Nevada requires an LLC to submit a long list of members/managers and a business license annually. This must occur on the last day of the anniversary month of the LLC increase. The registration fee is $150 for an annual listing and $200 for my business license registration. To rule.

Nevada LLC Taxes (Variable)

There are many different types of most of the taxes we undertake.Guests must pay. Federal income tax, taxes, payroll taxes (if we have employees), sales and use taxes, etc.

Nevada Certificate Of Good Conduct

Good To To ensure that your Nevada LLC is legally registered and maintained, you will need a certificate issued by Good Standing. It will set you back $50, which is not much considering the implications of the acquisition:

Nevada LLC Fees

The annual costs associated with Nevada LLC are Impressive Annual Managers or Managing Members and commercial state license. The annual fee for filing a list of directors is $150 and provides you with another up-to-date list of LLC managers at the US Department of State in Nevada. An annual business license costs $200 and must also be registered, so an LLC must be sure to maintain its good reputation with the Nevada state minister. The total cost is definitely $350.

Nevada LLC Name Requirement

The name of a strong LLC must end with “KoLimited Liability Company”, “Limited Liability Company”, “Limited”, “LC”, “Ltd. Co.”, “Ltd.”, “LLC” or “LLC.” The name must never be the same as or similar to the name of a corporation, limited liability company, limited liability company, foreign company, mystery limited liability company, company with limited liability company or a foreign limited liability company, and must not really or deceptively resemble a designation reserved for use by another LLC, unless there is written consent from the purchaser or other person for whom it is nominated, for whom the name is intended to be presented with products, For example, there are a number of keywords that require approval from your current government department or agency.

Annual Return (Annual Listing)

The State of Nevada requires you to file every annual return, or what the state technically calls an annual listing, forI am your LLC. Little information—mostly the names and addresses of SARL managers or managing partners—is needed to deepen the list. The initial list is that you pay no later than the last day of the first month after the submission of articles from all organizations. The deadline for receiving subsequent annual listings is the last business day of the month in which the LLC’s perpetuity falls. (For example, if you formed your LLC in June, each subsequent annual registration must be made on the last day of June. LLC)

Nevada Online Application Fee: $425

The Cost To Form An LLC Is $425 For Online Filing Of Your LLC’s Certificate Of Incorporation, Initial Listing, And Business License Fee With The Secretary Of State Of Nevada. Governed By Chapter 86 Of The 2017 Revised Nevada Bylaws. There Is An LLC In The State Of Nevada That Includes An Additional $75 (state Fee). To Deal With An LLC, They Must Help You File The Articles Of Incorporation And The ActualState Fees To The Secretary Of State, 202 North Carson Street, Carson City, NV 89701-4201.

Initial Costs Required To Start An LLC In Nevada

Let’s start small. You cannot form an LLC in Nevada without registering an Of Content Pieces organization. An article is a document that officially registers your business in many countries. This filing costs $75.

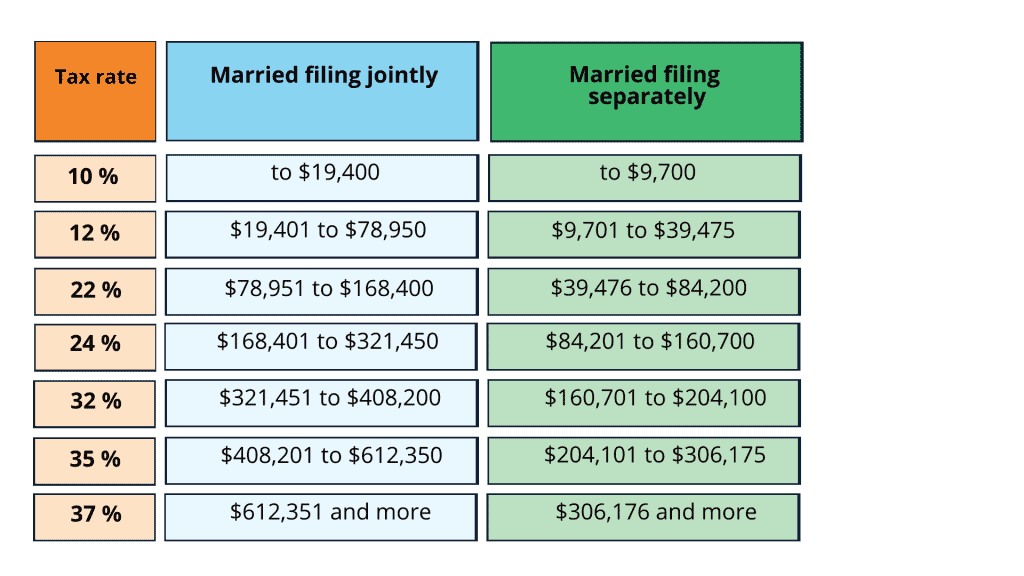

Nevada LLC Tax Rate Overview

Corporations are generally taxed in part based on their legal form. In most states, corporations are subject to corporate and income taxes, while corporations that qualify as “through entities” such as LLCs are subject to corporate income tax only on individuals, as well as sole proprietorships, S corporations, and partnerships.

