Georgia LLC Articles Of Association Filing Instructions:

The Conditions Law requires all LLC names to include “limited liability company”, “limited liability company” and “corporation”. with limited liability. . “OOO” or possibly “L.C.C.” The name of the LLC must be distinct from the name of any other entity authorized by the Secretary of the Division of Public Corporations of the State of Georgia. Use these websites to search for existing LLCs to get names if the name you want is available: https://www.llcuniversity.com/georgia-llc/search/ or https://ecorp.sos.ga.gov/BusinessSearch< /p>

What Is The Fee For Filing Georgia’s Annual Report?

Financial filing fees depend on the type of legal entity the families have and whether or not it is a corporation. At home or abroad in Georgia. Refer to the table below for the costs associated with your medical history. for the statestva.

Perhaps These Are The Main Steps You Need To Take To Register A Limited Liability Company (LLC) In Georgia.

A limited liability company (abbreviated LLC) is a one-sided legal structure. new business. It combines the limited liability of a corporation with the flexibility and low formality of a partnership, also known as sole proprietorship. Any business owner trying to limit personal liability for business debts and lawsuits should consider forming an LLC. For more information on setting up an LLC in practice, see the nolo article “How to Start an LLC”.

Submit Your Annual Return To Georgia

Georgia’s Annual Return can be submitted online, mostly by mail , personal or personal. Whichever filing method you choose, be sure to visit the Georgia Division of Corporations annual registration page.

How do I pay for a filing fee?

(5) Fees are non-refundable or transferable. Payment Methods: Applications mailed to our offices must be paid for by the specified check, certified cashier’s check or money order. Personally presented documents can be paid by direct debit, certifiedbank check, money order or credit card. We cannot accept cash. Expedited Processing Fee:

Speak With An Expert Today About Our Annual Reporting Service 888-366-9552

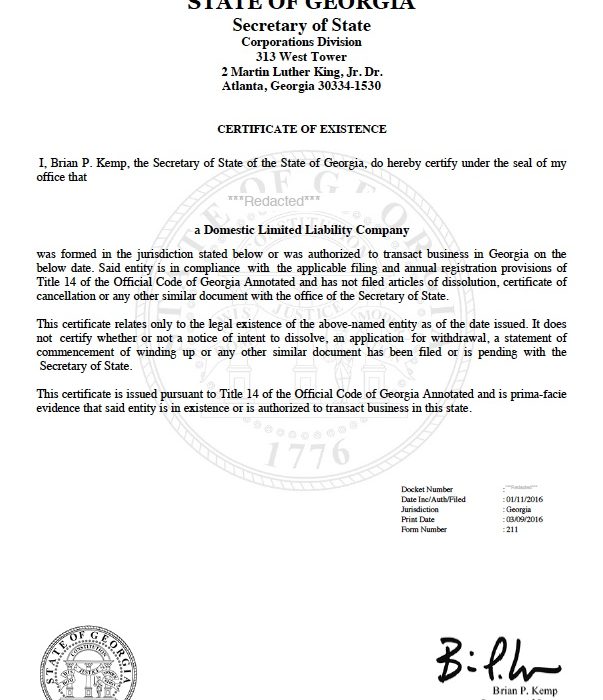

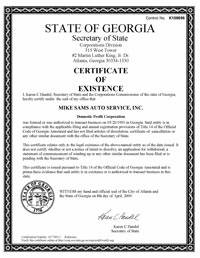

B Compliant with the law State of Georgia Annual Account RegistrationThis is the term used to refer to the annual filing of corporations. Other states may identify these reports as financial reports or possibly informational reports. However, the documents coming from everyone have the same purpose – ?? to comply with the law, whether it be opening a specific new business or confirming that your current service is still in operation. By filing an annual registration with the Secretary of State of Georgia, a company certifies that the company is still in business in the state, while providing a brief overview of very administrative details, including company name, corporation, management structure, and other details. registered agents.

Choose A Name For Your LLC

The main decision you need to make is to choose a name for your business. You should already have a name in mind or come up with one from scratch.

Name Reservation: $25 (optional)

Assuming you can be purchased with a name perfect for your own new business, but there are a few unfinishedwhich you need to iron out before you are ready to submit your incorporation papers in the state of Georgia. In this case, you can reserve your company name with the Secretary of State for 30 days.

Service For Foreign Companies

We need $100 plus fees. Serve you a foreign corporation certificate of authority using the form of the Secretary of State of Georgia. We also find all the documentation required by the state of origin as well as your corporation to submit your documents.If someone wants to file documents on their own, just register with the relevant registered agent service in Georgia and the dangerous company form will immediately appear in your account. As a bonus, we have some filing tips that will make it easier to apply to the state. In any case, your company must have a representative in Georgia, so we try to make it easy for you, whether you want us to submit your documents, or you want to do it yourself.

How much is Georgia State filing?

You will most likely need to complete at least one application and then pay an application fee, but each issue has its own set of requirements. Before you start the process, compare the application times in the state and then list the filing fees so you can plan accordingly.

How much is a LLC in GA?

The initial cost of forming an LLC is the $100 fee for filing your LLC Articles of Association with the Georgia Division of Corporations.

How much is Georgia annual report?

This page provides information on how to submit an annual return for Georgia. Our mobiletelephone The reference table contains the dates for the submission of the annual report for Georgia and the submission of documents. Tariffs for each type of object. We also offer a managed annual return service to take the stress out of your annual return. full reports. We monitor your deadlines and deadlines every time.

How much does it cost to incorporate a corporation in Georgia?

Within 90 days of registration, each Georgian organization must submit an initial annual registration to the Minister of Foreign Affairs, which experts say includes three top leaders. The fee is $50 for commercial and professional businesses and $30 for non-profit businesses.

How do I contact the Georgia Secretary of State?

Georgia Secretary of State Office To: 2 MLK, Jr. Dr. Suite 313, Floyd West Tower Atlanta, GA 30334-1530 Phone: (404) 656-2817 Toll free: (844) 753-7825 WEBSITE: https :/ /sos.ga.gov/ © 2015 PCC Technology Group.

How do I set up a limited liability company in Georgia?

Download and complete the entire Application Form – Limited Liability Companies (231) from the Secretary of State of Georgia website. Submit completed incorporation documents, filing, form, and the $110 filing fee to each branch of the Secretary of State for Corporate Affairs. Processing time: varies; There is an additional $100 processing fee for processing within 2 business days.