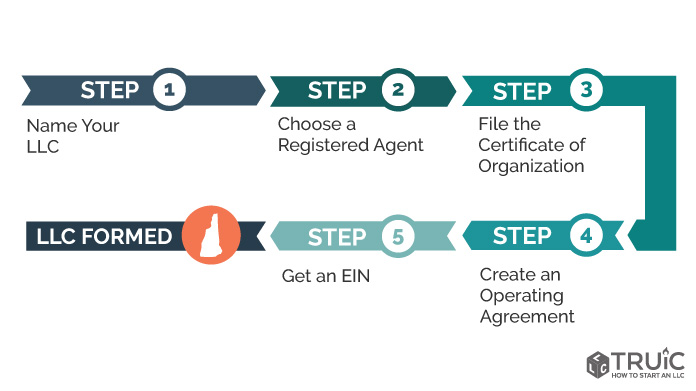

To have an LLC throughout New Hampshire, you must pay a $100 annual fee using 5% income tax and federal tax. If you are considering setting up a large New Hampshire limited company, the first step is to choose a company name. You must ensure that the alias you choose is available in your state.

Online Business Services

Starting your business with New Hampshire QuickStart is relatively easy. An online solution that not only allows you to act as a company, but also helps you register your company with the Foreign Office in a short time.

Hampshire Income Tax For New One Corporation: Varies

New Hampshire levies a flat tax in the amount ofee 8.2% with LLC with gross revenues over $50,000. This tax is due on the 15th day of the fourth month following the end of that tax year.

Annual Return

The State of New Hampshire requires you to file an annual return. according to the claim of your LLC. You can email the report or complete it online at the Secretary of State’s website. To access the online form, you will need your LLC’s government-issued corporate ID. Annual

Do LLCs pay taxes in New Hampshire?

If you want to register and therefore operate an Online Limited Liability Company (LLC) in New Hampshire, you need to prepare and file various documents with the state. This document covers basic current reporting requirements as well as state tax reporting requirements for LLCs in New Hampshire.

LLC Reporting Reminders

The New Hampshire Secretary of State will issue a courteous reminder shortly after January 1st. Depending on what you choose from New Hampshire LLC, the State will send you a reminder by mail or email.

Certificate Of Incorporation Fees

New Hampshire Certificate of Incorporation make up the bulk of the costs, which can also vary depending on whether you are registering a domestic LLC or a foreign LLC. However, you can file both with the new New Hampshire Secretary of State.

Can I Reserve A New Hampshire Company Name?

Yes. If you’re looking for the perfect company name and want to make sure it’s always found when applying for an LLC, you can reserve your company name 120 days a week by submitting a New Hampshire Corporation name reservation request. .

What Fees Are Included In The Total Cost Of An LLC In New Hampshire? ð??µ

It depends. The industry, location, and activities of your business play a role in determining the fees applicable to your business model. Here are some of the most common fees and penalties that are included in the costs of an LLC:

New Hampshire Annual Report Information

Companies and nonprofits almost always have to file annual returns to make sure they are in good standing. State registrar. Annual reports are accepted in most states. Terms and amounts vary by state. and the breed of the essence dog.

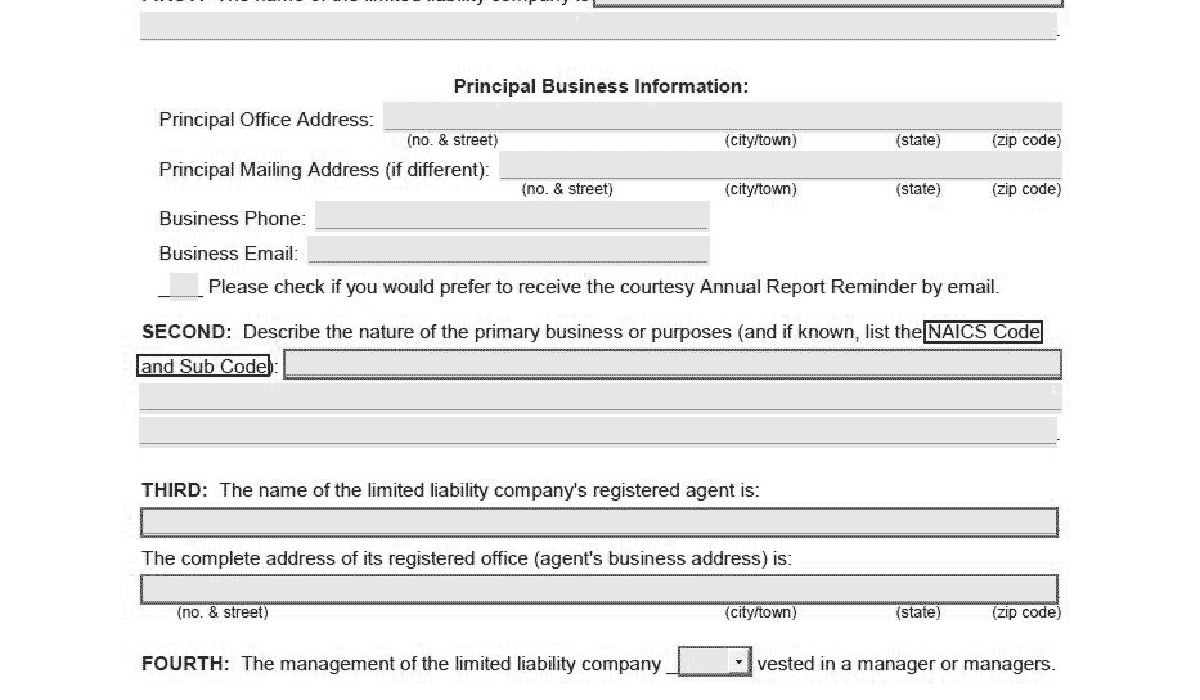

Certificate Of Registration

This is the biggest, most important (and ?(the vast majority of the most expensive) form you will need to register this LLC in New Hampshire. Filing a Certificate of Incorporation registers your LLC with the Secretary of State and enables it to conduct business in the state. Registration certificate number, without company. There is a $100 fee for this complaint and your company can file it online or on paper. You only send the Certificate of Incorporation once, so you don’t have to spend that $100 again.

Annual Report

Once you register a Solid LLC in New York, Hampshire, you must file an annual report confirming each change in membership, address, or registered dealer. This is done through websites on the Internet and must be no later than April 1 of each year, regardless of the company’s personal year. Submission of the report costs $100. Reports received after the April deadline will be subject to a $50 fee.

Who needs to file an annual report in NH?

Follow the methods below to successfully submit your New Hampshire Annual Return:

How much does it cost to file an LLC in NH?

Annual resultsEntries must be submitted by April 1st of each year. The annual return filing fee for operating a New Hampshire LLC is $100. When it comes to income tax, most LLCs are so-called pass-through tax entities.

How do I file an annual report for a New Hampshire LLC?

To start using the online form, you will need an LLC government identification number. The annual report must indeed be submitted by April 9 of each year. The annual return filing fee for a large New Hampshire LLC is $100.

What is a limited liability company in New Hampshire?

LLCs incorporated outside of New Hampshire must be incorporated with those currently registered in New Hampshire.

What is the filing period in New Hampshire?

The registration period is from January 1 to April 5. ** Fee varies; Please refer to the form for applicable fees. Online Filing: On J-Day, New Hampshire Legislative House Bill 1348 was signed into law and became law creating RSA 5:10-a.