Nevada LLC Benefits

Yes. Registration of a Nevada LLC (or Nevada Corporation) is not required with the NRS, regardless of the state in which you live. In fact, even as a foreigner, a foreign entrepreneur, you can register someone completely online. The State’s Only RequirementThe one you must qualify for is to be a registered agent in the state of Nevada with an accredited office in the state.

How are LLCs taxed in Nevada?

If you wish to form and therefore operate a Nevada State Limited Liability Group (LLC), you must prepare and file a number of documents with the State. This article describes the basic filing and national tax filing requirements for a Nevada LLC.

Do I have to renew my LLC Every year in Nevada?

Nevada LLC Costs: Nevada LLC Formation: $425 Nevada LLC Annual Fee: $350 per year

Is Nevada a good state for an LLC?

One of the most important decisions you need to make for your LLC is which state you want to incorporate.In some cases, it makes sense to incorporate a company outside of your state to take advantage of small business tax incentives and the national legal infrastructure of a larger state. However, out of 50 states, choosing the right one can be tricky.Delaware has always been the best state to register due to its strong, business-friendly institutions and laws. Recently, however, Nevada has become a strong contender for small businesses looking to create a fantastic LLC.Each state has its own advantages. However, there are key differences where the report may be better suited tofor your business.Nevada or Delaware?There are many reasons why LLCs have traditionally tried to make Delaware a registration haven. For example, all of the factors listed below have contributed to Delaware being the founding state of approximately 1 million companies, including half of all public companies and 64% of Fortune 500 companies.A division of Delaware Corporations has developed infrastructure upgrades to support new start-ups in the state.Its General Corporations and Business Enterprises Act allows corporations to avoid certain non-state income taxes.Delaware offers low franchise and pre-registration fees, as well as strong privacy protections for business owners.Delaware created its Court of Chancery to resolve disputes between businesses much more quickly than in other states.The state’s comprehensive jurisprudence serves as the de facto national standard in courts across the country.While Nevada is a relatively new player, lawmakers are working to turn the state into a business-friendly environment?? early 1990s. The combination of benefits makes it the best choice for small businesses in particular. Benefits of Starting a Great LLC in NevadaNevada as an inclusive state offers a wide range of benefits, including easy registration, relatively affordable corporate taxes, and no state tax office. Nevada also offers business owners strong privacy protections and a business-friendly environment. If you are forming an LLC, Nevada could potentially be a better home for your sales than Delaware.Nevada benefits for an LLC include:No income, corporate or commercial taxNo tax on shares or company profitsPrivacy barrier for owners who prefer to remain anonymousNo employment contract or annual meeting requirementLow business subscription fees and fast lead timesCreation of associations of one person, authorizedRules for obtaining releases related to creationA legal system that relies on case law to helpwhose will you resolve disputesA strong corporate veil that completely shields people from accountabilityNo formal information sharing agreement with the IRSThe key difference between Nevada and Delaware corporations is the absence of the Delaware loophole. This allows corporations to transfer their profits to their Delaware subsidiary and reduce their personal tax burden in other states where they may operate.However, Nevada does not require a real corporation to have a separate director just for incorporation. This favors smaller family businesses, as opposed to the much larger businesses that Delaware typically attracts.In addition, Delaware has state taxes on franchises, corporations, and household income tax, making Nevada the best place to collect taxes if reducing your tax burden is usually one of your top priorities.The Bottom Line During an LLC in NevadaChoosing a state of incorporation within your state can provide a thousand benefits, especially if you are planning toacquire large volumes of business in this state.However, your business may be classified as a qualifying foreign legal entity in your country if it is registered elsewhere, which may prevent you from opening a bank account or even operating legally if you cannot register in your country.Before choosing Out of State Wilderness, make sure it’s a reliable and smart choice for your business needs. When you’re ready to register your Nevada LLC company, let Incfile help you find the right start.