Annual Return

The State Of Maine Requires Your Organization To File An Annual Return For A Qualifying LLC. Can You Submit A Presentation Or Complete It Online At The Secretary Of State’s Website? You Will Need Your LLC Registration Number To Access The Web Form. In Order To Complete The Current Report, It Is Necessary To Give Some Advice, Such As A Brief Description Of The Characterra Of Your Business, And The Location And Address Of At Least One Of The Members Of The LLC.

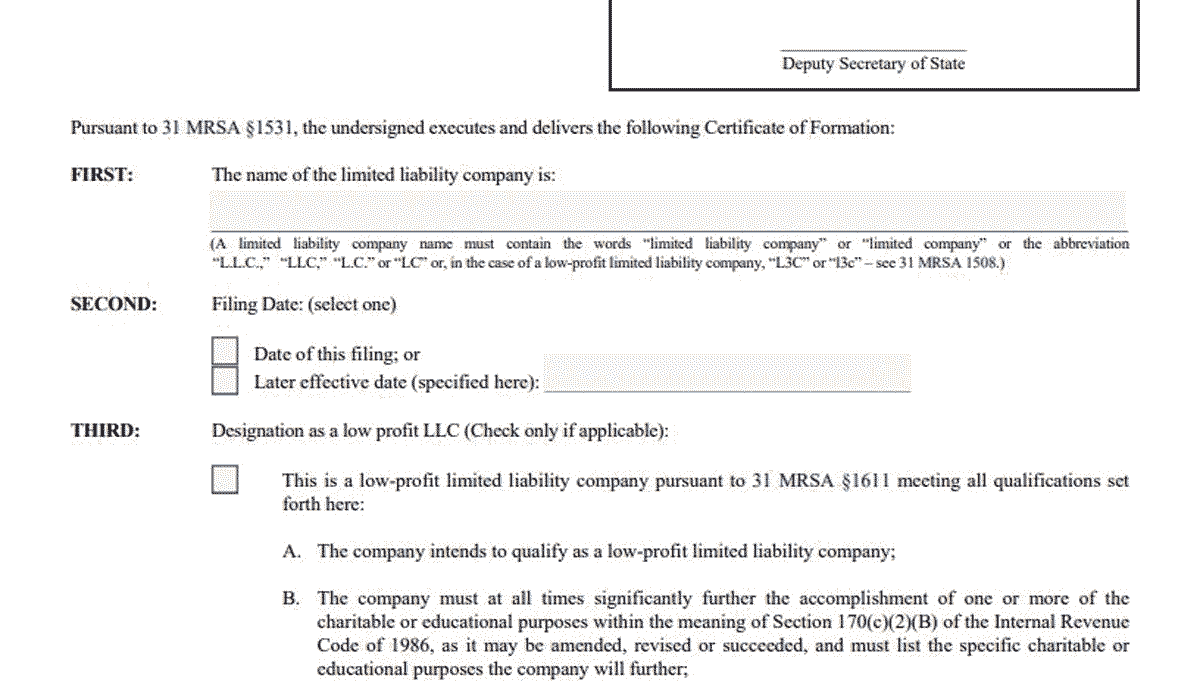

Name Of The LLC

The name of an LLC must end with “Limited Liability Company”, “LLC”, or “LLC”. LLC without Name permission cannot use an available name.

How are LLCs taxed in Maine?

Most taxes are at least some form of government business income. The details of taxation of a particular company’s assets usually depend in part on the company’s legal form. In most states, corporationsRations are subject to corporate income tax, while income from channel corporations such as S corporations, reasonable liability corporations (LLCs), partnerships and partnerships is subject to state income tax. Corporate and business income tax rates, as well as personal income tax rates vary greatly, of course, from state to state. Corporate rates, which most often include a flat rate regardless of the cost of living, typically range from 4% to 10%. Personal tax rates, which typically vary by income level, can range from 0% (for small amounts of taxable income) to about 9% or more in other states.

Incorporating An LLC In Maine Was Easy

To register an LLC in Maine, you will need help filing a Memorandum of Incorporation, usually with the Maine Clerk, who will set you back 175 dollars. You can apply by email. The Certificate of Incorporation is the legal document that formally establishes your limited liability company.

Employer Withholding Tax

All employers are required to withhold state withholding tax from their employees. pay checks. You will withhold 7.65% of their taxes and payroll, your employees will also be liable for 7.65%, giving you the current federal tax rate of 15.3%.

Name Your LLC

Choosing a Maine name for your current Maine LLC is a first step.The most important step in building your business. However, there appear to be state and federal guidelines for including certain words in company names.

Step By Step: Starting An LLC In Maine

With all the consequences you have made Decide to create a useful company Maine LLC. Set up your subscribers, a business plan and some capital, and you’re on your way.

Incorporating A Maine Corporation

Each state has its own set rules for companies wishing to form a company there . If you decide to register in Maine, include.com should take care of all the details. We will review the availability of your corporate URL and help you prepare and submit your own incorporation documents to the Secretary of State of Maine. We can also help with many of your tracking needs, such as amendments, written consents, and annual preparation and filing. s Available

. To form an LLC in Maine, you must maintain a record with the Secretary of State. You must fill inrequired forms, pay fees, and comply with all group name and registration requirements.

ME LLC Vs. ME Corporation

Now that we… After completing After covering the notable common characteristics of all LLCs and corporations, you should immediately know the characteristics that make a Maine LLC or an out-of-state Maine entity unique, which will lead us to a definitive answer to the question of what kind of legal entity it is. best suited for organizing your business. Each state has its own laws and tax laws that undoubtedly govern their businesses and these interesting details should be kept in mind when choosing the best business. The information in these sections contains this data for Maine LLC and Maine Corporation.

Step 1: Name It Maine LLC

The first step is to choose a specific LLC name. It may seem simple, but it’s important to keep a few tips in mind. You want a name that is easily identifiable and represents your business in Maine.

Do I need to file a Maine tax return?

If you are unable to initiate your application prior to the originally scheduled meeting, Maine will automatically grant you a six-month grace period during which you may submit your complete written application before the six-month deadline. As a general rule, the full renewal period cannot exceed eight months. The automatic renewal will only take effect if the declaration itself is filed within the six-month period.

How much does it cost to file an LLC in Maine?

Here are the steps you need to take to form an LLC in Maine. For more information about starting an LLC in any state, see How to Start an LLC.

Does Maine have a pass thru entity tax?

You must complete Form 941P-ME to report a withholding from a Maine source of income from non-Maine residents. For more information, see Withholding and Returning Transfers.