If there is no operational harmony, you and the co-owners will not be able to agree on managerial and financial misunderstandings. Even worse, your LLC must follow one of your state’s standard terms of use.

Does Florida LLC require operating agreement?

Florida does not require you to have a great operating agreement for your Limited Liability Company (LLC), but it is recommended that you do so in this case. As youIf you are growing your industry, you should seek the advice of a Florida LLC commercial litigation lawyer. Not only can business lawyers help you set up an LLC, but they can also help protect your business by drafting a comprehensive operating agreement.

Any Registered Member Can Enter Into An Agreement

Joe, Jane, and Jessie can each enter into an (majority) LLC agreement and associate the LLC with a permit without having to ask the other participants for section 401(a) of the LLC. For example, Joe could have signed the lease on behalf of the LLC rather than simply include Jane and Jesse in the decision. However, each member may only act to the extent that it obtains an LLC to the extent that the business concept of a limited liability company in the ordinary course of business is clear, see Section § 412(a) of the LLC Act. So, doing something that is clearly outside the scope of the LLC’s day-to-day operations, such as hiring a law firm, selling your current LLC holdings, or hiring applicants while an LLC has “never hired anyone before” is most likely unauthorized.and other members must agree.

Also, What Is An Operating Agreement?

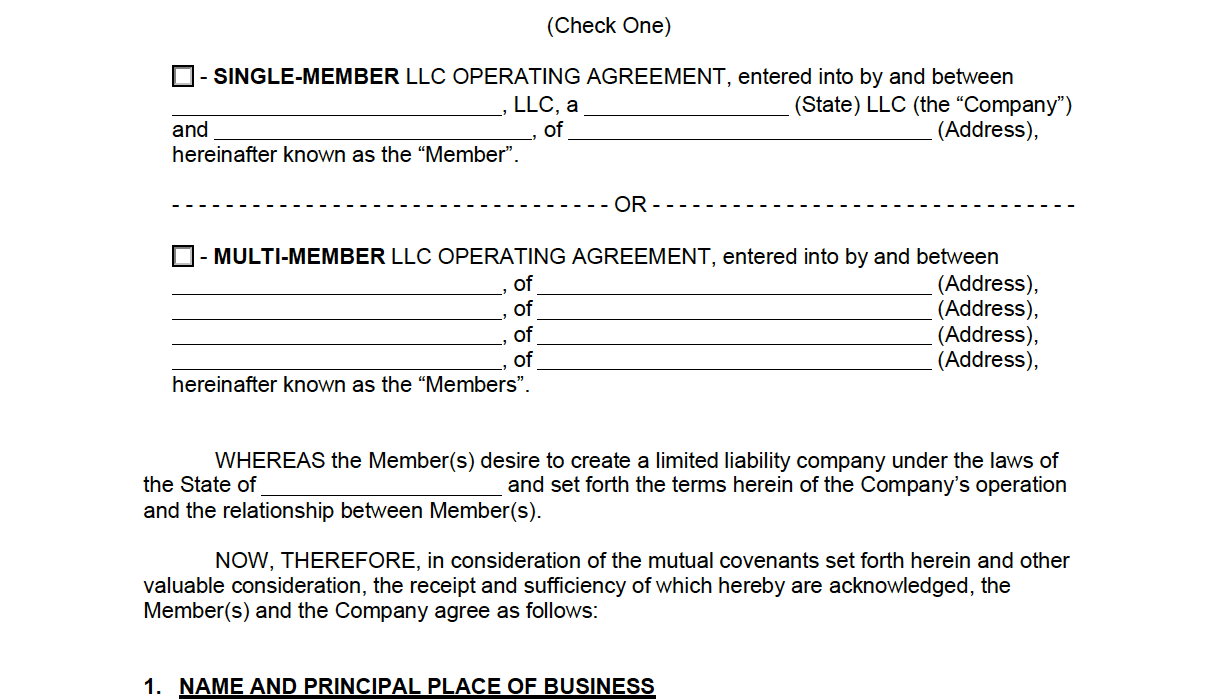

Most states require only minimal information, such as your company name and registered agent, in our own charters. Details regarding the structure and operation of an LLC should always be left to the discretion of the partners. Ideally, members accept a written user agreement that fits their specific needs, desires, and desires. This agreement, which will be binding on the participants once it is signed, must state:

The Issue Of Unauthorized Practices

As a corporate lawyer in Phoenix, Arizona, I (also) often encountered Clients LLC without an operating agreement. Usually operating companies don’t think about it until something goes wrong and one or more partners want to leave. These clients usually want to know if they can sell their shares (either to several other participants or even to a stranger) if they have experience with an operating agreement.between types of members.

