What kind of liability protection do you get with an LLC? The main reason ordinary people form an LLC is to avoid the personal risk of the debt of any company that owns or has an interest in these facilities. When establishing an LLC, only the LLC will be liable for the debts and obligations incurred within the business, and not the owners, managers.

Do you know about LLC member liability?

Knowing the responsibilities of LLC members is essential if you are running a business. Here’s what every business needs to know to protect themselves and their employees from liability. What is a Limited Liability Company? LLCs today play an important role in real business. They are a popular business option.

What Is A Limited Liability Company?

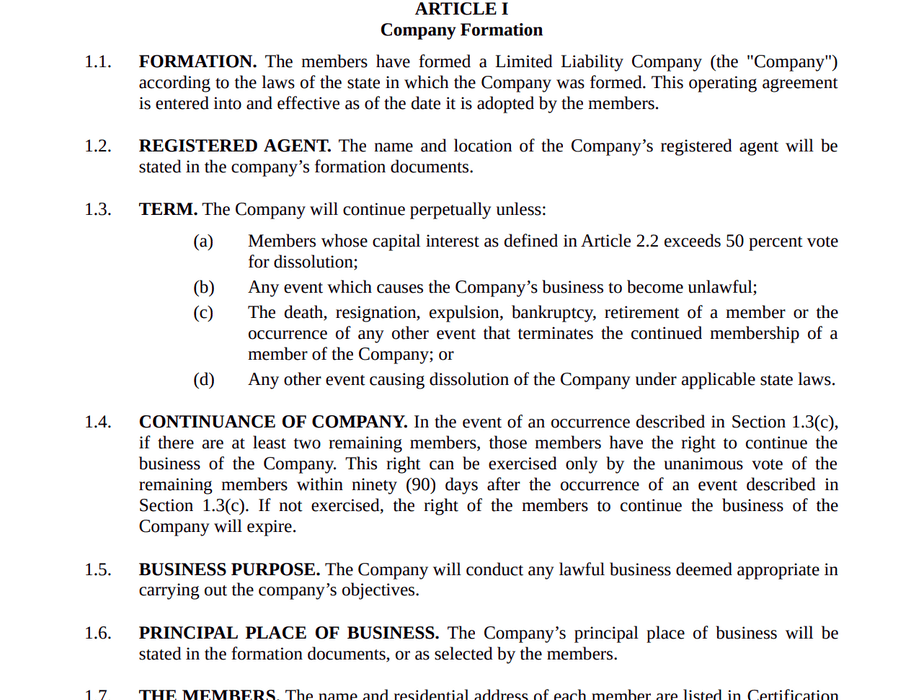

Limited Liability CompaniesThey play an important role in today’s business world. They are a natural favorite in the business. The required LLCs exist separately from the members and must be organized in accordance with state law. Members of a limited liability company have business indebtedness and personal liability protections that help just as much as a corporation. useful LLC, some of which are already openly spelled out in the founding documents, is another important document for creating an LLC. This usually includes the name of the LLC, legal address, term of office, administrative structure, statement of intent, and identification of its registered agent.

Limited Status

Small business registration as a new limited company Liability is a simple process and many of the leading lenders, investors and suppliers will appreciate the many other steps you take.Help to strengthen the business structure that underpins your new business. Providing a written agreement from the Operating LLC can be a reassuring document when obtaining a small business loan or meeting with venture capitalists.

Misleading Solicitations. Secretary Bellows Warns Business And Non-profit Organizations Regarding Obfuscated Requests

Interactive corporate services | Foreign limited companies | Use of the words “Bank”, “Trust” and “Credit Union” | Submission Requirements Reminders | Rules for Limited Liability Companies | Accelerated Service Terms

Separate Your Personal And Business Assets

If your personal and work accounts are mixed, your personal assets (your home, country, and other valuables) are at risk throughout the event , which accuses your company Montana LLC. In commercial law, this is called the ability to break through the corporate veil.

Are all members of an LLC liable for the actions of the others?

The eponymous feature of my Limited Liability Company (LLC) is that our LLC is a separate legal entity liable for its obligations to others and / or no other person, principal or agent, is not responsible for the fact of other persons for these types of identical obligations. Of course, an LLC, especially any legal entity, must act through several or other legal entities with confirmation that they are acting on behalf of the LLC. The person or organization with such incredible powers can be known by many different names: director, managing partner, attorney, officer.o or an employee or simply a real estate agent (collectively referred to as “Members”). Across all LLC charters, the general rule is that LLC members are not personally liable for the obligations of the LLC, barring such exceptions as personal guarantees or “breach” of organizational veil. This article discusses various aspects of vicarious liability: When a large entity is liable to an ultimate party for actions performed on behalf of the LLC. This does not affect the liability of any person in the LLC (or its owners as owners) to third parties, with the exception of the relationship between the LLC and the Players of the Product.

Are managing members of LLC liable?

