Annual Return Requirements for a New Hampshire LLC Annual Return The State of New Hampshire requires you to file an annual return for your LLC. State business tax State employer tax Sales and use tax Registration in other states

Your Online Business Services

Starting a business in New Hampshire is easy with QuickStart. An online solution that not only allows your entire family to search for a business term, but also helps you quickly submit your business to the Secretary of State.

How do I file an annual report for a New Hampshire LLC?

To access our own online form, you will need an LLC government identification number. The annual report must be submitted by April 1 of each year. The annual filing fee for New Hampshire LLC is $100.

Submit Reports Annual Reports

All LLCs in New Hampshire and foreign LLCs licensed to do business in the state are required to file a comprehensive annual return. The report must be received by the Secretary of State by April 1. The application fee must be $100. The return must be filed online, which means New Hampshire’s online annual return filing web page.

Annual Return

The State of New Hampshire requires you to file an annual fee for your LLC. You can send the report included in the report ?Or fill it out online through the Secretary of State’s website. You will need a state-issued LLC company identification number to access the online form.

Step 3. Certificate Of Incorporation, Usually Issued By New Hampshire LLC

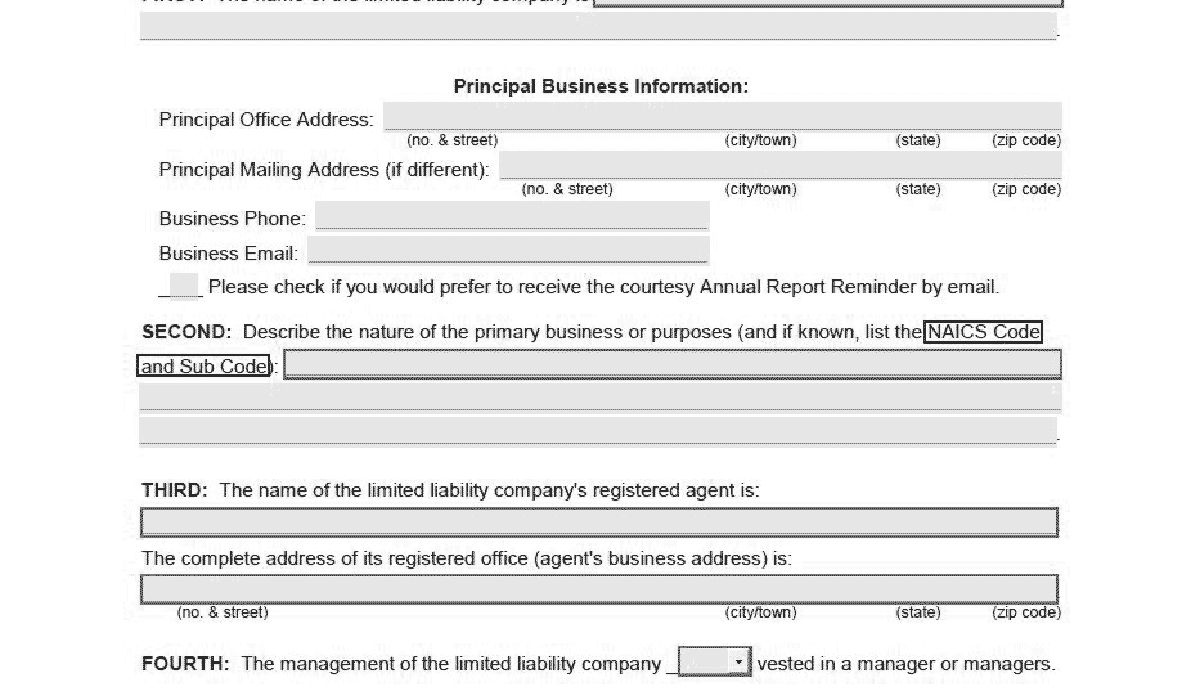

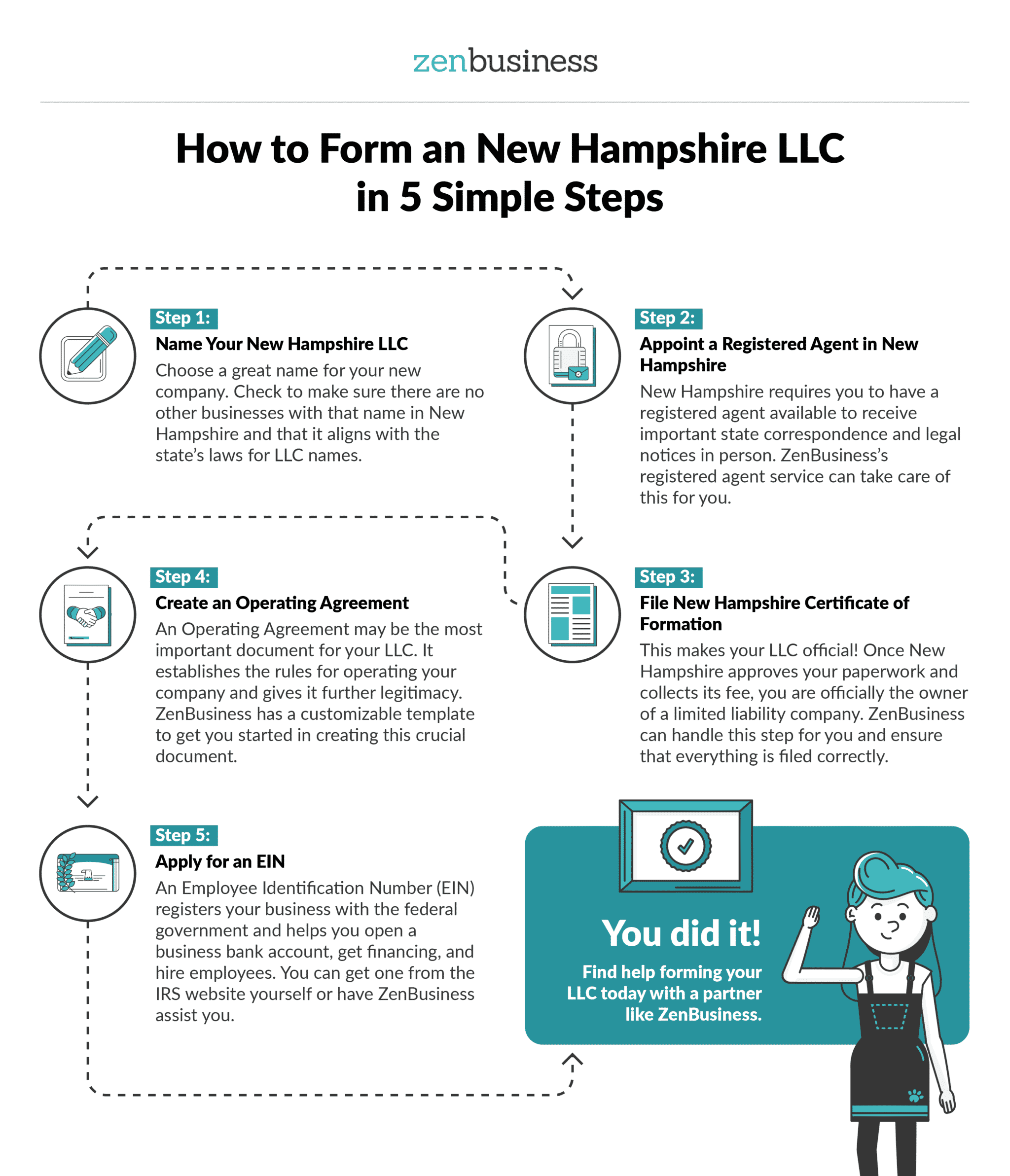

To list your LLC in New Hampshire, you must now file articles of incorporation with the New Hampshire Department of State. You can apply online through the NH QuickStart website or by mail.

New Hampshire Business Tax: Benefits Vary

New Hampshire levies a property tax of 8, 2% with an LLC with the $50,000 gross revenue mentioned above. . This tax is due on the 15th full day of the third month following the end of the tax year.

Can I Reserve This New Hampshire Business Name?

Yes. If you have the perfect business name but want to make sure it’s still available when applying for an LLC, a client can reserve your business name for 140 days by submitting a Name Reservation Request with New Hampshire Corporationsira by dividing and paying a fee of 15 US dollars.

Filing New Hampshire Articles Of Incorporation

To form a New Hampshire limited company, file the articles of incorporation with the New Hampshire Department of Corporations. We will guide you through this step and are currently finalizing the submission for you when you start using our business creation services. And to get you up and running quickly, we offer an expedited service to help you stay ahead of the curve.

