How much does it cost to set up an LLC in North Carolina? The North Carolina Secretary of State charges a $125 filing fee for your current charter. It costs $30 to file a name reservation request if you want to reserve the formation of an LLC before the articles of association are filed.

How do I start an Incorporation in NC?

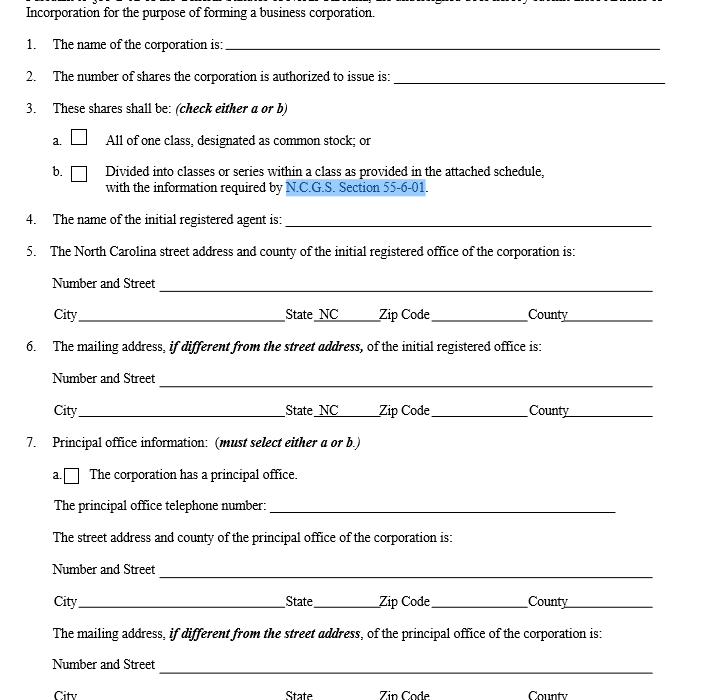

Your corporation will be legally incorporated by filing a charter with the North Carolina Secretary of State. Articles should contain, for example, company name and address; the name and address of the agent for the process associated with the service; the number of shares that the company is actually authorized to issue; registered office address, if applicable; the name above this address of each founder; and fast relevance of articles.

How To Order A Certified Copy Of The Articles Of Incorporation, Possibly A Certified Copy Of The Articles Of Incorporation Of The State Of North Carolina

You can order a certified copy of the Articles of Incorporation along with the Articles of Incorporation by fax, mail, e-mail, telephone, online or any other way, but we recommend it?Fine. On-line canning is instantaneous and costs between $15 and $1 per side. Normal processing takes approximately 5 days plus additional shipping time and costs $15 plus $1 per blog site. Expedited Service is not available as web processing is instant.

Organize Your Articles In Terms Of Forms

You can upload and email your own North Carolina Organizer Articles. You can create an account. and send online. Whichever you choose, you must download the Bylaws in PDF format and complete the permitted sections.

Need A Certified Copy Of Your North Carolina Bylaws?

Social media is increasingly becoming the preferred way for companies to communicate with their customers, colleagues and potential customers. We are committed to sharing information and therefore tools to help you grow your business.

North Carolina Incorporation Costs

In We bizfilings, describe our fees, and therefore the state’s fees, for incorporating a corporation in New York. Check outto see:

Other Useful North Carolina Facts

Consider creating the following special item conditions when preparing your family To be in North Carolina, remember:

It Is Very Easy To Register A Company In North Carolina

To register a corporation in North Carolina is a simple process, which in turn is followed by filing articles with incorporation into the Secretary of State. In the following guide, we have shown you step by step how to start a business in North Carolina.

Why Should You Start A Business In North Carolina?

You know that North Carolina is the best business climate in the United States? This is true! The state of Tar Heel is certainly known for its tax climate, with a corporate tax rate of 3%, the lowest in the country. The state also values ??the equity of small businesses with a highly skilled workforce. In 2018, Capital Raleigh was even nominated as a finalist when Amazon held a generalNational search for their future headquarters HQ2.

NC LLC Vs. NC Corporation

Now that we have… the main options common to all LLCs and associations, then we will discuss more specific aspects what makes a limited liability corporation in North Carolina, North Carolina, or North Carolina unique compared to several other states, which will lead us to each of our definitive answers. is the ultimate for your business. Each state has a unique set of tax laws and principles that govern business conduct, and these unique details should be considered when choosing your business. The guide in this section provides this data for North Carolina LLC and the specific North Carolina Corporation.

Do I Need A North Carolina Secretary Of State Identification Number?

According to your company , can you count on specific registration with the secretary of state? resulting in a SOSID. This is when you create a limited liability company, such as a limited liability companyauthority to notify the Territory of any material changes to the program. Your company can do this by dealing with official documents. This procedure is called modification.