Single member LLCs can be grouped as S Suppliers, C Corporations, or Sole Proprietors. An LLC with multiple members can choose in which order the S corporation, partnership, or C corporation is taxed.

Business Structure Options

When planning (owning) a new business, one of the first and most important decisions is to determine its business structure. Tax considerations are included in this decision. You should, I would say, choose the framework that best suits your needs. As a general rule, it is a good idea to consult with knowledgeable lawyers associated with tax advisors in order to make an informed decision about which business style is best for you.

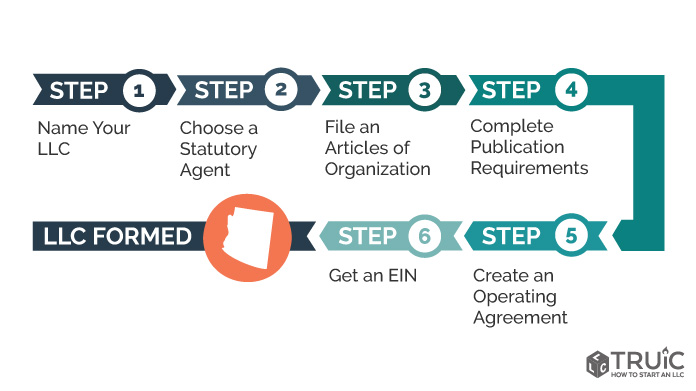

It Is Very Easy To Register An LLC In Arizona

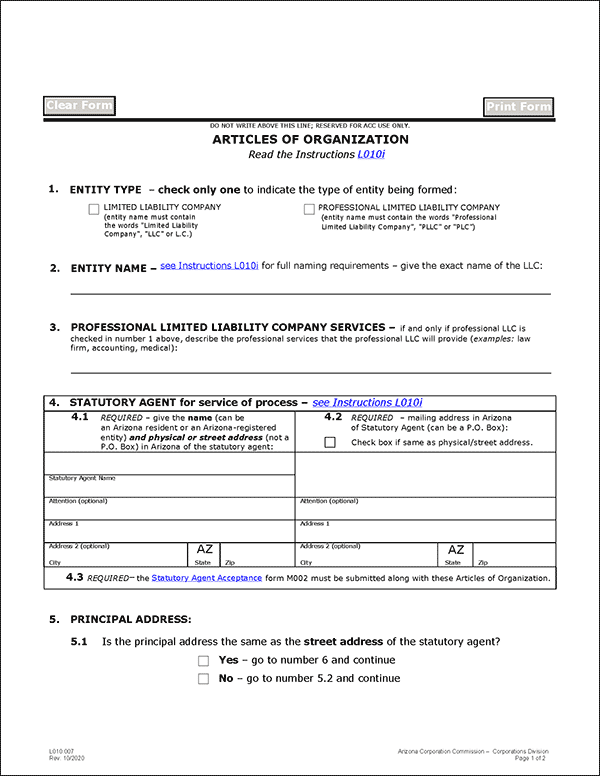

llc. To form an LLC in Arizona, you must file your articles of association with the Arizona Corporate Commission, which costs $50 online. You can apply online, by mail, fax or in person. The Articles of Association is the legal document in which your limited liability company was once incorporated.tate Arizona.

Choose A Name For Your LLC. Arizona Law Requires The Name Of An LLC To Include The Keywords “Limited Liability Company”. Or The Abbreviations “LLC”, “L.L.C”, “L.C.” Or “CL”. Evidence Of A Professional LLC Must Include The Words “Professional Very Little Company Commitment” Or The Abbreviations “P.L.L.C.”, “PLC”, “PLLC” With “PLC”. The Name Of Your LLC Must Be Distinct From The Names Of Other Professional Organizations Already Registered With The Arizona Corporation Commission.Name Availability Can Be Checked By Searching The Arizona Corporation Commission’s Company Name Database.

Opening An LLC In Arizona

To form an LLC, you must list your preferred Arizona corporation registered with the Arizona Commission Corporation (ACC) This process puts your promising business on a public record that contains the information the state needs to help you communicate with your new LLC and regulate it.

LLC Name

The name of the LLC must end with the words “Limited Liability Company”, “Limited Liability Companyvalue”, “L.C.”, “LC”, “LLC” or “L.L.C.”. The word “Association” cannot be used as a strong name for an LLC. With the words “bank”, “bank” and also “bankorp”, the company must be a real bank and approval of the name by the Department of Banking is required.

What are the 3 types of LLC?

Did people know that there are 8 types of LLC? As if choosing a business rule wasn’t hard enough!

Your LLC Name Must Not Be The Same As Existing LLCs In Arizona

Arizona law requires your LLC username to be unique across multiple applications. You cannot choose one. Use reputation and add “OOO” to close it. A:

Step: Choose A Unique Name For Your Arizona LLC

Choosing a unique and distinctive name for your LLC will help make it stand out from the competition. Under the Arizona Limited Liability Company Law, your business must:

Why An LLC In Arizona?

Arizona is probably a very business-friendly state due to the low cost of doing business . , low tariff burden and limited state regulation. Therefore, it is not surprising that forming an LLC in Arizona is cheaper and easier than in other states. Before registeringStarting your LLC business in Arizona, it is important to understand the ins and outs of becoming an LLC. Arizona allows corporations to register three types of recognized business entities: corporations, not-for-profit corporations, and limited liability companies (LLCs).

Step 1. How To Set Up An LLC In Arizona

You might think that Setting up an LLC in Arizona is a complex task, but either way, the first part of the process will no doubt only take a few steps – and again, once you get professional help, it will be much easier. /p>

How To Use Our Instructions For An Arizona LLC:

Before filing the Memorandum of Association of an Arizona LLC, including with the Arizona Corporations Commission (AZCC), you must search by state. s to ensure you can use the correct LLC URL.

What type of LLC is best?

1. What type of LLC do I need?2. Individual entrepreneurship / individual entrepreneurship 3. General partnership4. Family partnerships with limited liability5. Series OOO6. LLC with limited access7. ?Company L3C8. Anonymous LLC9. LLC managed by a member or LLC managed by a manager

What are the different LLC classifications?

1. Tax classification options for LLC2. Does not affect the protection of private assets3. Benefits of corporate tax classification4. Management structure5. Options for LLCs taxed as corporations6. How to make sure you choose a tax classification for your LLC7. Refinement of your W-98. State tax classification for LLC

How much does it cost to set up an LLC in Arizona?

To form an LLC in Arizona, you must file a document called “Articles of Organization” with the Arizona Corporations Commission (AZCC). You can also pay the regular application fee ($50) or the full expedited fee ($85).