If you cannot pay your Arkansas franchise tax for your years of gardening, your LLC status will be terminated.

How much is the franchise tax in Arkansas?

Confusion 2021: It was initially revealed that franchise tax returns were filed with the Secretary of State (SOS). In January 2021, the Department of Finance and Administration (FDFA) assumed this responsibility. However, the transition from SOS to EDA failed. And as of March 2021, franchise tax returns are again being processed by SOS today. If you see a mention of all involved DFAs, pay attention?No, this is also old information. As part of this alignment with this new change (back to how it has always been), these SOS will not charge interest or bank fees for late filings until July 15, 2021.

How To Pay Your Franchise Tax In Arkansas

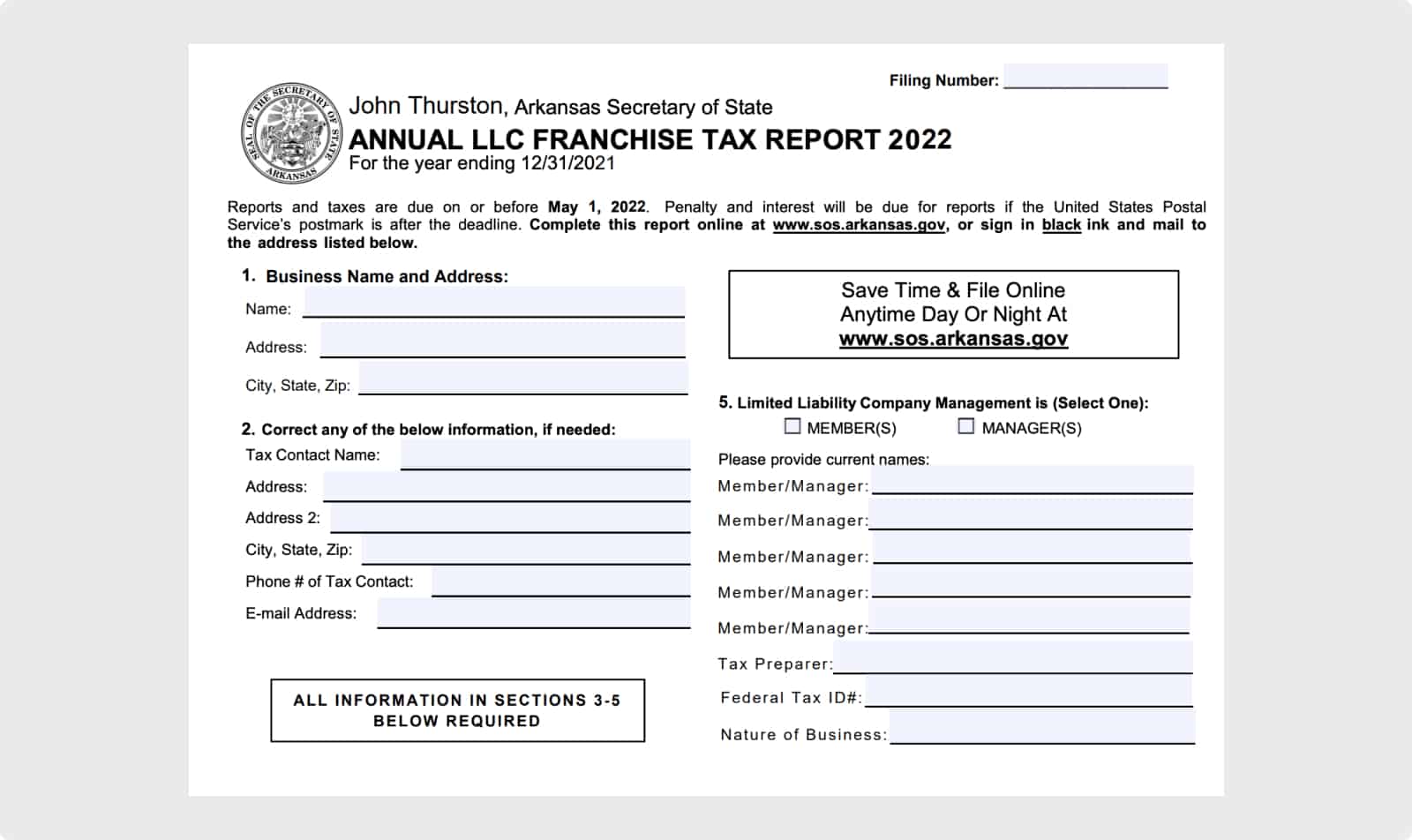

You can pay as early as January. To pay by mail, download the Annual Tax Credit PDF Form. Write a check or money order to the Secretary of State of Arkansas and attach the documents.

When Is The First Annual Franchise Tax Return Due?

Your LLC The first annual tax deduction must be filed within one year from the effective date of the LLC, which is the date your LLC was incorporated (the date your LLC was authorized). In Arkansas, this is called the “Filing Date”.

Arkansas Franchise Tax Report – Deadlines And Fees

Arkansas LLC, and therefore non-stock corporations, pay a fixed amount for tax on their franchise. However, stock-backed corporations pay 0.3% of the total amount of their unique common shares.x outstanding shares of $150 or some amount? whichever is greater.

