The corporate tax (“BET”) was introduced in 1993. The IRS tax is calculated based on the company’s taxable value, which is the sum of fees paid or due, accrued interest, and dividends paid to the company at a tax rate of -60% for tax periods ending with .

Do LLCs pay taxes in New Hampshire?

If you need to register and operate a limited liability company (LLC) in New Hampshire, you will need to prepare and file various documents with the state. This article reviews the most important and state tax returns required for New Hampshire limited liability companies.

LLC Name

The name of an LLC must end with “Limited Liability Company”, “LLC”, or “LLC”. The name must not be identical or surreptitiously similar to the name of a limited liability company authorized to do business in the region, a reserved or registered name, an alias of a foreign LLC, a domestic limited partnership, or a foreign or other risky entity. The name should not contain language suggesting that the LLC is organized for a specific purpose that is not permitted by law or possibly by articles of association.

It Is Very Easy To Register An LLC In New Hampshire

To register an LLCin New Hampshire, you must file an Articles of Association with the State of New Hampshire, which costs $100. You apply by mail or online. The registration associated with the certificate is legal, the document that previously included your New Hampshire Limited Liability Company.

NH LLC Vs. NH Corporations

Now that we’ve covered the key features that apply to each individual LLC and corporation, then you need to delve into the more specific characteristics of what will make a New Hampshire LLC or New Hampshire Corporation unique compared to other states, which brings us to the final answer: a business is best for your finances. Each state has its own separate tax rules and laws governing the conduct of business by an individual, and these real details should be considered when choosing the main legal entity. The information on this website provides this data to Hampshire New LLC and Hampshire Creative Corporation.

Understanding State And Corporate Income Tax

Many people ask the question, I would sayE: “Is there an income tax in New Hampshire?” Not really. Although New Hampshire does not have state income per se, New Hampshire corporate taxes must of course be paid in proportion to your market income.

New Hampshire Corporation Annual Report:

You can find more aspects in our New Hampshire publishes annual reports on the Clearinghouse website.

Can I Reserve A Working Name In New Hampshire?

Yes. If everyone has the perfect company name and wants your website to stay active when you apply to form an LLC, someone can reserve your company name for 120 business days by submitting a name reservation request to the New Corporations Division. -Hampshire and paying a fee of 15 dollars. How to

Incorporate An LLC In New Hampshire

This page describes the steps to register a new family member, New Hampshire For-Profit Limited Liability (LLC) providers. However, if you want to start your noncomA PLLC or LLC in New Hampshire, you need to understand the process for this type of business. If you already have an out-of-state LLC and want to do business in New Hampshire, you will need to register Harmful LLC. Foreign LLCs also have a separate incorporation process that is not covered here.

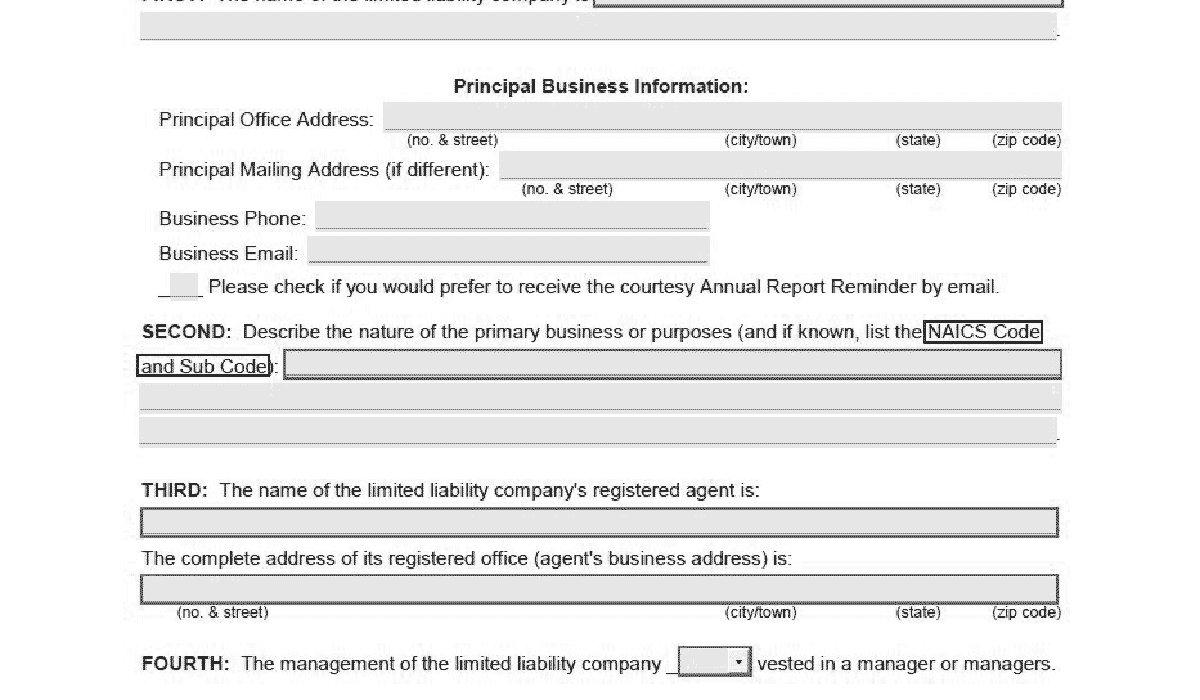

Filing Memorandum Of Association

A LLC is incorporated in New Hampshire by filing the Memorandum of Association of New Hampshire Limited. with the Secretary of New Hampshire, including the state. The certificate can be filed online or printed and mailed to the Secretary of State’s office. The registration fee is $100 and credit card is the preferred payment option.

Sharing Costs

Starting any new New Hampshire LLC doesn’t have to be stressful. In fact, in most cases, the process is not that difficult if you get help. Get started today by reading the following steps:

Incorporate An LLC In New Hampshire

You have the option to apply to register an LLC inNew Hampshire by simply sending the Certificate of Incorporation online or by mail. . Is there a $100 fee to complete the form ($102 as if applying online) and receive a perfect copy of your certificate with file stamp within twenty days? Checks are payable to the State of New Hampshire.

Does New Hampshire require a state tax return?

New Hampshire does not charge individuals for earned income, so you do not need to file a New Hampshire personal income tax return. The state taxes only interest, and therefore dividends, at a rate of 5% for residents and trustees whose gross interest and dividend income from all sources exceeds $2,400 per year ($4,800 for co-applicants). If you have investment income from interest and dividends as described in the New Hampshire Income Tax section, you may need to file a State Tax Return.New Hampshire for this income.

How much does it cost to file an LLC in NH?

In all cases, the annual return must be submitted separately in April of each year. The annual return filing fee for a large New Hampshire LLC is $100. When it comes to income tax, most LLCs will certainly be subject to pass-through taxation.

How do I file an annual report for a New Hampshire LLC?

To access my online form, you will need your state-issued ID.your company’s LLC registration number. The annual report must be submitted by April 1 of each year. The annual filing fee for New Hampshire LLC is $100.

Can I file a NH proprietorship business profits tax return for SMLLC?

For New Hampshire business tax purposes, SMLLC must file its own return. Can I file a specific NH Proprietorship Income Tax Return and show the total profit and loss of my business (Federal Plan C) and residence income or loss (Federal Plan E) for which I created an SMLLC?

How do I file a New Hampshire state tax return?

These taxes are remitted to the New Hampshire Department of Revenue Administration (DORA). You can find forms for both tax credits (form BET and form NH-1065) on your current DORA website. You can also file most of these returns online through the eFiling system.