The Kansas Certificate is a certified document for use in countries not subject to the Hague Convention. The Kansas Secretary of State will also notarize the signature so that the document can be used overseas. You must request notarization from the Minister of State of Kansas by mail or in person.

Open Corporate Bank Account

The use of corporate bank accounts and special plastic accounts is necessary to protect your corporate veil. If ayour personal business and custody business are mixed up, your personal money (your house, car and other valuables) is at risk if your LLC is often sued.

LLC Name

< P>

LLC Name

H2> The Layout On The Next Page Is Actually A Little Confusing Trying To Figure Out If You Pre-ordered A Name Or Not (which Isn’t Actually A Requirement, By The Way).

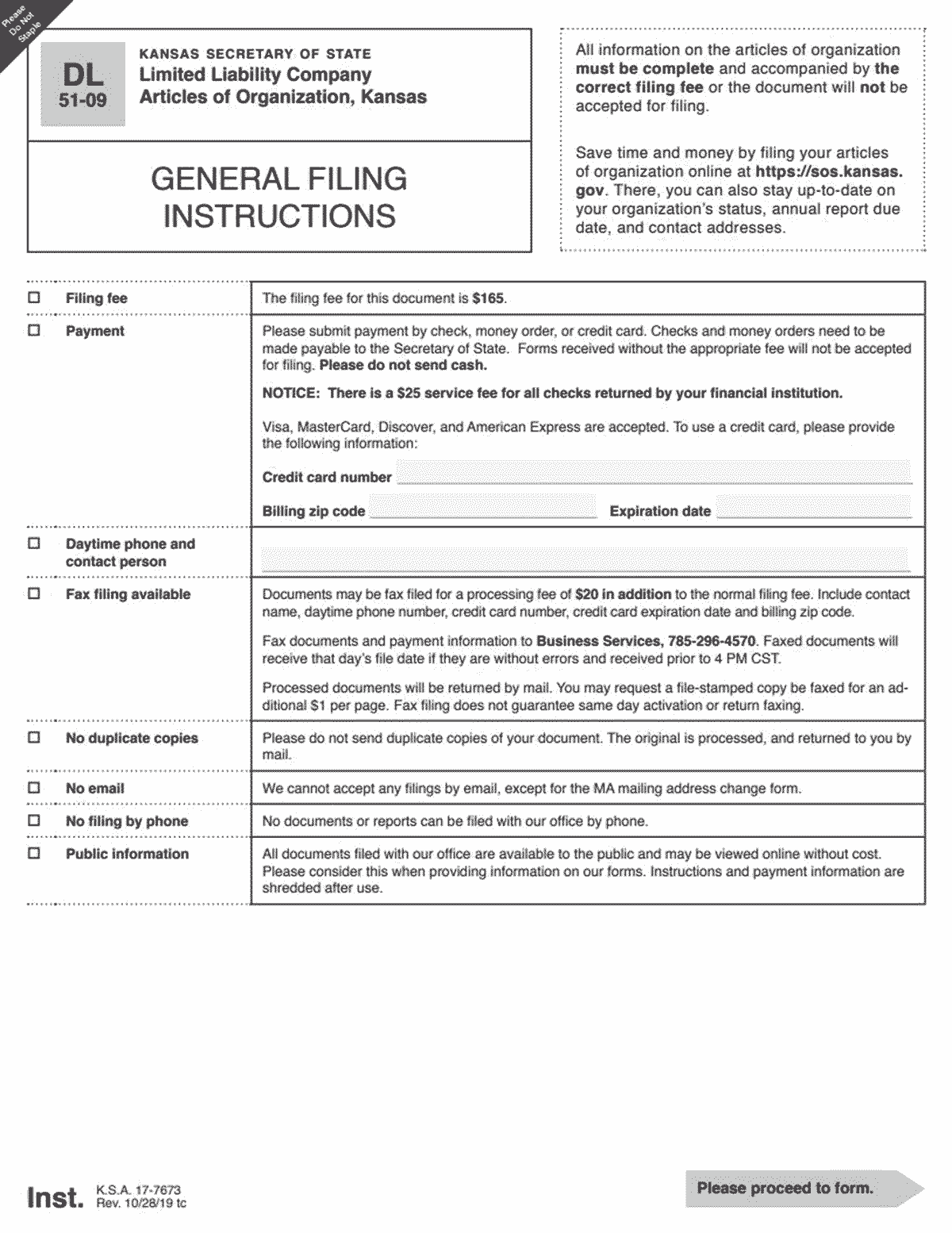

How To Submit Organizational Documents

It is important to help you prepare organizational documents well in advance of their submission, including all the necessary information in them. Incorrect or incomplete item organization will be rejected, resulting in a waste of your precious season and money. However, here are the basic steps you need to take to get complete Kansas Organization Items on time.

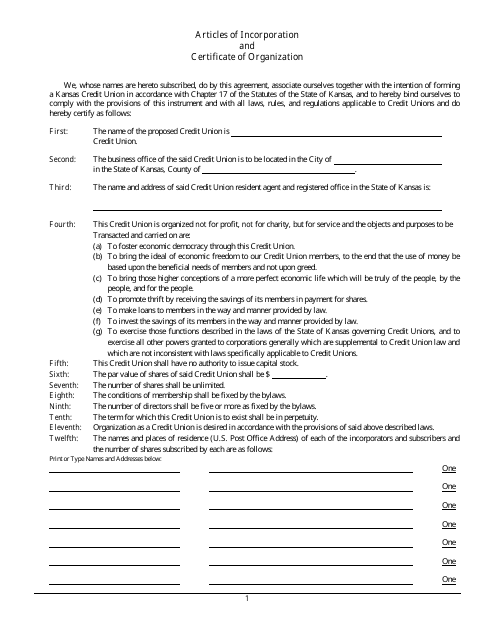

How do I get an article of organization in Kansas?