Franchise Tax Annual Return

The State of Arkansas requires you to manually prepare an annual franchise tax return for your LLC. The report concerns the state franchise tax, which is most commonly applied to LLCs. The tax payable to the benefit state is $150. You can file your franchise’s annual tax return online or submit the form from the SOS website. The franchise tax return, including the $150 tax payment, is due on May 1 of each year. There are penalties for late reviews.

How To File Annual Franchise Tax

Companies can file their returns and pay their annual franchise tax online with confidence through the Secretary of State of Arkansas website. In addition, corporate webmasters can send a letter to Commercial and Commercial Services at:

Before Starting Helpful Arkansas LLC

In the early stages of setting up your business, there are a few things you need to take care of ?Start important details. Read the following sections to learn what to look out for before you start building your incredible LLC.

Arkansas Annual Report Information

Businesses and non-profit organizations were required to file annual returns in order to maintain their good reputation. Deputy State The states require a large percentage of annual income. Deadlines and fees may vary by state and enter Entity.

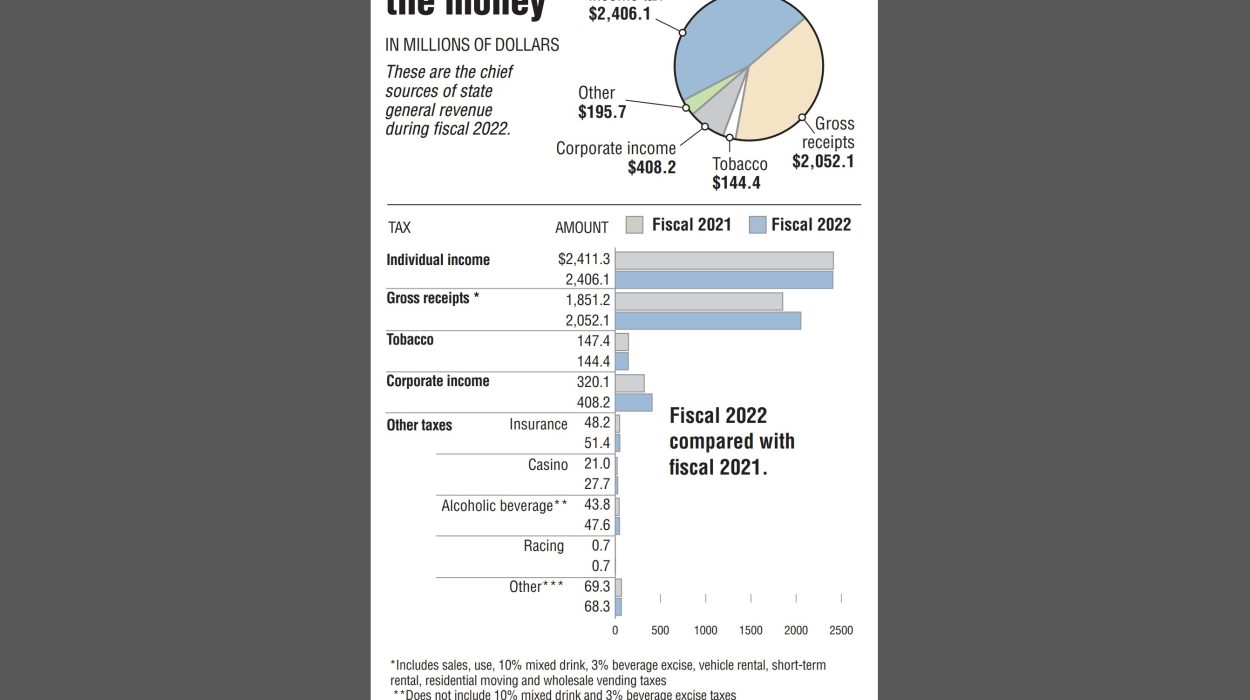

Tax Calculation

Franchise tax is based on the taxable business margin. If a taxable entity does not qualify and does not decide to apply for an EZ calculation, the tax base can be described as taxable entity margin and is calculated in one of the following ways:

Is A Deductible. Tax?

The label franchise tax refers to the IRS tax paid by certain companies when they are required to do business in certain states. Also referred to as a preferential tax, it entitles a business toto obtain a license and/or permanent employment in that state. Corporations in some states are also, of course, subject to tax liability even if they are licensed in another state. Despite its name, corporation tax is not a franchise tax and is separate from federal and income taxes, which must be filed annually.

Arkansas Annual Return Fees And Instructions

To comply fully with Arkansas law, all associations are required to file an annual return with the government. The total cost does vary depending on the type of business. Most companies will likely have to pay the equivalent of $150 in fees, while companies with no listed shares may pay $300. It is important to note that this is separate from any applicable taxes the business may pay.

How is an LLC taxed in Arkansas?

If you want to incorporate and operate an Arkansas Debt Limited Company (LLC), you must also file various paperwork with the state. This article reviews the basic ongoing insurance coverage and state tax reporting requirements for limited liability companies in the state of Arkansas.

Do sole proprietors pay franchise tax in Arkansas?

1. What is the Arkansas franchise tax return? How to File an Arkansas Franchise Tax 3. Who Files an Arkansas Franchise Tax Return?4. How much tax do you have to pay on business income in Arkansas?