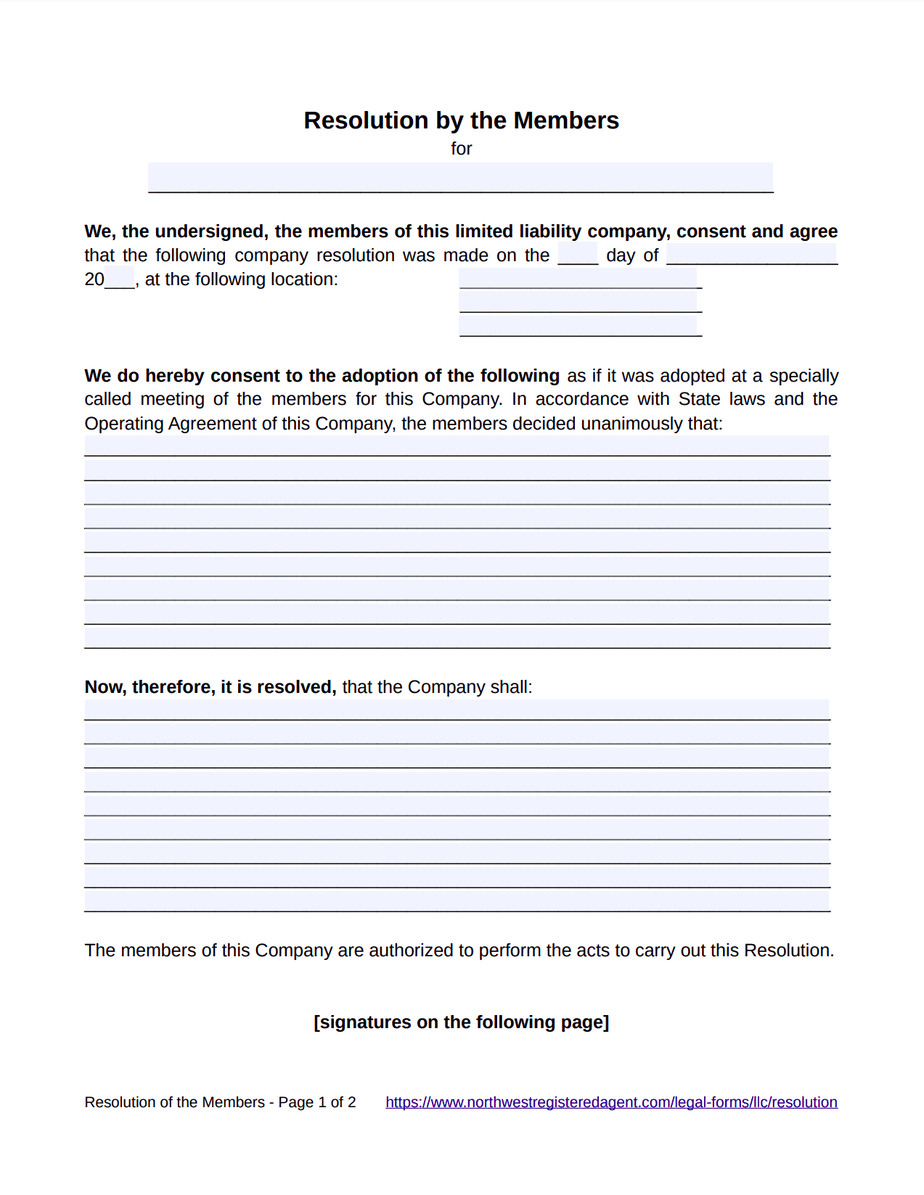

Once your LLC forms are submitted, it is recommended that your LLC has a great organizational meeting.Not your members/managers. This dating facilitates the key steps in creating your final SARL: accepting an operating agreement, issuing membership certificates directly to members, and other preparatory steps such as authorizing a credit card for the SARL. For more information about the steps you need to take to create an LLC, see How to create an LLC on the marketplace.

Should an LLC indemnify its members?

[LLC (Limited Liability Company)] is unique in that, by law, it can elect one person from two management structures. However, the method of default management for an LLC is clearly member driven. This is because LLC laws provide that the management of a corporation is vested in its members in addition to the business of the LLC. However, by providing in the Truck Body Clauses or [Operating Agreement with LLC] (depending on the state), the LLC may specify that it is to be primarily managed by managers.

What is a limited liability company?

Limited liability companies today need an important role in the business period. They are a popular alternative to settlements. LLCs must exist separately from members and must be organized in accordance with state law. Members of a low liability corporation are protected from business funds and personal liability just like their corporation.

What are personal obligations in an LLC?

For example, if a member chooses to sign a personal guarantee associated with a loan, lease, or contractual obligation of an LLC, they are personally financially responsible for that obligation. Personal obligations take precedence over state law, which means that the veil of operational protection associated with that particular contractual obligation is lifted.accepted.

Can I be held liable for LLC debts?

Section 17703.04 of the California Corporations Code addresses specific cases in which members may be liable for the debts of an LLC: personal liability under basic law, a member’s tortious act, and the member’s sole consent to be personally liable for an important matter. Commitment.