The annual report can be submitted from January 1, but must be submitted by April 15. All business corporations with a non-calendar year tax period must file their annual return no later than the early morning of the 15th of the fourth month following the extended corporate tax period.

Does Kansas require an annual report?

Businesses and nonprofits must file annual returns to stay in good standing. Deputy State Annual reports are required in most states. Deadlines and penalties vary by state. and entity types.

Kansas State Annual Report Information

Businesses and non-profit organizations must? Submit annual returns to stay in good standing. Secretary of State. Annual returns are required in most states. Deadlines and fees vary by state and type of organization.

Kansas Annual Return Fees And Instructions

If you are a corporation, LLC or partnership typically engaged in online marketing in Kansas, you must apply to file an annual return by paying 50 USD. in year. If you choose to mail the report, a $5 fee will apply. For companies, returns are due on the 15th day of the fourth day following the end of a full financial year, which in most cases is April 15th.

Email Notifications

Enter any email address mail from the addresses of people who want to receive notifications about your favorite LLC. Consider this a security measure that alerts you that every document is filed in the name of your current LLC.

What If I Forget To File My Kansas Annual Return?

L Eligible Kansas State notimposes a penalty for late filing of an application if the annual service is not submitted. However, if you do not respond within 90 days before the deadline, the state will cancel the local company or administratively ban the best foreign company.

GENERAL INFORMATION

The income statement is unexpected 15th day of the 4th period following the end of the tax year. For calendarAnnual taxpayers (tax weeks from January 1 to December 31), a convenient date is April 15. Approved state expansionwill also carry over Kansas. Excluding estimated tax payments for all taxpayers in the year of assignmentFarmers and fishermen are usually due April, June, September, and January 15 of the next fiscal year.

What Is Kansas’ Annual Income?

The Kansas Annual Report is the government’s way of verifying your eligibility to do business through the state and keeps track of payments and state taxes on the business. Experts say the Federal Securities and Exchange Commission (SEC) may require moreIts broad annual report depending on the size and trading status of your business. It is still slightly different from the annual shareholder report that large corporations send to individual shareholders.

The Contents Of The Annual Report

Typically, the report is provided by an LLC (or any other company). entity for that matter) is likely to contain all information relating to their business and actual members. Typical contents of an annual return or small business annual tax return:

What Is Filing An Annual Return?

Filing an annual return is the last process for updating your company records as government agencies require an annual return, perhaps once every two years. Businesses such as corporations, LLCs, and partnerships are required to file an annual return in every state in which they are licensed to do business. Failure to report to the Secretary of State’s Internet Business Unit each year can result in late fees, fines, and loss of “good reputation”. stimulatedname and status, and the subsequent administrative dissolution of your company and trade name. Depending on the type of company and state of incorporation, incorporation, or possibly qualifications, you will have to pay an annual return filing fee with varying filing deadlines, online or by mail. Obtaining an annual return, like registration, is a legal method that is best done with the help of business setup lawyers. Experts Spiegel & Utrera, P.A. Complete your annual returns accurately and on time in all required states.

Annual Return

The State of Kansas allows you to file an annual return for a new LLC. You can submit your annual payment to the Kansas Business Center online or on paper using Form LC-50. The 12 month return must be submitted on the fifteenth day of the fourth month after the last month of your tax bill. For example, if your tax year is the same as the journal year, the annual report will be released on April 15th. Can you already send an invoice for January 1st? Paper trays.

F. Can I Apply Electronically To W-2 Kansas?

A. Yes, you canSubmit W-2 documents in Kansas electronically. Remember that the state requires electronic filing of an event with 51 W-2 or higher. If you are looking for an e-filing agency, check out TaxBandits. Create a FREE tax bandit bank account and complete Form W-2.

Who needs to file KS annual report?

Explain to the Kansas state secretary’s office that you will continue to do business in the state by filing an annual return. The deadline for filing these reports may vary depending on the type of business your entire family runs.

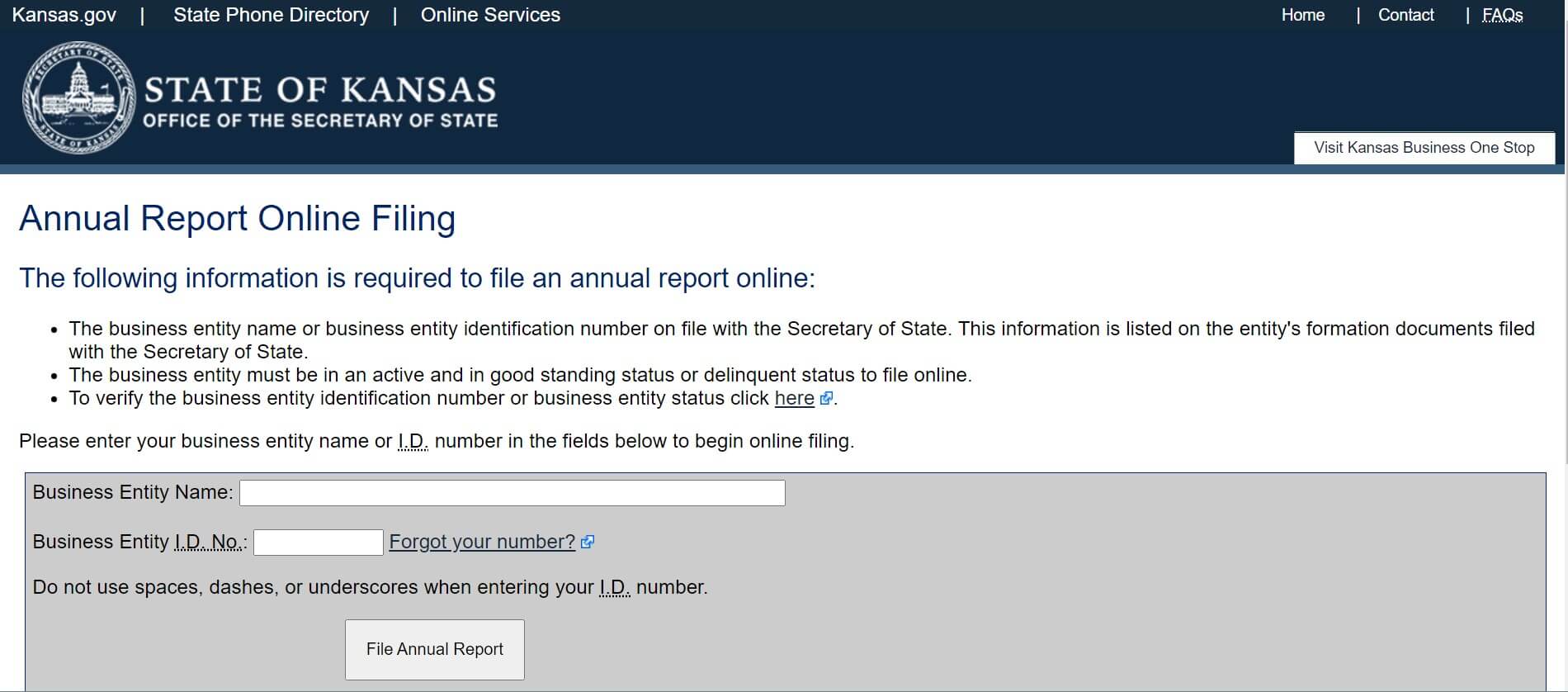

How do I file an annual report in Kansas?

To successfully catalog the Kansas State Annual Report, you will need time to complete the following steps: