A multi-member LLC, also known as an MMLLC, is a definitive limited liability company (LLC) with more than one member.

Here Are The Steps Families Need To Follow To Set Up A Limited Liability Company (LLC) In Montana.

A Limited Liability Company (LLC) is a form of incorporation of a limited liability company. . It is the first limited liability corporation to take advantage of the flexibility and informality of a partnership or sole proprietorship. Any business owner trying to limit their actual or personal liability for debts, business ventures, and litigation should consider forming an LLC.

Opening An LLC In Montana Is Easy

H2>Starting Montana The Right Way LLC, You Must Submit Matters Such As The Organization To The Secretary Of State Of Montana, Which Costs $70. You Can Apply Online. The Articles Of Association Is The Legal Document That Formally Leads To The Formation Of Your Limited Liability Company In The State Of Montana.

Adding The Ideal Member To Montana LLC

The Process of Adding a Specific Member to Montanaana LLC may require an amendment to the company’s articles of association to include a new member. Under the terms of the agreement, current LLC visitors may be required to vote to accept the change. If you are a one-member LLC and you add another member, it becomes a multi-member LLC, which changes your tax status so you can be taxed as a corporation or partnership. You can also manage multiple businesses under any LLC by registering DBAs (Doing Industry As) or operating under the LLC name. An LLC can be a member of another LLC and own a one-person LLC. An LLC can have any number of members.

Name The Real Montana LLC

One of the first choices you will need to make is choosing a name for your operator. The name of your LLC must meet several criteria. It must promote and sell your brand, be memorable and exclusive, and meet all Montana LLC identification requirements. LLC or “LC” included. To register a corporationTo qualify as an LLC, this fictitious name must be distinguishable from existing registered legal entity names on file with the Secretary of State of Montana. Montana LLC is incorporated by the Articles of Association with the Secretary of State of Montana.

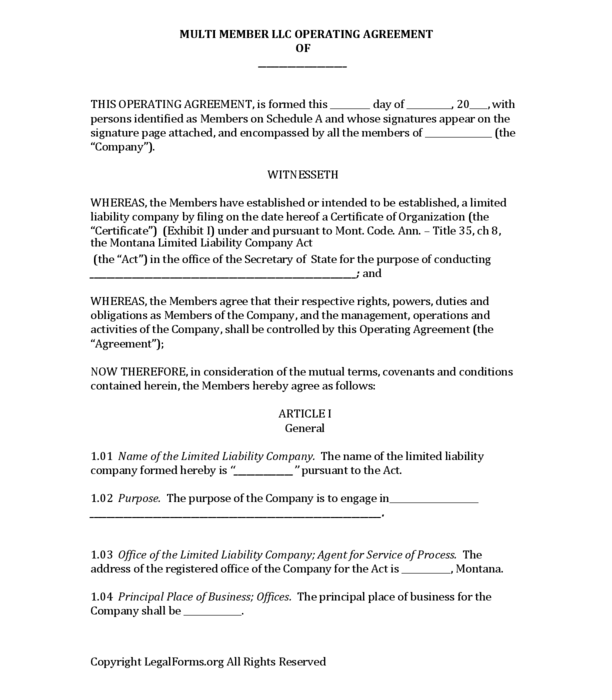

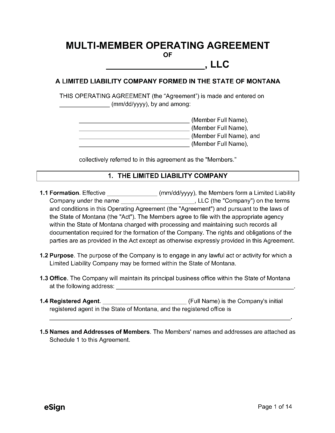

Montana LLC Operating Agreement

The Management Agreement is the legal document that describes the organization and structure of the LLC. and work processes. Topics not limited to a single member or, alternatively, multi-member LLCs will be discussed. While the changes may not affect day-to-day operations, these people must be included for legal reasons.

Is it better to be a single-member LLC or multi-member LLC?

The formation of an LLC from one or more persons does not depend solely on the number of persons involved. Because of the pros and cons of each, one group owner may want to start a new company with a few members rather than a few.? a person may want to set up a company with one company.

Steps To Successfully Form A Montana LLC

Forging a Montana LLC must be yourself, not be difficult on the way. Just follow these simple steps below and your new business will be up and running just in time!

Why Not Start Your Business In Montana?

In 2019, WalletHub conducted a survey of the best USA to start a small business. Montana placed 9th in the overall top 10. What contributes to the highWho ranks The Treasure State? Relatively poor business performance and a favorable environment for small businesses continue to be the reasons why entrepreneurs choose an LLC in Montana.

Single Member LLC Vs. Multimember LLC

H2> If Business With Only One Owner (or A Married Couple As Owners), The Business Is A Sole Proprietorship. This Single Member Has Full Control Over The Business In Question And How It Is Run. When Some LLCs Have Two Or More Owners, The Problem Is That The LLC Has Multiple Members. An LLC With Multiple Members Can Have An Unlimited Number Of Users (unless They Choose The S Tax Regime, Which Limits Ownership To 100 With Fewer Members). All LLCs Have Excessive Control Over Their Multi-member LLCs, And The Roles, Responsibilities And Distribution Of Profits Are Defined In The LLC Operating Agreement.

What Is Montana LLC?

Montana LLC is one of the most popular business structures in the state. This is a unique form of business??, more agile and flexible than a corporation, but providing exclusive asset protection that sole proprietorships and partnerships do not have.

What is the difference between single and multi-member LLC?

Although the main difference between a good solid single member LLC (SLLC) and a multi-member LLC may be obvious (the former has one specific owner, while the latter has two or more), these differences in the corporate structure of a limited liability company are significant. various nuances to be taken into account. They have a lot in common, but it’s not just the number of owners that you should consider when determining if a business is the right fit for your business.

What is a multi-member LLC in Montana?

A Montana Single Member LLC, known as a Single Member LLC, if your LLC has more than one owner, it is referred to as a Multi Member LLC. Step 1. Name your new business

What is a Montana LLC and what are the requirements?

What can be OOO “Montana”? LLC “Montana” (“Limited Liability Company”) is a legal form that can be incorporated in the State of Montana. Unlike an S corporation or small business, LLCis usually the new sole owner of a single-member LLC or other multi-member LLC partnership.

What is the difference between an LLC and a multi-member LLC?

The most obvious difference between the two types of LLC is the number of pet owners. However, there are times when a former business owner may want to register your LLC with multiple members. A person starting a business can create an LLC with multiple members and promote their spouses, parents, or children as affiliates of the asset protection business.

Can a single-member LLC have more than one owner?

An LLC may be managed by one person or owned by several persons. One member Montana LLC has always been referred to as a single member LLC, if your current LLC has more than one site owner, it is referred to as a multi member LLC. Step 1. Name your new business