The Certificate of Incorporation is a document certifying the registration of the best business. This document, also referred to as informational articles or articles of association, is essential for the conduct of business in a company today. Anyone authorized by your company can file your articles of association.

How do I obtain a certificate of authority in Connecticut?

A foreign company wishing to do business in Connecticut can obtain an Authority Certificate by submitting our Authority Certificate Request. The application includes the appointment of a registered agent.

Filing The Connecticut Articles Of Association Today

The Connecticut COI, like memorandums of incorporation in other states, describes the facts of the business. This provides the basis for registering your business with the Secretary of State (SOS) to explain and establish. The degree allows you to run your business like a corporation. We focus on commercial enterprises.

Choose A Specific Company Name

Your company name must be different from any company name already registered with the corporate secret?I. Names can be verified by searching the Connecticut Secretary of State’s Business Registry.

Order A Certified Copy Of Articles Related To The Organization Or A Certified Copy That Complies With The Articles Of Association Of A Connecticut Company.

A certified copy of your articles of association or articles of association may be requested by fax, mail, email, or in person, but we recommend that you fax it. Clarification usually takes up to 5 business days, plus much longer shipping and a $55 certification fee. Expedited Service is available for an additional $105 and should take less than 24 hours plus additional delivery time.

More Information

By using this site, you agree to our security monitoring and verification for . For security reasons and to ensure that the community center remains accessible to users, this government workstation system uses network client monitoring programs to detect unauthorized attempts to download and/or modifyinformation or cause damage, including attempts to deny users access to the Center.

Section 3. Registered Agent And Registered Office

Enter a new email address associated with your non-profit organization. This email will be used to send you a special reminder to turn in your annual return. If your non-profit organization does not have address information, DO NOT write anything on the form.

At A Glance

Be sure to consider the following specific requirements when preparing to be included in the society. in the state of Connecticut.

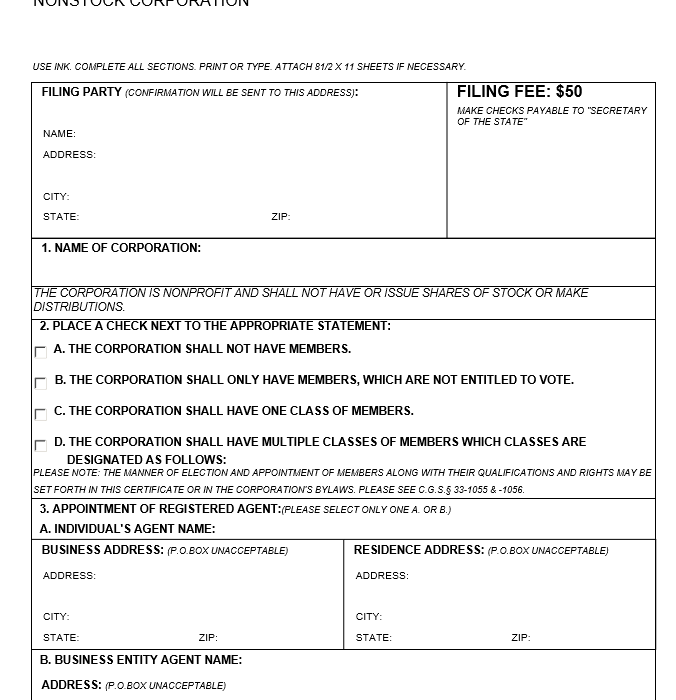

It Is Usually Necessary To File A Certificate Of Incorporation In The State Of Connecticut

You must file a certificate of incorporation in the state of Connecticut directly to register a corporation in the state of Connecticut. The Certificate of Incorporation is the document that officially registers your corporation in Connecticut. You can initiate it online, by mail, or in person with the Secretary of State. Rate $250.

BENEFITS OF CONNECTICUT LLC.

