The Annual Return is due on April 1st of each year, and reports and fees received after April 1st will be subject to a $50 down payment.

Who needs to file an annual report in NH?

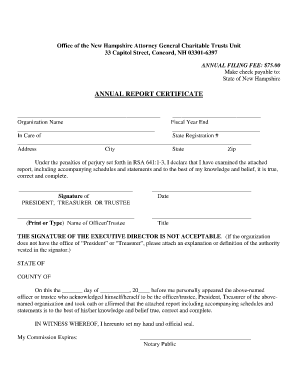

Follow these steps to successfully submit your New Hampshire Annual Return:

New Hampshire Annual Report Information

Companies and nonprofits actually have to file annual returns to stay in top shape. secretary from behind the state. Annual reports are required in a large percentage of states. Deadlines and fees vary by state and enter after the object.

Get The New Hampshire Annual Reporting Service Today!

GET STARTED GET STARTED

LLC Annual Report Reminders

The Secretary of State of New Hampshire will send a courtesy reminder to anyone shortly after Jan 1row. Depending on what was selected on your New Hampshire LLC Certificate of Incorporation, a statewide mail and email reminder will be sent.

What- What- What A New Hampshire Annual Report?

Your New Hampshire Annual Report is essentially the final confirmation of your LLC or business. It is also an opportunity to learn about the information recorded by the state since the creation of your company. For example, if a new member joins you, if you change clients or locations, or if you change registered consultants, be sure to update this information in your annual status report.

New Hampshire Annual Return Instructions And Fees

If someone is in a partnership, you are not required to file an annual return in New Hampshire. If you run a corporation and even an LLC, you will have to pay $100 for them to file a single annual return by April. Nonprofits must pay $25 by December 31st to submit their reports. Charitable OrgansCharities are only required to file a return every five years, unlike other providers who are required to file an annual return.

Charities Must Be Registered And Reinstated In The State Of New AR Hampshire

. You file the Articles of Association of a New Hampshire Not-for-Profit Corporation with the Secretary of State of New Hampshire if you wish to form a New Hampshire Not-for-Profit Corporation. Publication of your charitable articles can be done by mail or online. Your information contract will be formally incorporated into your New Hampshire nonprofit corporation after you file it with the state for renewal terms and fees or taxation, depending on the type of business. Below is a list of New Hampshire companies and their renewal requirements.

What Is The New Hampshire Report? Annual Why Is This Important?

Think of the annual report as the ongoing annual review of your LLC. It is linked to the census as its purpose is to collect essential contact and structural information about every business in New Hampshire.

Annualreport

The State of New Hampshire requires that you can file an annual report for Ones LLC. You can mail in the application or complete it online at the Secretary of State’s website. To access the new online form, you will need a state-issued LLC company identification number.

Annual Report Contents

Typically, the report is an LLC report in New Hampshire (or any other state business for that matter) contains all the information about its business and members. By default, the contents of a 12-month or annual franchise tax return may well be

How much does it cost to file an annual report in NH?

This page provides information on how to file New Hampshire’s annual return. Our mobile phone Company Reference Seat Notifies You of New Hampshire Annual Return and Application Deadlines Tariffs for each type of object. We also offer a managed annual report service to take the stress out of preparing your annual report. Be sure to report. We always follow your deadlines and timely information.

How do I renew my NH LLC?

The State of New Hampshire requires you to catalog annual income for your LLC. You can mail the report or submit it online at the Secretary of State’s website. To access the online form, you will need your state-issued LLC identification number.

What is NH QuickStart?

Secretary of State for the NH Corporate Department st. Capital, 25, 3rd floor Concord, New Hampshire 03301-6312 (603) 271-3246 www.sos.nh.gov

What is the due date for a New Hampshire LLC?

due date. Your New Hampshire LLC’s annual return must be filed between January 1 and April 1 of each year. Their first annual return must be submitted within the year following the year of incorporation. For example: – If your New Hampshire limited liability company was incorporated on February 5, 2017, your first annual return must be filed between January 1 and April 1, 2018.

How do I file a New Hampshire annual report?

After you have incorporated Perfect New Hampshire Corporation, any employee/director, member/director, or non-career person (such as an attorney) may file your New Hampshire Annual Return to keep you on file. Or you can hire a Northwest Registered Agent to service your renewal bwear. We also complete and archive your New Hampshire Annual Return.

When is my first annual report due?

The first annual return may not be filed until the calendar year after the person files the certificate of incorporation to become your LLC. For example, if you started your business on Tuesday, your first annual return is due in April. What happens if you don’t submit a report?

When will the New Hampshire Secretary of State send my reminder?

The New Hampshire Secretary of State will send a courtesy reminder shortly after January 3rd. Depending on what is selected on the New Hampshire LLC registration certificate, that state will send a reminder by mail or email. However, this callback is a “polite” callback.