In this tutorial, we’ll walk you through the filing of articles of incorporation to get a good foundation for the state. This is the document that can legally register your Kansas LLC company.

Submit Kansas Organization Items Online

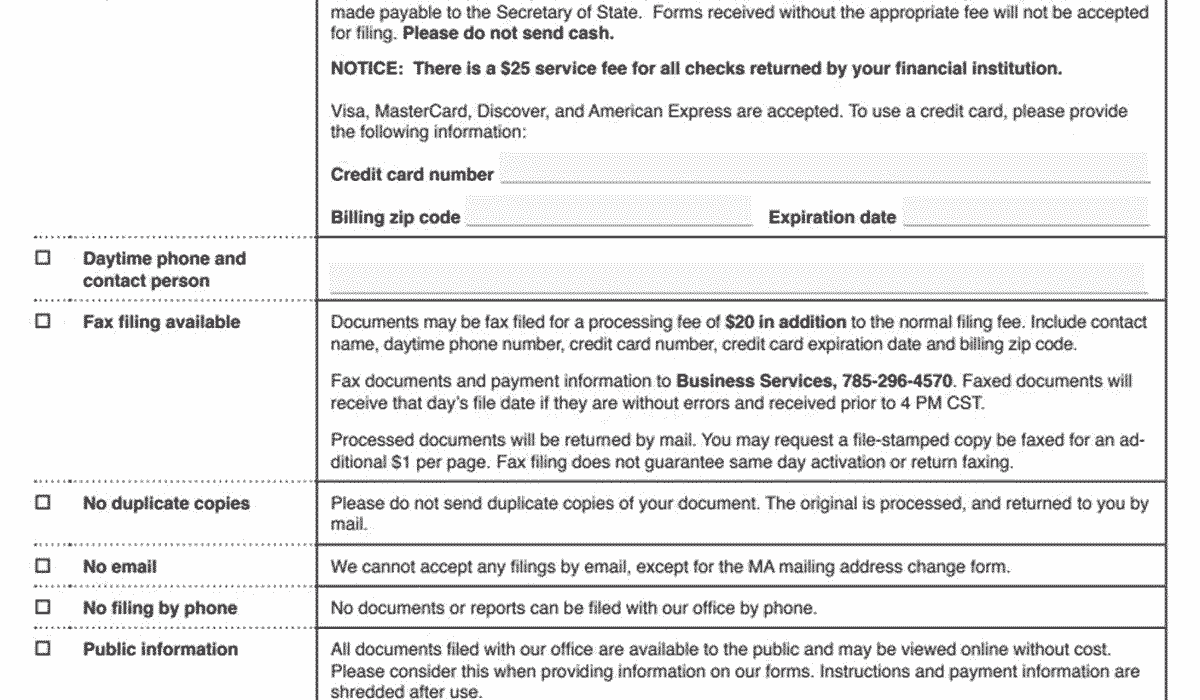

If you expect your articles to be sent to your organization by mail, read the instructions below to learn more about applying for your Kansas organization’s article by mail. State (SOS) allows feeding. You can edit your articles or reviews of Kansas organizations by electronically submitting them to the Kansas the.gov Business Center website. Link to business center processing. You can then submit that particular change. You need to know the Market Entity Name and/or Business Entity ID. Choice of Secretary of State. You can very well pay the deposit online with a credit card or checking account.

For Domestic Companies:

As you usually prepare for registration, please note the most important specific requirements below. in Kansas.

To Create A Strong Limited Liability Company In Kansas, Here’s Everything You Need To Know.

A limited liability company (LLC) is legally sound and trustworthy business. . It combines the limited liability associated with a corporation with the flexibility and freedom from formalities offered by one or more individual entrepreneurs. Any business owner who wishes to limit theirliability for business debts and lawsuits, should consider forming an LLC.

Discuss Changes With An Expert Today By Calling 888-366-9552

All Basics about changes to the specific information provided in your company registration PDF files, you must report to the State of Kansas. You must submit the documents correctly. If the changes you are about to make could affect your company’s registered office, you will need to file an amendment.

Creating An LLC In Kansas Is Easy

You can form an LLC in Kansas online by registering its charter with the secretary of state. The cost of registering an LLC in Kansas is $160 online or $165 by mail.

You Have Filed A Kansas LLC Memorandum Of Association! What Now?

After a particular LLC was formally filed with the Kansas Secretary of State, there is little left. Below is a list of some of the tasks I would suggest.

Can you file a DBA in Kansas?

Q. Is it possible to enter documents on the establishment of a domestic company online?

Who is required to file a Kansas annual report?

Explain to the Secretary of State of Kansas that you continue to do business in the state by completing the actual annual return each year. The deadline for submitting these reports depends on the type of your business.

What is a certificate of good standing in Kansas?

What is an authorization certificate? A Certificate of Good Standing is a certificate issued by the Kansas Secretary of State certifying that the work complies with the applicable laws of the State of Kansas, is in good standing, and is eligible to do business or do business related to it in that state.

What is the Kansas form for non-profits?

In this case, the taxpayer will submit the correct Kansas form for their business structure. In many cases, this is the Kansas form of K-120. Non-profit organizations can beAre required to pay other fees such as property or employer taxes.

How do I find information about a business in Kansas?

Business Object Database (check registered business experience with specific secretary of state, order authoritative certificate for business) Name Availability (check if the named business is available)

How do I file an annual report with the Kansas Secretary of State?

Nonprofit organizations are required to file an annual return with the Secretary of State of Kansas. The report is submitted on the 15th day of the 6th month following the end of the non-profit organization’s tax year. Click here to submit a great annual report online. Other documents with the Secretary of State