Create A Foreign LLC In Rhode Island

If you already have an LLC registered in another state and want to expand your business in Rhode Island, you can do so. To do this, you need to register the LLC as a foreign LLC in Rhode Island. Prior to the

Annual Return Submission Deadline

, LLCs must file a consolidated return no later than September 1 and November 1 of the calendar year commencing one year after the application of the original articles of association. . and subsequent years throughout the life cycle of the business.

State IT Corporation Tax

, if applicable, will help pay income tax that is presumably paid by most LLCs. through -Companies. In other words, the responsibility for paying federal income tax lies with the LLC itself and with all the individual members of the LLC. By default, LLCs themselves do not pay federal income tax, but its members do. However, Rhode Island applies its minimum corporate tax rate to very common corporations (those LLCs that don’t want to be corporations after they’re gone).Tax rates; see below). The annual income tax is $400. Use Form RI-1065 to return this tax to the Department of Internal Revenue (DOT). Visit the DOT website for more information.

Filing Annual Returns

All Rhode Island limited companies and subsequently foreign limited companies are licensed to maintain business when the state files a limited liability company annual return (Form 632) with the current Secretary of State of Rhode Island upon completion pays a $50 filing fee. The return must be filed between September 1 and November 1 of each calendar year, generally beginning with the year following the year in which the articles of association of the particular original LLC were manually filed with the corporate secretary. The complaint can be filed online or by mail. Be sure to contact your Resident Representative regarding documents obtained from this report.

Instructions For Filing Rhode Island LLC Annual Return Online

Important: The Rhode Zone Online system will disconnect you fromafter ten minutes of inactivity. To avoid the hassle of having to start registration over and over again, we recommend that you read the following facts twice. Once just to get a clear idea of ??what you are going to do, and then the second time when you fill out reports online.

Submit Annual Reports

All companies with Limited Liability Company in Roda The Island Company is required to file an annual limited liability company return with the Department of State between October 1 and November 1 of each year. This includes foreign LLCs doing business in the state. The first report must be submitted within the year following the most significant year in which the LLC files its articles of association.

Can I Reserve A Company Name In Rhode Island?

Yes. If you are delaying registering your LLC, you can reserve any of your chosen company names for up to one day. You must submit a request for a reservation unit name ($50) offered by the DepartmentState Department Business Services.

Get Rhode’s Annual Report Service Island Today!

GET STARTED GET STARTED

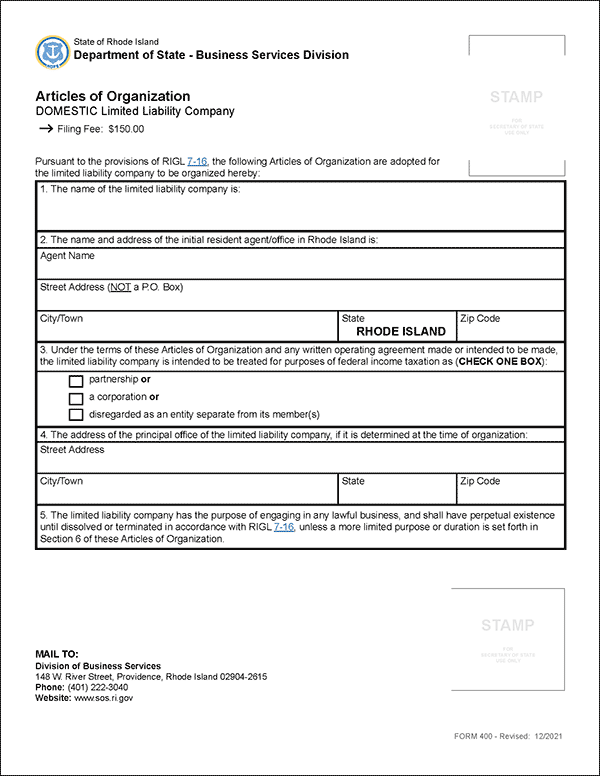

Total Cost Of Forming An LLC In Rhode Island

First of all, you should know that reserving a company name is not required to register an LLC, so this $50 rate is optional . However, if you have a perfect name that isn’t quite right for starting your business, consider reserving it. If you submit a booking online or by mail, you receive a non-renewable hold for 120 days against your registered entitlement. On the other hand, if you are up and ready to file your bylaws, do so because your name will be automatically written on the document.

About The Rhode Island Annual Report

Businesses and nonprofits must file annual returns to stay in good standing. Foreign Secretary. Annual returns are required in most states. Deadlines and fees ?State dependent and object type.