New Hampshire Corporation Annual Report Requirements:

You can find more factors in our New Hampshire is available for selection on the Reports Clearinghouse page.

Filing Memorandum Of Association

A LLC is formed in New Hampshire by filing a Memorandum of Association for a New Hampshire Limited Liability Company with the Secretary of State of New Hampshire. The certificate can be submitted on the World Wide Web or printed out and sent to the Office of the State Secret?rya. The application fee is $100 and credit card is the preferred method of payment.

Submit New Hampshire State Incorporation

Proof of Incorporation, commonly referred to as “Statutory Organization” . becomes. in different states, is a document for creating an LLC. The New Hampshire State Charter must be filed with the New Hampshire Secretary of State online, by mail, or in person.

Do LLCs pay taxes in New Hampshire?

If you want to register and manage a limited liability company (LLC) in New Hampshire, you will need help preparing and filing various documents that are usually filed with the state. This article covers the most common tax reportsand documents for an LLC in New Hampshire.

How do I file an LLC in NH?

Here are the steps to register a Limited Liability Company (LLC) in New Hampshire. For more information on starting an LLC in any state, see Nolo’s article on how to start an LLC.

How long does it take for an LLC to be approved in NH?

How to set up an LLC in New Hampshire – you are here. This quick guide is a quick comparison of how to start an LLC in New Hampshire.

How much does it cost to register a LLC in New Hampshire?

The basic requirement to form an LLC is an actual fee of $100 to file an LLC Certificate of Incorporation online with the New Hampshire Department of State.

How much does it cost to file an LLC in NH?

GApprenticeship must be completed by April 1 of each year. The annual return filing fee due to New Hampshire LLC is $100. When it comes to income tax, most LLCs are so-called pass-through tax entities.

How do I set up a foreign LLC in New Hampshire?

To conduct business in New Hampshire, all LLCs organized outside of the state must register with the New Hampshire Minister of State. Foreign LLCs must appoint a registered process agent who is physically located in New Hampshire. To register, apply for registration through a foreign joint-stock company.

What is a New Hampshire registered agent for an LLC?

Every LLC in New Hampshire must have a strong procedural agent on staff. This is the person or entity that agrees to accept legal documents on behalf of the LLC in the event of a lawsuit. A registered agent may be a New Hampshire resident or a corporation, LLC or limited liability company licensed to do business in New Hampshire.