Vlast and prestigeCorporations are the oldest business entities in the United States and are subject to stricter rules and regulations than LLCs. While this requires some extra effort on your list, things look very good for investors. Unlike LLCs, corporations can hide problems and are required to provide assistance and advice to shareholders at the annual investor meeting. and corporations, then you need to look at the characteristics of why a Connecticut LLC or Connecticut Corporation might be a better fit for your business model. Each state has its own laws and tax laws that govern the general way of doing business, and these interesting details should be considered when choosing your business. The information in this section contains detailed information about Connecticut LLC and Connecticut Corporation.

Final Steps

Connecticut corporations are required to file an annual return with the state. National offices must register their constituent assembly within 29 days. The cost is 150 dollarsin the US for state companies and $435 for foreign companies doing business in the main state.

How do I file a business form in Connecticut?

Some of them may well be filed directly online here at business.ct.gov. For other business forms, please return to our forms page for a wider selection. Do you have other questions? Robin, our chatbot, can help you!

How do I get a certificate of authority in CT?

Corporations must register with the Connecticut Secretary of State before doing business in Connecticut. Out-of-state companies generally adhere to the Connecticut Certificate of Authority. This will allow you to register a companyas a foreign company and eliminate the need to create a new company.

Can I get a certified certificate online in Connecticut?

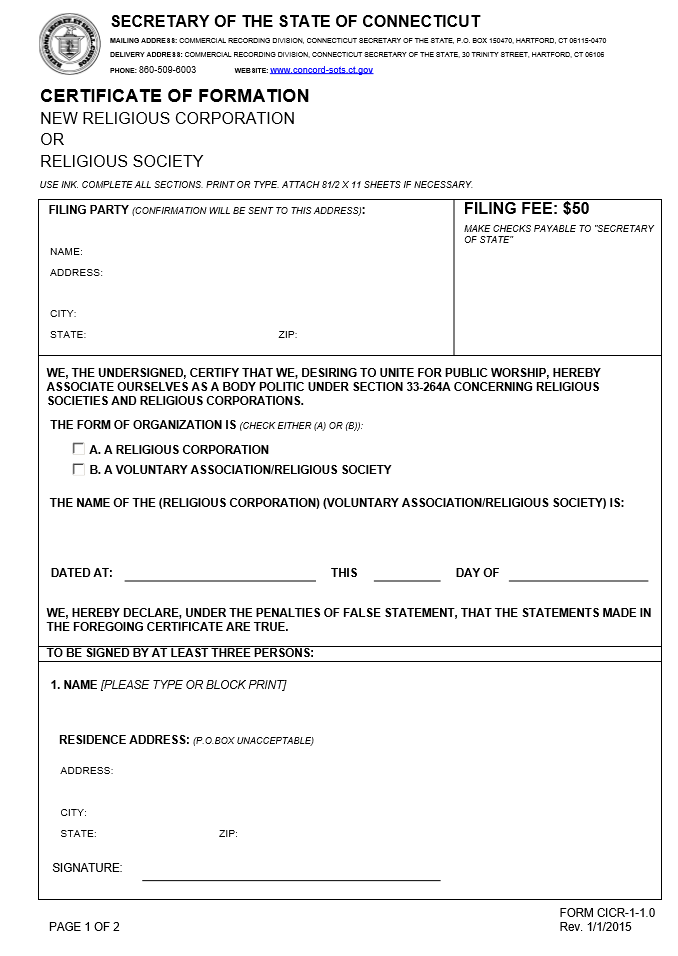

Certificates are not available online to specially licensed, religious, banking, and insurance companies in Connecticut. The most important thing is to verify the authenticity of almost all certificates issued by our office in the last 90 days.

Where is the Connecticut Secretary of business and human resources located?

Postal address of the State Secretary of Connecticut: Business Service Secretary, Secretary of State Connecticut, mailbox 150470, Hartford, Connecticut 06115-0470 Delivery Address: Business Service Secretary, Public Secretary of Connecticut, 30, Hartford Street, 30, Hartford Street 06106