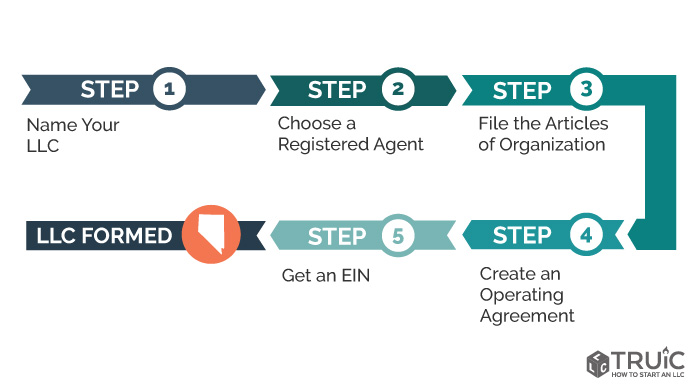

To form an LLC in Nevada, you need three things: your business name, an appropriate registered agent, and the required documents, including articles of association.

What Is A “business”?

“Business” means starting, carrying on and continuing a business, exercising corporate and corporate powers or privileges in relation to a business, including the liquidation of a business that ordinarily carries on or has operated a business where any liquidator exposes himself to the public as running this business.

Does an LLC have to file a tax return in Nevada?

If you want to register and manage your Nevada Limited Liability Company (LLC), you will need to prepare and file various documents while you have the state. This article will discussLearn the basic tax filing and appeal requirements for an LLC in Nevada.

Taxes For An LLC In Nevada

Recommendation: We recommend that you and yours Talk to several Nevada accountants to help you complete all your federal, state and local tax obligations. For tips on finding an accountant for your Nevada LLC, see our guide to finding a financial advisor.

Nevada LLC Taxes And Fees

All Nevada businesses should consult with a professional on taxes. business license from the Secretary of State of Nevada. This business license must be renewed annually. License renewal and fees are actually $200. The license is obtained byBy applying for an “other” Nevada business license. You can also apply online at the Nevada Secretary of State website or create a new business license by mail. Your registered real estate agent will remind you to renew your business license each year.

Nevada LLC Tax Rate Overview

Generally, a corporation is taxed based on its share of the form crime. In most states, a corporation may be subject to corporate income tax, as can entities that qualify as “through entities” such as LLCs, sole proprietorships, S corporations, and certain income partnerships.

Nevada LLC Name Required

The name of the LLC must end with the words “Limited Liability Company”, “Limited Liability Company”, “Limited”, “LC”, “Ltd. Co., Ltd., LLC, or L.L.C. In no event shall the name be identical or deceptively similar to the name of any company, including a limited partnership.private company, limited liability company, foreign corporation, foreign limited partnership, or foreign trademark limited liability. as a nickname, or deceptively similar to a nickname reserved for use by other proposals, unless there is written consent from the specific individual or other organization for which the name is reserved, and items declared by the entire organization. content, the use of which requires the approval of any relevant foreign department or agency, such as (but not limited to) “Accountant”, “Banking”, “Broker”, “Finance” and “Real Estate Agents”.

Employer Withholding

All businesses are required to withhold federal taxes from their employees. wage. You withhold 7.65% of your entire taxable wage and your employees are typically liable for 7.65%, which equates to the current federal tax rate of 15.3%.

Overview

LLC can be the most popular businessstructure because they are inexpensive educate, give owners flexibility when they want it, and be simple run. Creating your LLC legalizes your business and cuts down on your personal life. liability and tax flexibility of profits. The following step by step instructions will help you while you are trying to complete this process.

Incorporating An LLC In Nevada Will Likely Be Easy

In order to register an LLC in Nevada, you must file a Memorandum of Incorporation with the Secretary of State of Nevada, which price 425 dollars. You can apply online or by mail. The Memorandum of Association is the complete legal document that formally registers your LLC in Nevada.

Disclaimer

. LLC Professionals: LLC owners (called members) are not personally liable for debts. business, and this includes debts from most business lawsuits. A corporate lender cannot use the member’s personal assets (house, car, bank accounts, etc.).

Single Member LLCicom, Because. Multi-person GmbH

If a company has only one type owner (or a married couple as the main owner), it is a single-person GmbH. This single member has complete control over how and how to manage it. If an LLC has two others or webmasters, it is a multi-member LLC. A multi-member LLC can have an unlimited number of related members (unless they choose the S corporation tax regime, which limits ownership to 90 or fewer members). All LLCs leverage their LLC with multiple members whose roles, terms and distribution income are defined in the current LLC Operating Agreement.

Do I need to file a Nevada tax return?

Prepare your 2020 tax returns and simply submit them electronically to eFile.com.

What is the annual report for LLCs called in NV?

Late Fee: Nevada imposes a $175 fine on all corporations, LLCs, LPs, LLPs, and LLLPs for failing to file an annual return. Non-profit organizations pay an additional $50.

How do I get an LLC license in Nevada?

Approval can be obtained by applying for a Nevada “Other” business license. You can apply online at the State of Nevada website for a business license or by mail only. With regard to income tax, some LLCs are so-called pass-through tax entities.

Do I have to pay taxes on my Nevada LLC income?

Thus, a state tax return is not required for most LLCs that include those that may have chosen to be automatically taxed as corporations. ?In addition, because there is no personal income tax in Nevada, LLC employees generally do not pay state taxes on income received from Nevada LLCs. Does your GmbH have employees? In this case, you must pay employer contributions.

Does Nevada require an annual report for LLC?

Annual Report (Annual List) The State of Nevada requires you to prepare an Annual Report, or what is more commonly known in speech as an Annual List, when it comes to your LLC. Little information is needed to complete the list, mainly the names and addresses of certain officers or managing partners of the LLC.

What are the benefits of forming a Nevada LLC?

Because Nevada’s LLC law provides members with certain benefits, businesses continue to be established in that state even if their primary location is in another state. When forming an LLC in Nevada, the only way to avoid paying sales taxes is if that particular corporation’s entire income is generated in a pre-Nevada state or in states that are unlikely to collect income tax.