The LLC franchise tax in the state of Arkansas is a “privilege tax”. That means it’s a flat tax of $150 a year for the privilege of using opportunities in the state. The purpose of all taxes is to generate revenue for the state of Arkansas.

How is Arkansas franchise tax calculated?

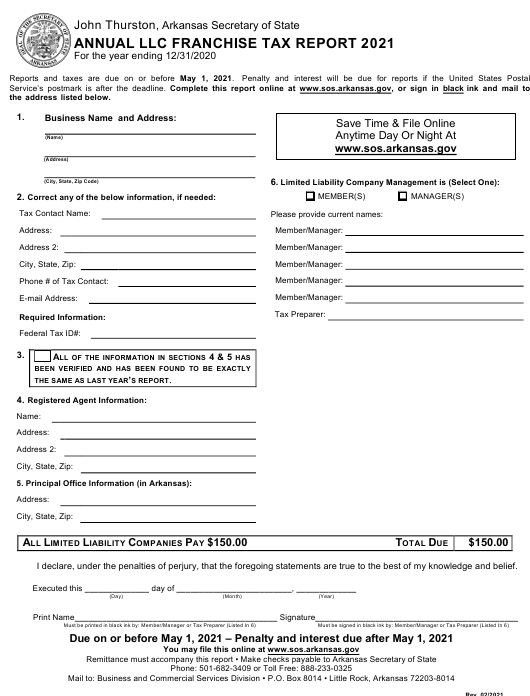

Follow these steps to file your Arkansas franchise tax return:

How To File Your Arkansas Franchise Tax Return

You can try to get paid as early as January 1st. Download the annualFranchise Tax Postal Invoice in PDF format. Prepare a check or receipt addressed to the Secretary of State of Arkansas and mail it along with these documents.

Arkansas Franchise Tax Report – Dates And Fees

Arkansas Limited Liability Companies and non-shareholders invest a fixed amount of their deductible debit. However, for company shares, more than 0.3% of their total capital is issued OR shares or divided by $150. whichever is greater.

Control Formula

For professionals outside of registered companiesArkansas, but with a direct business license in the state, mobile phone numberissued and outstanding shares increase at parget the full price. This value is multiplied by a certain percentageAssets applicable to Arkansas assets (Arkansas divided into total assets)to save the ordinary Arkansas stock. number, which is then increased by0.0027 franchise tax.

How To File An Annual Franchise Tax

Companies can applySubmit your returns and annual franchise tax online through the Arkansas Clerk’s website. In addition, business owners can submit data to the Business and Commercial Services Division at:

What Is The Arkansas Annual Report?

In Arkansas, Limited Liability Companies (LLCs) with corporations report on the annual report. A form titled “Annual Franchise Tax”. These fees are in addition to these fees, whether or not our company actually did business in its state. If a corporation exists in Arkansas, it must pay tax until our own business is properly wound up by the Secretary of State of Arkansas. In order to properly liquidate an agency, you must file an article dissolving an LLC or Crown Corporation.

Establishing An LLC In Arkansas Is Easy

LLC 4 . Arkansas To register an LLC in Arkansas, you must provide a certificate of organization to you, the Secretary of State of Arkansas. You can deposit up to $50 online, by mail, or in person. An organization certificate is a standardAn official document that officially registers your company Arkansas LLC.

What Happens If You Do Not Spend Money On Taxes. Franchise Fees In Arkansas?

For each franchise tax debt. , an LLC in Arkansas is charged the best late payment fee of $25 plus 10% percent of the total debt. Interest will continue to accrue, but the total amount of the penalty will not exceed twice the amount of the original debt. How do I file another Arkansas LLC tax return? Start by registering your business with the DFA, online or on paper (Combined Business Tax Registration Form, AR-1R). After registration, you will need to file monthly tax deductions. Version 941M can be used for this purpose.

Arkansas Annual Return Fees And Instructions

In full compliance with Arkansas Arkansas law, all corporations are required to file an annual return. with the government Total costs vary depending on the type of business. Most companies will have to pay their own fee.e $150, while companies with no shares may have to pay $300. It is important to note that these are the costs of any applicable taxes the business may pay.

Incorporating A Business In Arkansas

Customers you e.g. each IncorporateFast.com tag when launching an innovative new LLC business in Arkansas or a new association in Arkansas because they are subject to our customer service. Once an order has been placed, one of our expert reviewers will perform a final preliminary search on the name â?? Be aware of potential disputes in Arkansas, prepare and submit your Articles organization to the Secretary of State of Arkansas and ensure that the application is approved as soon as possible when the legal employment company has been officially registered.

What Are Some Requirements For A Company Name In Arkansas Corporation?

The name must contain the phrases “Corporation”, “Incorporated”, “Incorporated”. “Company”, “Limited” or their abbreviation. It should not contain wording or statements.? indicating that the company is organized for additional business purposes and should be distinguished from the names used by some other protected companies.

Does Arkansas have franchise tax?

The Arkansas Secretary of State expects some businesses to report and file franchise tax returns annually. The annual franchise tax is a special tax that limited liability companies (LLCs) and corporations must pay in order to operate an Arkansas establishment.

What happens if you don’t pay franchise tax Arkansas?

To reinstate a revoked Arkansas LLC, you must file and settle all overdue franchise tax returns. Below, we provide you with a free step-by-step guide to finally get your revoked Arkansas LLC back in good shape.