What Does A Florida LLC Offer?

A LLC operating agreement is an agreement between the owners or members of a Florida LLC that, among other things, governs the members’ actions? Funds deposited with the LLC, withdrawal of profits from the LLC, and how decisions were made in the LLC. Unlike articles of incorporation, a Florida LLC operating agreement is not required. However, it is generally a good idea to formalize my LLC membership agreement through an operating agreement.

An LLC Operating Agreement Protects Special Status From Limited Liability

The existence of an employment contract helps ensure that the judge acknowledges your limited personal liability. In fact, this is usually important for a sole proprietorship LLC because with an operating agreement, the LLC does not look like ownership. With this formal consent, the existence of an LLC acquires its own status of limited legal liability.

New Jersey Rules For GuardianshipTraining Agreement With LLC

The training agreement for LLC is a gift. founding company’s written footprint, which basically describes how they are structured to run their business. This document is no longer required for an LLC in most cases, but it is a very good tactic for registering an LLC. A well-drafted operating agreement can settle disputes between participants and ensure that everyone is truly in the know, even when major changes or potential problems arise.

How Does It Work? /h2>If There Is Only One LLC Owner, Is An Operating Agreement Still Required? The Answer Will Probably Be Yes. Here Are A Few Reasons Why A Sole Trader LLC Must Prepare And Comply With An Operating Agreement.

Article I: Organization

The first section of all company agreements concerns the release of the company. This is definitely in regards to the founding date of the business, members, as well as the ownership structure. Now, if there are several participants, they can all have comparable ownership shares or different levels of ownership.Ownership.

Why Is An Operating Agreement Important?

If your company has one, not a treadmill agreement, your LLC’s internal structure is by default governed by the limited liability company version of the law accepted in your state. For example, the Maryland Code generally stipulates that consumers have a percentage of voting power in decisions equal to that participant’s percentage of ownership in the business (which is equal to any interest that participant puts in). However, this approach will not be the best for your business. You need to determine which decision-making structure will be most beneficial for your business.

Check If The Connection To The Site Is Secure

www.nolo.com needs to check the security of your connection before proceeding.

Does a single member LLC need an operating agreement Florida?

These are decisions to form a Single Member Limited Liability Company (SMLLC) in Florida. Remember: For most constitutional purposes, an SMLLC in Florida is considered a Manufacturer Limited Liability (LLC) with multiple members.

What rules apply to an LLC without an operating agreement?

What rules apply to an LLC without the need for an operating agreement? 1 LLC without operating agreement. 2 New York LLC Standard Rules. 3 Conclusion of the contract. 4 voting and distribution. 5 Acceptance of operating contract 6 No exclusion of members. 7 Expulsion of a minority member. 8 Don’t leave without your work agreement.

What is a single member LLC operating agreement?

With single member LLC operating agreementWith whom you can register the business as a separate entity with all aspects owned by the LLC rather than a single male member. Allows members to purchase charms that are sold through another call before the third party can make a new offer.

What is an LLC operating agreement and why is it important?

The designation was created broadly to help small businesses gain easier access to the undeniable liability protection afforded to corporate stakeholders. The LLC operating agreement identifies the corporation, specifies its ownership, defines the obligations of the members, and establishes other structural characteristics of the parent corporation.

What should be included in an LLC operating agreement?

It typically contains basic information about the LLC and its owners (called members), the chosen tax treatment for these entities, and guidance on how certain key procedures are resolved. Operating agreements act as a legal obligation between the members of an incredible multi-member LLC, although single-member LLCs can also benefit.