual Return Filing Fee In New York?

The fee for an annual medical history report depends on your lifestyle and whether you have a profession. from home or abroad in New York. Refer to the table below to determine the registration fee for you Condition.

New York, Startups And Taxation

New York is recognized as the world capital of finance and business. New York also has a large startup ecosystem based on a strong financial system that helps create venture capital available to startups.

Penalties For Failure To File Or Late Filing

There are no delays if the LLC does not file this biennialreport within the stipulated time. However, an LLC may face serious consequences, such as loss of reputation in the State Archives or liquidation.

Do I have to renew my LLC Every year in NY?

Under Section 408 of the Corporations Act, both domestic and foreign corporations are required to file a return every two years with the New York State Department. The two-year report must include: (i) each name and business address of our CEO, (ii) the attendance order of its CEO, (iii) certain addresses where the Secretary of State of New York should receive copies of the experiences contained in the acceptance the name of the company, i.e. (iv) the number of directors normally on the board and the number of women on this type of board of directors.