The currency of the Maryland Corporation is an INC, called an out-of-state company that registers if you want to do business in Maryland. The process involved in registering a foreign corporation in Maryland is often referred to as a foreign qualification.

Can a non-Maryland corporation create a Maryland SDAT account?

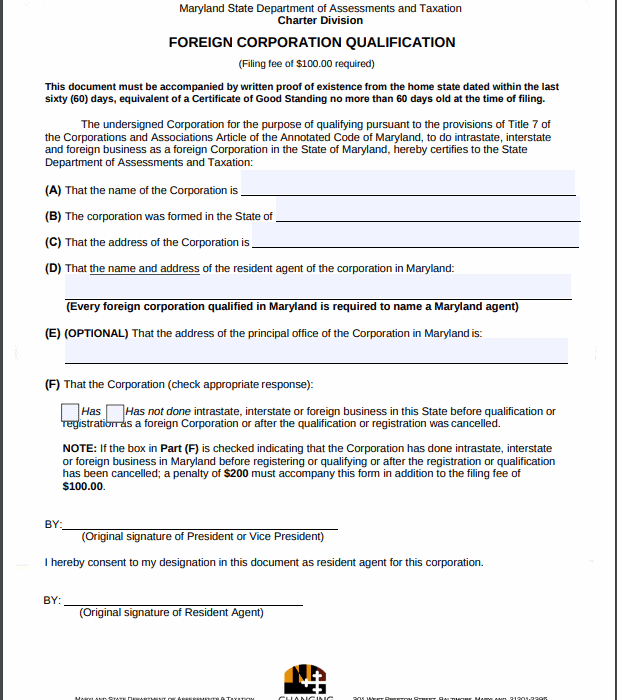

When a corporation not incorporated in Maryland, LLC, LLP, LP, etc., submits an initial application equipped with an SDAT that creates or reactivates a record, that application must be accompanied by a printed proof of permanent residence, usually equivalent to an associated certificate status.

Do I Need A Maryland-registered Guide For My Business?

Yes, if you use?? Northwest as a registered agent, the annual flat rate is currently $125 per year. Do you have an online account where you track key deadlines for reports detailing your condition when you complete your annual maintenance at u. With. works and all the materials that we collect for you on the spot are immediately uploaded to your own account for full viewing. On the other hand, if you are facing a dispute, we can email up to 4 people and your lawyer at the same time to get a complete real-time view of the other dispute. You will receive annual report reminders. It’s the same price every year, and there are no weird fees or specials fees.

Maryland Annual Requirements

After you’ve completed your foreign degree in Maryland, the State Department of Evaluation Maryland and Taxation requires all LLCs, corporations (commercial and non-commercial) in connection with an LP to file an annual return. These reports must be submitted by April 15, otherwiseOtherwise, late fees will apply. The report can be sent online or by mail.

Ready To Qualify Your Maryland Business Overseas?

Social media is, and more than that, the preferred way for companies to communicate with their customers, colleagues, and customers. We are committed to sharing effective information and tools to help you in a growing market.

What Is A Maryland Government Certificate?

Corporations must register with the Maryland Department of Valuation and Taxation before doing business there. Maryland. Out-of-state businesses typically require a certificate from Maryland. Authority. This registers the company against the foreign company and eliminates the need to create a new company.

What Is An Actual Foreign Diploma?

A foreign diploma allows your partnership to do business in that particular state of Maryland. It doesn’t matter what specific statement you originally created your registered company from. or in other words, a problem with your ?Is a natural LLC hidden in real life? because the qualification process to register a true foreign LLC in Maryland is the same no matter where your domestic LLC is currently located.

Speak To A Foreign Qualifications Expert Today At 888-366-9552 < /h2>Foreign Is Nothing More Than A Business Registration, Although It May Legally Operate In A State Other Than The One In Which It Was Registered And Exists, Thus Providing A Physical Presence In Maryland To Complete The Global Business Qualification Stages.< /p>

Certificate Of Authority Service

If you want to do business in Maryland but are a corporation incorporated in a state other than Maryland, you must register your group in Maryland. A Maryland administration degree can be obtained by submitting a large foreign corporation dossier to the Department of Corporations of the Minister of State of Maryland.

To The Stairs Create A Foreign Company In Maryland

To apply as a foreign company in Maryland, you must? must complete and submit this qualification request for a foreign company. The app will probably ask you about it. the following information:

What If I Did Not Previously Have A Foreign Qualification To Do Business In Maryland?

A foreign qualification is actually an application for a license in Maryland to do business. And the idea that “it’s easier to ask for forgiveness than just asking permission” does not apply here. Failure to meet overseas prior to opening a business in Maryland tends to have far more costly consequences than applying. If you have suffered losses abroad, verify the right to your business:

How To Know If You’re Doing Business In Another Country And Why It’s Important To Know

In our previous article on each of our Moe’s Southwest Grill cases, published June 16, 2015, we discussed the importance of government compliance to maintain low liability status in every state where personal businesses regularly do business. The example showed how unableSimply preventing your business from actually defending its rights can have other serious legal consequences. We now routinely address the important question of what domestic activities constitute “doing business” in order to require government participation as a foreign entity.

What is a foreign qualified corporation?

Foreign company. Any business entity operating outside of the state in which it is incorporated is now recognized as a “foreign” entity in the states in which it is licensed.

How do I qualify or register a foreign out of state or out of country business entity in California?

To register your small foreign business in California, you must file a foreign corporation declaration and list it at the Secretary of State’s office. This registration must be accompanied by a valid certificate of good conduct.

What is foreign qualification for a Maryland Business?

A foreign qualification can be nothing more than the registration of a business for legal activity in a state outside of our state in which it isyl registered and located. If you want your business to have some sort of physical presence in Maryland, you need to work your way through to qualify overseas.

How do I start a business in Maryland?

Build with Maryland Corporation Incorporation Maryland Business Express is SDAT’s award-winning online platform for incorporation and incorporation, annual filings, and document copy requests. Click here to see if your esteemed legal entity can be created online.

How do I file a UCC financing statement in Maryland?

See CCU Funding Type Summary page for more information. The best and easiest way to file both an annual return and a personal property tax return is through Maryland Business Express (MBE), SDAT’s award-winning business registration platform, by preparing raw returns and requesting copies of documents online.